The battle over 5,000 still rages on.

Bulls seemed to the have upper hand with 2 straight closes above. And then comes along a hotter than expected CPI report on Tuesday alerting folks that rate cuts may be even further down the road.

This had bond rates running north on Tuesday with stock prices headed south. Thus, we find ourselves back under 5,000 for the S&P 500 (SPY) making us all ponder...what comes next?

That will be at the heart of this Valentines commentary for the Reitmeister Total Return service.

Market Commentary

I have written several commentaries of late saying that 5,000 should be a lid on stock prices until the Fed raises rates (See commentary archive here). How foolish I looked Friday when stocks broke above this mark with gusto. And how relieved I was on Tuesday that investors came to their senses.

Don’t get me wrong...I relish bull markets as they spread joy and prosperity. And really the 3 month bull run from the start of November til now has been about as much fun as one could have with investing.

But even more than stock market profits, I prefer some degree of rationality. Case in point was the tech bubble of the late 1990’s when my value roots wouldn’t allow me to participate in these obscenely priced stocks.

On the other hand, everyone and their mother thinks they were stock market geniuses making money hand over fist for a while. And that I was a fool that doesn’t understand the new world order.

But did these new titans of wall street sell their shares at the top in March 2000? Of course not. They are likely the ones who sold me their Amazon shares I bought in 2001 for 43 cents (split adjusted). And yes, I still own those shares today.

Back to the main point...

I want rational markets. And in that regard the Fed could not have been clearer that there were no rate cuts coming in March. And yet as of a week ago investors were still acting like there was some chance that could happen.

Those hopes were dashed today on the too hot and too sticky CPI report. Most investors just look at the headline reading of +3.9% Core CPI and appreciate that is above the Fed’s target of 2%. Yet they console themselves on the idea that it has been trending lower over time.

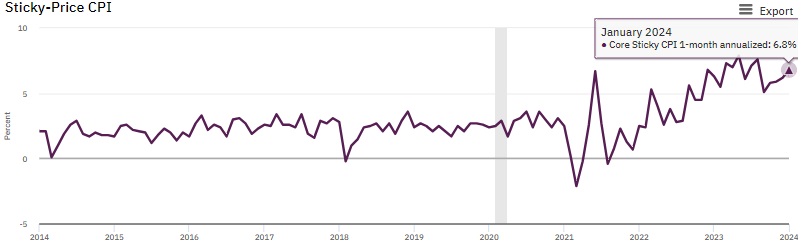

That is why I want to concentrate on the Atlanta Fed’s work to isolate “sticky” inflation. The kind that is more persistent like wages and housing that the Fed pays more attention to than gas and food prices.

The above chart is isolated on the 1 month annualized Core CPI. Yes, that was heading down for a while, but the last few reports have headed higher once again. Today’s reading points to +6.8% annualized sticky inflation.

It doesn’t take a math wizard to appreciate that is even further above the 2% Fed target and why they are more likely to not lower rates any time soon.

This inflation report finally pushed the idea of a March rate cut completely off the table. Further the odds of a May 1st cut went from 83% a month ago to only 38% today.

No...I am not calling for a bear market. I am just saying that this bull run should logically end here at 5,000. And then spend some time below.

Let me assure you that the Fed is more patient than the rest of us. They will NOT lower rates until they are 110% convinced that inflation is heading back to 2% for good. And there is simply no way to look at recent inflation data and say that we have arrived at that point.

Thus, I would say odds of May rate cut are even lower than currently believed with June or July being the more likely starting point for rate cuts. And even those months are in question given the data in hand.

With earnings growth nearly none existent and stocks pretty fully valued at new historic highs for the S&P 500, then the LOGICAL response from investors is to pause at this time. Meaning that 5,000 should be a pretty tight lid on stock prices.

More likely a consolidation under 5,000 with quite possibly a 3-5% pullback in stock prices seems in order. This leads to a trading range between the previous break out point at 4,800 (that is now support) and 5,000.

I don’t think investors will stomach much more than a classic 3-5% pullback. Just looking for a chance to take some excess profits off recent impressive gains.

The reason for not a larger decline is that investors know that the rate cuts are coming. Just a matter of when. Thus, they wouldn’t want to sell off too much when that bullish catalyst is right around the corner.

In recent commentary, I likened this scenario to pulling your car up to a red light. You know it will turn green relatively soon. Thus, you do not get out of your car and sit on the curb. Rather, you keep your eyes straight ahead ready to hit the gas pedal once again.

Reity, will you be getting more defensive with this likely pullback on the horizon?

No. I am not a fan of market timing when the primary trend is not in question.

Meaning we are in a bull market and not interested in taking money off the table as it can race ahead at any time. Often at unexpected times.

I would rather stay fully invested in my favorite stocks packed with the outperforming goodness from our POWR Ratings model. Gladly that approach often squeezes out a gain as these fundamentally more attractive stocks often rise even as most other stocks are stuck around breakeven.

More importantly, we are fully invested for whenever the light turns green. Sometimes when that happens unexpectedly the market can race ahead 3-5% in just a couple fantastic sessions. To have too much cash on the sidelines during those times creates a handicap on the year that may be hard to overcome.

Above is what I find to be the logical trading plan for this market environment. Now let’s discuss the best stocks to own at this time...

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

SPY shares were trading at $494.58 per share on Tuesday afternoon, down $6.40 (-1.28%). Year-to-date, SPY has gained 4.05%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

Are Stocks in a “Sticky” Situation? StockNews.com