AvalonBay Communities, Inc. (AVB), valued at a market cap of $28.2 billion, is a leading real estate investment trust (REIT) specializing in the development, acquisition, and management of high-quality apartment communities across the United States. Headquartered in Arlington, Virginia, AvalonBay operates in regions characterized by growing employment in high-wage sectors and lower housing affordability.

Shares of the REIT have underperformed the broader market over the past 52 weeks. AVB has gained 2.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 10.2%. Moreover, shares of AVB are down 10% on a YTD basis, compared to $SPX’s 1.3% dip.

Zooming in, AVB has also trailed the Real Estate Select Sector SPDR Fund’s (XLRE) 8.8% gain over the past 52 weeks and a marginal fall in 2025.

On April 30, AvalonBay reported Q1 2025 results with an EPS of $1.66, marking a 36.1% year-over-year increase, and core FFO rising 4.8% to $2.83 per share, outperforming analyst expectations. Same-store residential revenue grew 3% to $693.1 million, while same-store operating expenses increased 4%, driving net operating income up 2.6% to $478.3 million.

The company commenced construction on two new apartment communities and expanded its Texas presence by acquiring two properties in Austin for $187 million. Although the total revenue of $693.4 million was below Street estimates, AvalonBay’s shares rose 1.4%.

For the current fiscal year, ending in December 2025, analysts expect AVB’s core FFO to improve 3.5% year-over-year to $11.39 per share. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

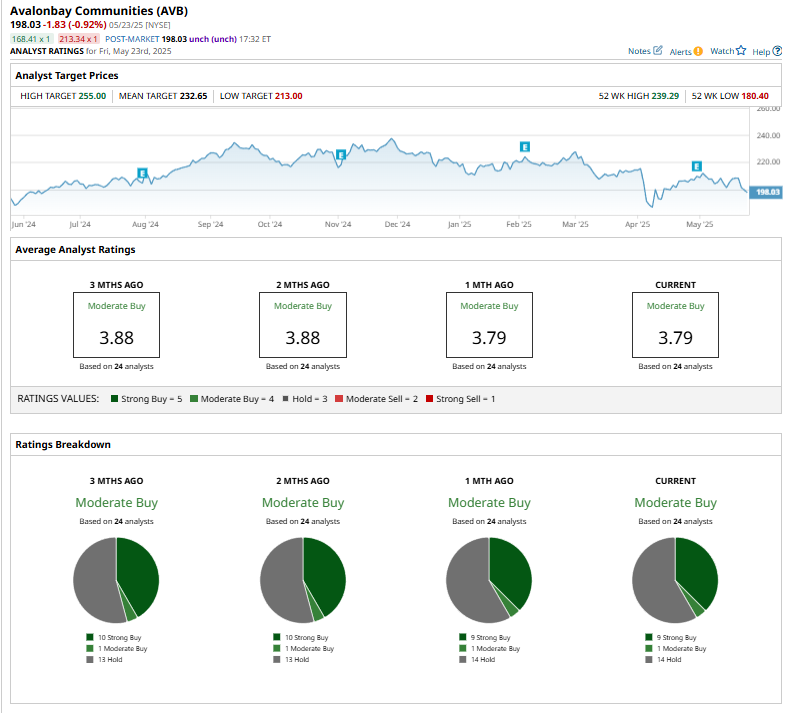

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, one “Moderate Buy,” and 14 “Holds.”

This configuration is less bullish than two months ago, with ten “Strong Buy” ratings on the stock.

On May 23, Mizuho lowered its price target for AvalonBay from $238 to $213 but kept an “Outperform” rating. The cautious move reflects first-quarter results that met only minimal expectations and weak spring leasing activity in key Sunbelt and coastal markets. Additionally, Mizuho’s outlook for 2025 and 2026 earnings is subdued, viewing apartments as a "show me" sector needing clear positive catalysts to boost investor confidence.

AVB’s mean price target of $232.65 represents a premium of 17.5% from the current market prices. The Street-high price target of $255 implies a potential upside of 28.8% from the current price.