/Assurant%20Inc%20logo%20on%20phone-%20by%20rafapress%20via%20Shutterstock.jpg)

With a market cap of $10.8 billion, Assurant, Inc. (AIZ) is a global provider of risk management solutions serving North America, Latin America, Europe, and Asia Pacific. The company operates through its Global Lifestyle and Global Housing segments, offering protection services for connected devices, homes, and automobiles.

Shares of the Atlanta, Georgia-based company have underperformed the broader market over the past 52 weeks. AIZ stock has risen 11.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 15.2%. On a YTD basis, shares of the company are up 1.4%, compared to SPX’s 10.2% gain.

Looking closer, the insurer stock has also lagged behind the Financial Select Sector SPDR Fund’s (XLF) over 20% return over the past 52 weeks.

Shares of Assurant surged 11.2% following its Q2 2025 results on Aug. 5. The company posted stronger-than-expected Q2 2025 adjusted EPS of $5.56 and adjusted revenue of $3.14 billion. The upside was fueled by a 25% jump in profit led by its Global Housing unit, which delivered a 10% increase in net earned premiums, fees, and other income to $697.7 million. Higher investment income of $128.7 million, supported by rebounding markets, further boosted results alongside resilient demand for essential insurance coverage.

For the fiscal year ending in December 2025, analysts expect Assurant’s adjusted EPS to grow 5.8% year-over-year to $17.60. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

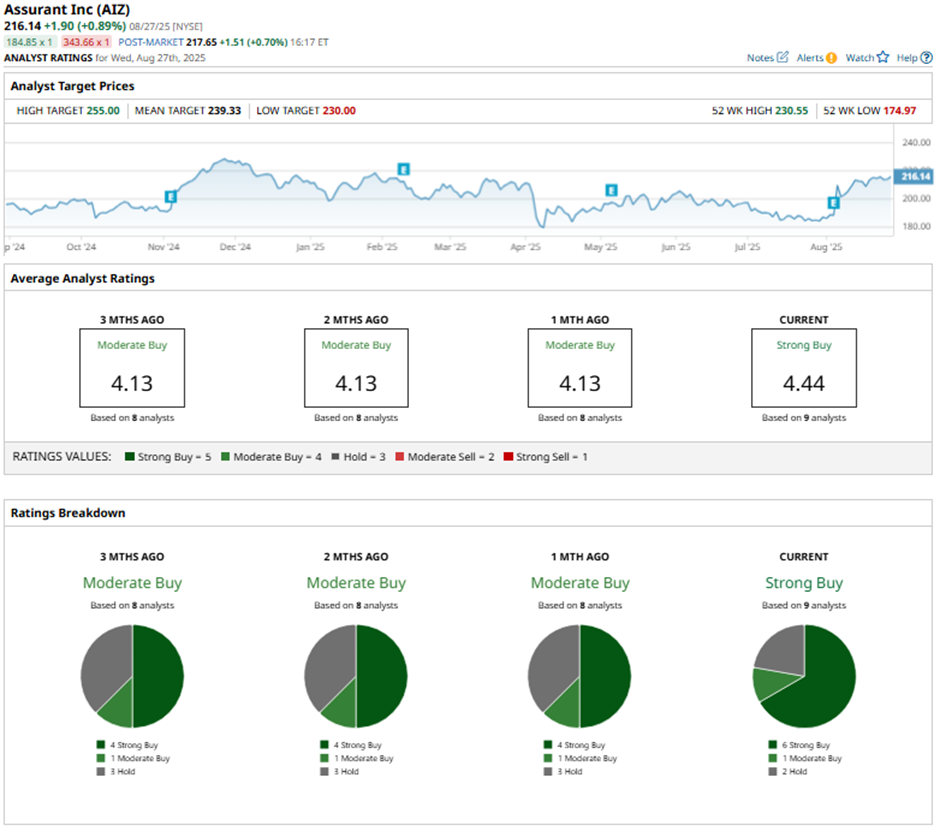

Among the nine analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

This configuration is more bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Aug. 18, Morgan Stanley raised Assurant’s price target to $230 with an “Equal Weight” rating.

The mean price target of $239.33 represents a 10.7% premium to AIZ’s current price levels. The Street-high price target of $255 suggests a nearly 18% potential upside.