Archer-Daniels-Midland Company (ADM) is a leading global agricultural and food processing company headquartered in Chicago, Illinois. With a market cap of $30.4 billion, it operates across three main segments: Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition, handling everything from grain trading and oilseed processing to food ingredients and animal nutrition.

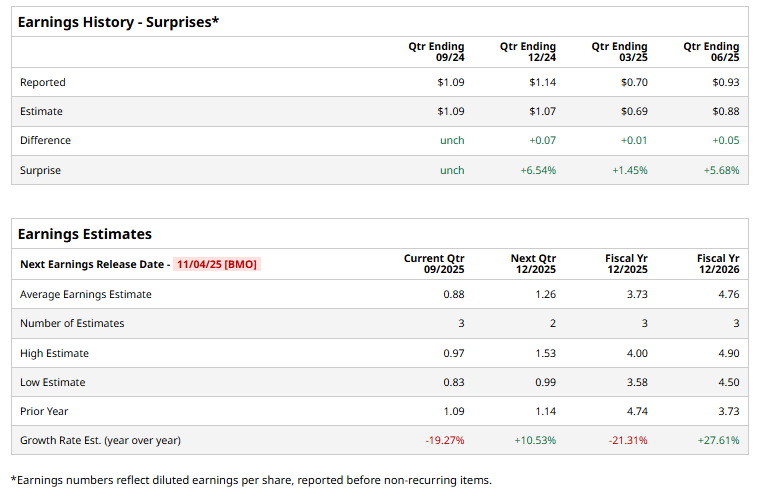

The farm products giant is expected to release its Q3 earnings on Tuesday, Nov. 4. Ahead of the event, analysts expect ADM to report a profit of $0.88 per share, down 19.3% from $1.09 per share reported in the year-ago quarter. The company has surpassed or matched the Street’s earnings projections in all of the past four quarters, which is admirable.

For the fiscal 2025, analysts expect the company to deliver an EPS of $3.73, down 21.3% from $4.74 reported in the previous year. However, in fiscal 2026, its earnings are expected to rebound 27.6% annually to $4.76 per share.

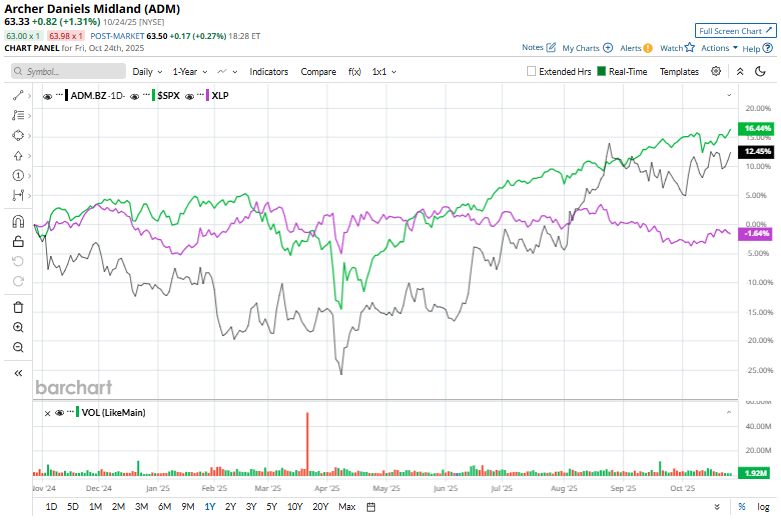

ADM has soared 12.1% over the past 52 weeks, underperforming the S&P 500 Index’s ($SPX) 16.9% gains. However, the stock has outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.2% dip during the same time frame.

Archer-Daniels-Midland has been battling persistent macroeconomic headwinds from weaker global demand and volatile biofuel prices to rising input costs and weather-related disruptions that have pressured margins. Yet the stock found some relief recently, gaining over 2% on Oct. 15 after President Trump hinted that Washington may end certain trade ties with China, including the purchase of cooking oil. The move sparked hopes of shifting global trade flows that could benefit U.S. agricultural exporters like ADM, offering a potential boost amid an otherwise challenging macro backdrop.

Analysts remain cautious about the stock’s prospects. ADM has a consensus “Hold” rating overall. Of the 11 analysts covering the stock, opinions include one “Strong Buy,” eight “Holds,” and two “Moderate Sells.” The stock currently hovers above its mean price target of $57.67.