/Caterpillar%20Inc_%20sign%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

Caterpillar Inc. (CAT) is a Texas-based global leader in manufacturing construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and locomotives, serving industries such as infrastructure, energy, and transportation. With a market cap of $193.8 billion, the company operates through Construction Industries, Resource Industries, Energy & Transportation, Financial Products, and Other segments.

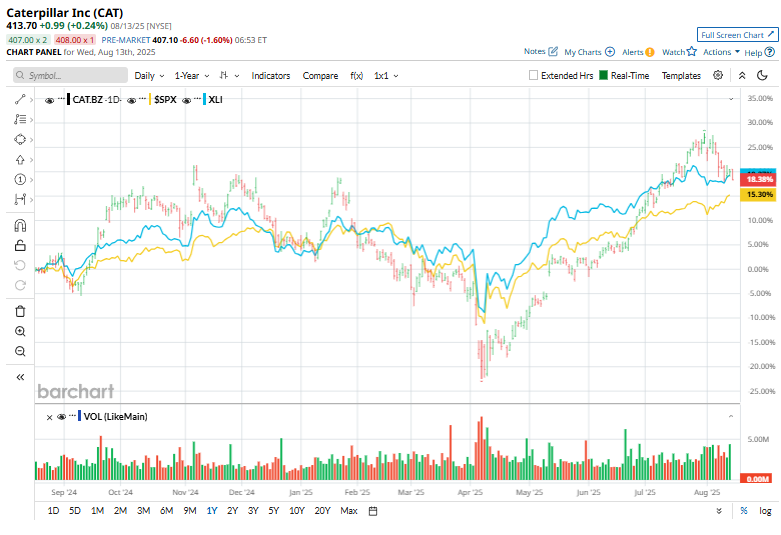

CAT stock has surged 22.1% over this time frame, outpacing the broader S&P 500 Index ($SPX) has gained 19%. Moreover, shares of CAT are up 14% on a YTD basis, compared to SPX’s 10% return.

Looking closer, Caterpillar has also lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 22% surge over the past year and 15.7% gains in 2025.

On Aug. 5, Caterpillar released its Q2 2025 results, and its shares dipped 1.5% in the next trading session. Its sales slipped 1% year-over-year to $16.6 billion, as weaker pricing and higher tariffs outweighed modest volume gains, and adjusted EPS rose to $4.72 from $5.99. Adjusted operating profit margin was 17.6% for the second quarter of 2025, compared with 22.4% for the second quarter of 2024.

For the current fiscal year 2025, ending in December, analysts expect CAT's adjusted EPS to decline nearly 16.7% year-over-year to $18.24. The company has a mixed earnings surprise history. It missed the Street's bottom-line estimates in three of the past four quarters, while beating on one occasion.

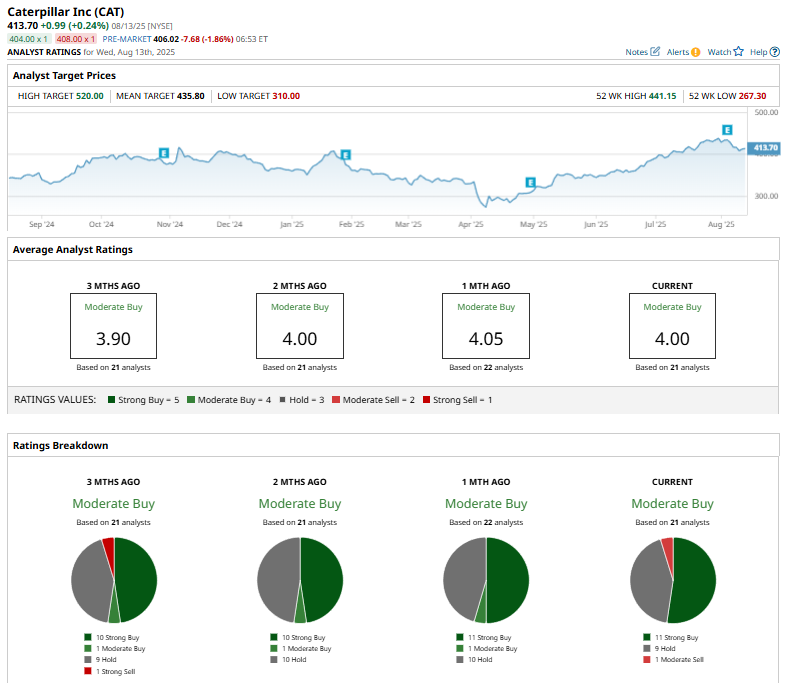

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy,” nine “Holds,” and one “Strong Sell.”

This configuration is slightly more bullish than it was two months ago, with ten “Strong Buy” recommendations for the stock.

On Aug. 6, Truist Securities analyst Jamie Cook reiterated a “Buy” rating on Caterpillar and raised the price target from $414 to $507.

Caterpillar’s mean price target of $435.80 indicates a premium of 5.3% from the current market prices. The Street-high target of $520 suggests a notable 25.7% upswing potential.