/Allegion%20plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Valued at a market cap of $14.6 billion, Allegion plc (ALLE) is a leading global provider of security and access control solutions. Headquartered in Dublin, Ireland, the company operates in over 120 countries with a portfolio of more than 30 trusted brands, including Schlage, LCN, Von Duprin, and CISA.

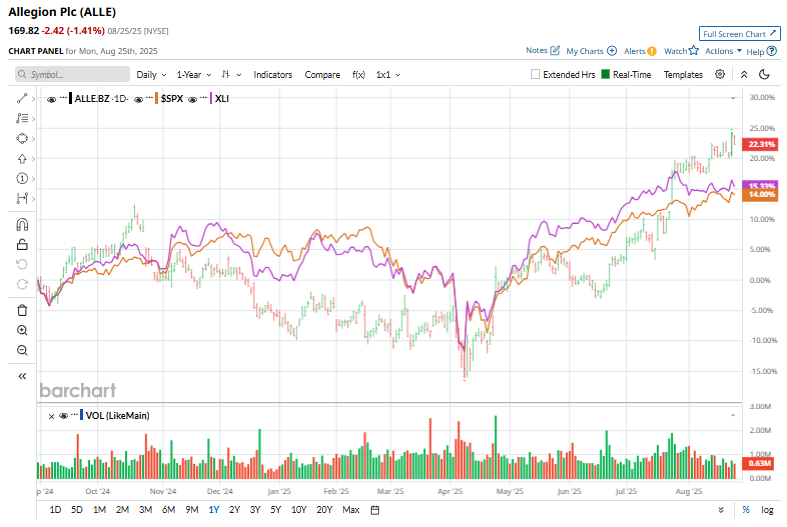

Shares of ALLE have outpaced the broader market over the past 52 weeks. ALLE has risen 24% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.3%. Moreover, shares of ALLE are up 30% on a YTD basis, compared to SPX’s 9.5% rise.

Zooming in further, Allegion has outperformed the Industrial Select Sector SPDR ETF Fund’s (XLI) 17.3% return over the past 52 weeks and 15.1% rise on a YTD basis.

On Aug. 12, Allegion shares surged 1.2% following the announcement of its acquisition of Brisant Secure Limited, a leading UK-based provider of premium residential security hardware. Headquartered in Dewsbury, Brisant is best known for its Ultion high-security lock cylinders and key systems, as well as a portfolio of mechanical and electronic locks and door accessories.

The deal, which will see Brisant integrated into Allegion’s International segment, further strengthens Allegion’s presence in the UK market and complements its non-residential security portfolio, as well as its recent acquisition of UAP Limited.

For the fiscal year ending in December 2025, analysts expect ALLE’s adjusted EPS to increase 8.5% year-over-year to $8.17. The company's earnings surprise history is solid. It beat the consensus estimates in the past four quarters.

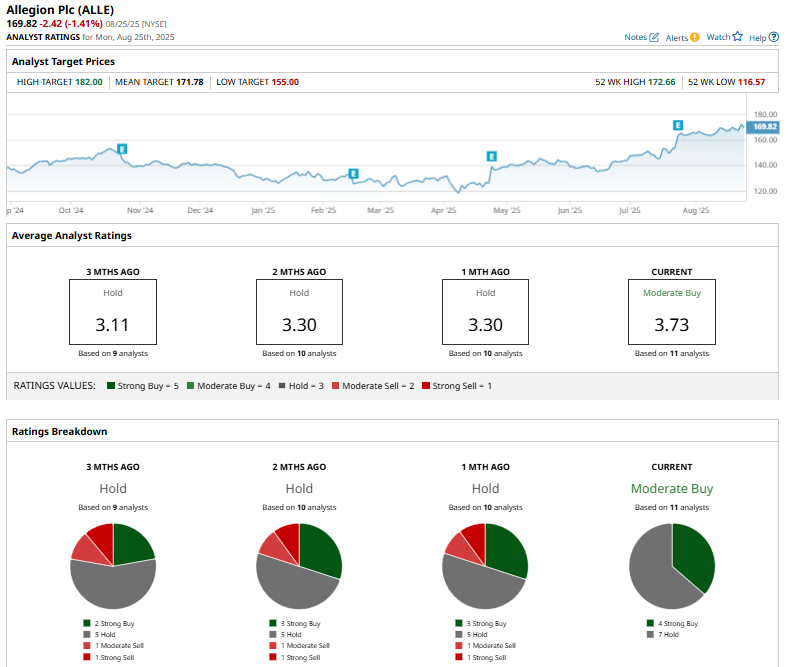

Among the 11 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings and seven “Holds.”

The current consensus is more bullish than a month ago, when the stock had three “Strong Buy” suggestions.

On Aug. 14, Barclays upgraded Allegion from “Underweight” to “Equal-Weight” and raised its price target to $163 from $156, citing easing downside risks as non-residential construction markets stabilize.

Allegion is trading slightly above the mean price target of $171.78. The Street-high price target of $182 implies a potential upside of 7.2% from the current price levels.