Shares of electric air taxi maker Archer Aviation Inc (NYSE:ACHR) are surging Monday afternoon, becoming a top trending stock on social media as investors speculated about a potential connection to a highly anticipated announcement from Tesla Inc (NASDAQ:TSLA). Here’s what investors need to know.

What To Know: The frenzy ignited after Archer released a promotional video last week featuring its Midnight air taxi alongside a Tesla vehicle and its Optimus robot. The rumors intensified when Tesla’s social media account posted a cryptic video of its logo on a spinning propeller-like object, teasing an announcement for Tuesday.

This led to widespread speculation on social media that Tesla could be entering the electric vertical takeoff and landing market or forming a partnership with Archer.

While many on Wall Street anticipate Tesla’s announcement will actually be the launch of a more affordable EV model, the buzz around a possible collaboration was enough to send Archer’s stock to its highest point since July.

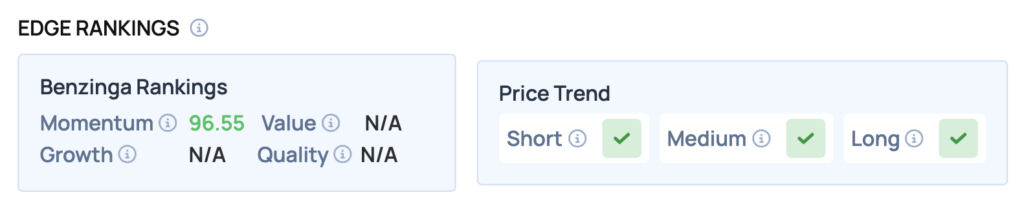

Benzinga Edge Rankings: The stock’s strong performance is underscored by a Benzinga Edge momentum score of 96.55.

ACHR Price Action: Archer Aviation shares were up 17.89% at $13.64 at market close on Monday, according to Benzinga Pro.

ACHR is experiencing strong upward momentum, significantly surpassing its 50-day moving average of $9.53. The stock is approaching its 52-week high of $13.92, indicating potential resistance at this level while the recent price action suggests a bullish trend.

How To Buy ACHR Stock

By now, you're likely curious about how to participate in the market for Archer Aviation — be it to purchase shares or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Read Also:

• JPMorgan Chase, Archer Aviation, Capital One Financial And An Energy Stock On CNBC’s ‘Final Trades’

Photo: T. Schneider via Shutterstock