Monday brought some sunshine for the cannabis industry, which has otherwise seen dark clouds looming over the past few years. Cannabis shares are rallying sharply today after President Donald Trump publicly endorsed the use of cannabidiol (CBD) as a potential tool in senior healthcare.

The market reaction was immediate. At the time of writing, U.S.-listed shares of Canadian cannabis players are gaining:

Meanwhile, domestic cannabis players are also seeing notable gains:

- Green Thumb Industries (GTBIF) is up 15.7%

- Curaleaf Holdings (CURLF) is up 20%

- Trulieve Cannabis (TCNNF) is up 12.7%

What Really Happened?

According to Reuters, Trump stated in a social media post that hemp-derived cannabidiol (CBD) could be a game changer, potentially slowing disease progression and serving as an alternative to traditional prescription drugs. The remarks came weeks after Trump signaled that his administration was considering reclassifying marijuana under federal law. While such a move would not constitute full legalization, it might lower marijuana-related fines and alleviate some of the operational and tax challenges that cannabis businesses face.

Analysts noted that even a symbolic nod from Trump gives momentum for an industry that has long been hampered by tight regulations. According to Reuters, Ben Laidler, head of equity strategy at Bradesco BBI, stated that any high-profile political backing carries significant weight in an industry that has long struggled due to regulations. Cannabis remains classified as a Schedule I substance under the Controlled Substances Act, a category designated for drugs considered to have no recognized medical use and a high risk of abuse. While former President Joe Biden previously asked health regulators to reconsider marijuana’s status, recommending a move to Schedule III, no final decision has been made.

1 Cannabis Stock That Deserves Attention

The global cannabis market is estimated to be worth $444.34 billion by 2030. Although the industry has high growth potential, it remains volatile. Investors who can stomach the risk might find Tilray Brands an intriguing cannabis stock to invest in.

Valued at $1.27 billion, Tilray Brands has evolved from a Canadian pure-play cannabis company to a global consumer packaged goods (CPG) and lifestyle company that operates at the intersection of cannabis, beverages, and wellness products.

Tilray stock has surged 18.1% year-to-date, compared to the S&P 500 Index ($SPX) gain of 13.3%.

For fiscal 2025, Tilray delivered net revenue of $821 million, up 4% from the prior year. Adjusted EBITDA came in at $55 million, with management citing strategic actions that preserved margins while slowing top-line growth by about $35 million. In the fiscal year, Canadian cannabis remained the top market by revenue; international cannabis sales also went up by 19%.

In order to expand its beverage alcohol business, Tilray made some strategic acquisitions over the last few years. Beverage sales increased by 19% year-over-year, boosted by the acquisition of four craft beer brands from Molson Coors (TAP). Additionally, distribution revenue from its European distribution business saw a steady 5% year-over-year gain, while wellness revenue rose by 9%.

Despite a $2.1 billion non-cash impairment charge related to previous acquisitions and shifting U.S. cannabis legalization forecasts, adjusted net income increased 45% to $9 million. The company also paid down roughly $100 million in debt while retaining a good liquidity position of $256 million in cash and securities.

Overall, Tilray is in a strong position as it continues to improve profitability, develop its worldwide footprint, and leverage innovation in cannabis, beverages, and wellness. Management cited continuous international cannabis expansion, a stronger craft beverage platform, and innovation in wellness and THC-infused drinks as key growth drivers.

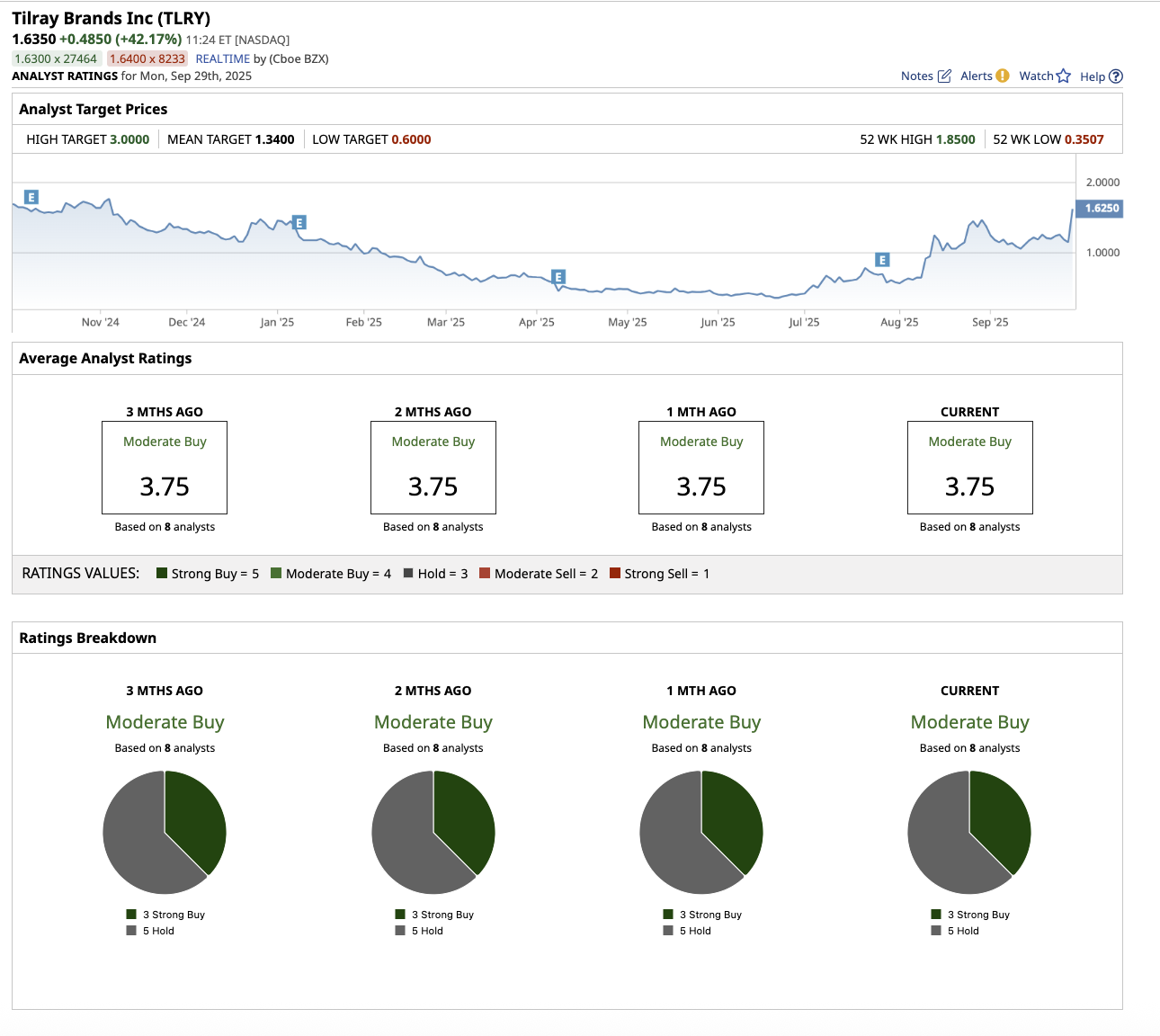

On Wall Street, Tilray stock is a “Moderate Buy.” Out of the eight analysts that cover the stock, three rate it a “Strong Buy,” and five rate it a “Hold.” The stock has surpassed its average analyst target price of $1.34. The Street-high estimate of $3.00 indicates the stock could rise as much as 84% in the next 12 months.

Investors and industry experts predict that momentum toward reclassification might be the most significant federal policy shift in years, one that the cannabis market has eagerly anticipated. However, I believe even if reclassification happens, federal legalization is still not guaranteed. Therefore, banking and tax hurdles remain a challenge for cannabis companies. Meanwhile, fundamentals and cash burn still matter, as regulatory optimism can only push prices so far until fundamentals resurface.

The Bottom Line

The cannabis industry is not for the faint-hearted. While the industry has the potential to deliver outsized gains, it will require patience and a long-term horizon to see federal policies shift in favor of cannabis companies so that they may reach their full potential. Investors keen on the cannabis industry might want to keep a close watch on political developments, especially as Trump meets with lawmakers this week.