Shares of Archer Aviation Inc (NYSE:ACHR) are trading lower Friday morning, extending an after-hours slide from Thursday following a mixed batch of company announcements. Here’s what investors need to know.

- ACHR stock is showing notable weakness. Get the latest updates here.

What To Know: After the bell, Archer reported third-quarter financial results, posting a loss of 20 cents per share, which was narrower than the 31-cent loss analysts had estimated. The company reported a third-quarter adjusted EBITDA loss of $116.1 million.

However, the company also announced a registered direct offering of 81.25 million shares priced at $8.00 per share. While this move, along with other fundraising, brings Archer’s total liquidity to over $2 billion, the offering likely put downward pressure on the stock.

Read Also: From Hype To Clear Skies: Joby Vs. Archer — A Race To Rule The Flying Car Era

Operationally, Archer announced a definitive agreement to acquire Hawthorne Airport in Los Angeles for $126 million in cash. The company plans to use the airport as an operational hub for its LA air taxi network and as an AI testbed.

For its fourth-quarter outlook, Archer anticipates an adjusted EBITDA loss of $110 million to $140 million. In response, Needham maintained its Buy rating on Friday but lowered its price target from $13 to $10.

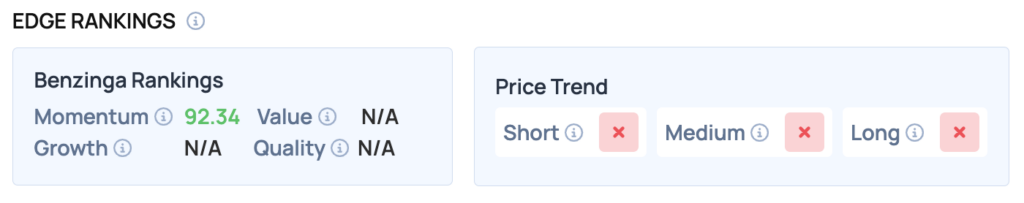

Benzinga Edge Rankings: According to Benzinga Edge Rankings for the stock, Archer shows a strong Momentum score of 92.34.

ACHR Price Action: Archer Aviation shares were down 16.81% at $7.38 at the time of publication on Friday, according to Benzinga Pro data.

Read Also: Elon Musk’s Trillion-Dollar Pay Package Approved By Tesla Shareholders Amid AI, Robotics Push

How To Buy ACHR Stock

By now you're likely curious about how to participate in the market for Archer Aviation – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock