Paperless statements promise less clutter, better organization, and faster delivery. Banks, credit card companies, and investment firms encourage customers to make the switch. Yet, as more financial institutions move to digital-only communication, there’s a growing concern: are paperless statements hiding crucial annual notices? Many people assume going paperless means they’ll never miss important updates. But the reality is more nuanced. If you’ve gone digital, you might not be seeing every critical message your financial institutions are required to send.

Missing an annual notice can mean missing changes to terms, privacy policies, or even fee structures. Some notices are buried deep within online portals, while others get lost in email clutter or spam folders. Let’s look at why paperless statements could be hiding crucial annual notices and what you can do to stay informed.

1. How Paperless Statements Work

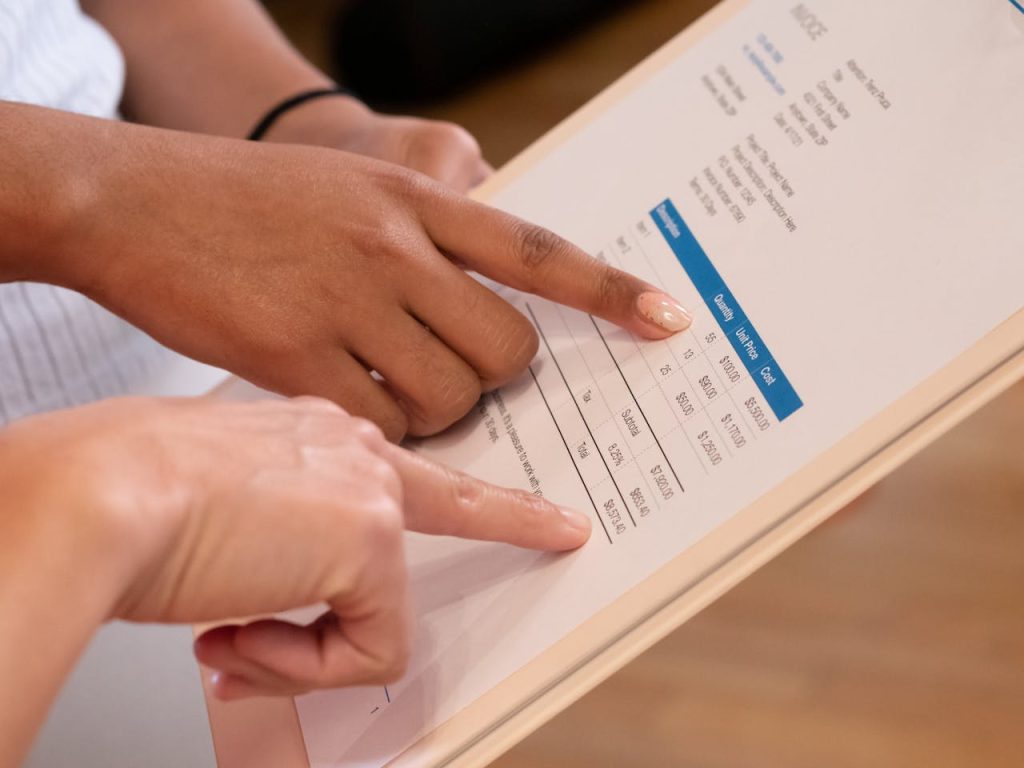

When you opt for paperless statements, your bank or financial provider typically stops mailing physical copies of your monthly and annual documents. Instead, they send you an email, usually with a link to log in and view your statement online. This system is efficient, but it puts the onus on you to check your account regularly.

The shift to digital means you no longer get a physical reminder in your mailbox. If you ignore or miss these emails, you might not realize a new statement—or a crucial annual notice—is waiting for you. Some systems group statements and notices together, so unless you open and review every digital document, important information could be overlooked.

2. Annual Notices Hidden in Plain Sight

One of the main concerns about paperless statements hiding crucial annual notices is how these documents are presented. Annual privacy notices, changes in terms, or updates to account features are often required by law. Financial institutions do send them, but they might be tucked away in your online account’s “documents” or “statements” section.

If you don’t log in regularly, you could miss these updates entirely. Even diligent customers may overlook subtle notifications or small links buried in email footers. Some banks only post these notices online without a separate alert, assuming you’ll find them during your normal statement review.

3. Email Overload and Spam Filters

With so many emails flooding our inboxes every day, it’s easy to miss a message from your bank or credit card provider. Notifications about new statements or annual notices can look just like marketing emails or routine alerts. If your email provider’s spam filter is aggressive, these messages may not even reach your inbox.

This digital noise is a big reason why paperless statements hiding crucial annual notices is a real risk. Many people only notice they missed something important when a problem arises—like a new fee or a change in policy that affects them.

4. Legal Requirements and Your Responsibility

Financial institutions are legally required to provide certain annual notices. For example, banks must send privacy policy updates and changes to account terms. When you sign up for paperless statements, you often agree to receive these notices electronically. That means it’s your responsibility to check for them.

Unfortunately, not all providers make it easy. Some send a generic “your statement is available” email, with no indication that an annual notice is included. Others might rely solely on a posted document in your account portal. This can make paperless statements hiding crucial annual notices more common than most people expect.

5. Tips to Stay Informed and Protected

To avoid missing crucial annual notices, adopt a few simple habits. First, set a recurring reminder to log in and review all new documents in your financial accounts. Look specifically for sections labeled “notices” or “legal updates.”

Second, adjust your email settings to ensure messages from your bank or investment firm are marked as important and never sent to spam. Consider using a separate folder or label for financial emails, so you can spot new messages quickly.

Finally, if you’re unsure whether you’re receiving all required notices, ask your provider directly. Some companies offer the option to receive both paper and electronic notifications for key documents.

What to Do If You Missed an Annual Notice

If you suspect you’ve missed an important notice due to paperless statements, don’t panic. Log in to your account and search for any recent documents or policy updates. Most institutions keep an archive of previous notices. If you can’t find what you need, contact customer service and request a copy.

It’s also wise to review your account activity and statements for any changes you weren’t expecting. Staying proactive can help you catch potential issues early.

Staying Alert in the Digital Age

Paperless statements offer convenience, but they can make it easy to miss crucial annual notices if you’re not careful. Financial institutions have shifted much of the responsibility onto customers to track these updates. By understanding how information is delivered and taking steps to stay organized, you can avoid unpleasant surprises.

Have you ever missed an important notice because of paperless statements? Share your experience or tips in the comments below!

Read More

Whats The Real Reason Your Mail Might Be Missing This Month

7 Credit Card Features Disappearing Without Any Notice

The post Are Paperless Statements Hiding Crucial Annual Notices? appeared first on The Free Financial Advisor.