/Boeing%20Co_%20corporate%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

The Boeing Company (BA), headquartered in Arlington, Virginia, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense systems, human spaceflight, and launch systems, as well as services. Valued at $152.8 billion by market cap, the company’s global presence spans over 150 countries, serving top clients like NASA, the U.S. Department of Defense, and major airlines.

Shares of this aerospace giant have outperformed the broader market over the past year. BA has gained 32.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19.6%. However, in 2025, BA stock is up 15.6%, compared to the SPX’s 16.5% rise on a YTD basis.

Narrowing the focus, BA’s underperformance is apparent compared to SPDR S&P Aerospace & Defense ETF (XAR). The exchange-traded fund has gained about 59.8% over the past year. Moreover, the ETF’s 49.4% gains on a YTD basis outshines the stock’s returns over the same time frame.

Boeing's Q3 performance saw solid operational gains and rising deliveries but was weighed down by a $4.9 billion charge related to 777X certification issues. The company still managed a notable turnaround with positive free cash flow.

On Oct. 29, BA shares closed down by 4.4% after reporting its Q3 results. Its adjusted loss per share of $7.47 did not meet Wall Street expectations of $3.85. The company’s revenue was $23.3 billion, beating Wall Street forecasts of $21.9 billion.

For the current fiscal year, ending in December, analysts expect BA’s loss per share to grow 59.6% to $8.24 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

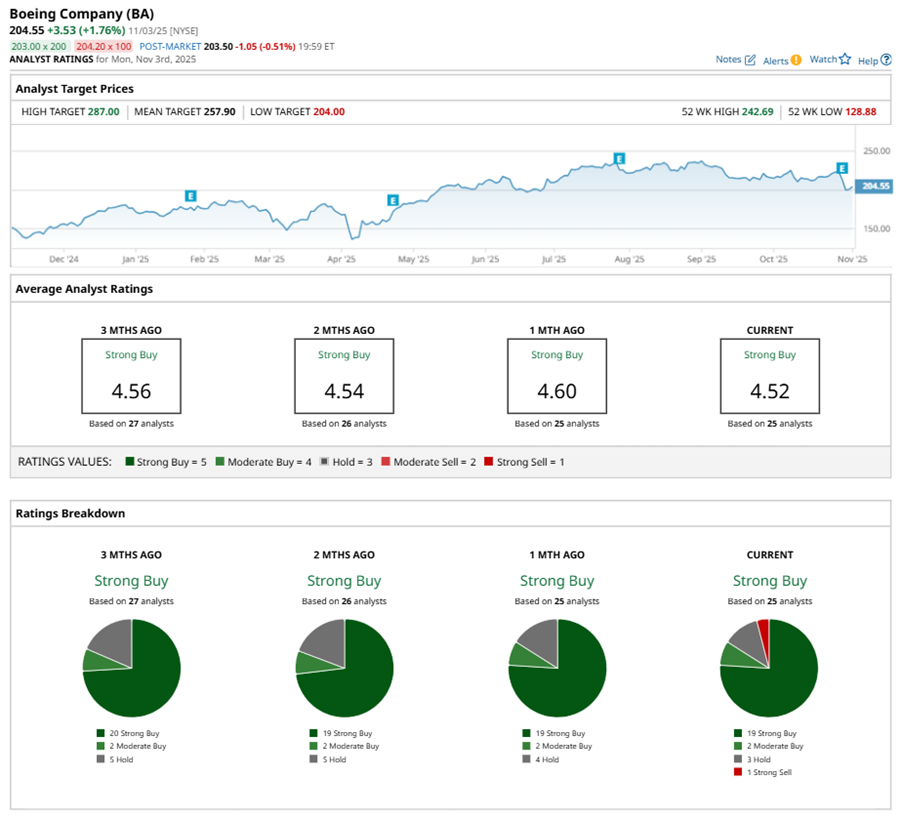

Among the 25 analysts covering BA stock, the consensus is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, two “Moderate Buys,” three “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with 20 analysts suggesting a “Strong Buy.”

On Oct. 29, Susquehanna analyst Charles Minervino maintained a “Buy” rating on BA and set a price target of $270, implying a potential upside of 32% from current levels.

The mean price target of $257.90 represents a 26.1% premium to BA’s current price levels. The Street-high price target of $287 suggests an ambitious upside potential of 40.3%.