Shares of Archer Aviation Inc (NYSE:ACHR) are moving higher in early trading Thursday morning, fueled by investor optimism following the company’s successful acquisition of Lilium’s patent portfolio. Here’s what investors need to know.

- ACHR is among today’s top performers. Check the fundamentals here.

What To Know: Archer secured approximately 300 advanced air mobility patents in a competitive bidding process for a reported 18 million euros ($20.95 million).

Per the company, the strategic acquisition enhances Archer’s intellectual property, expanding its portfolio to over 1,000 patents worldwide. The newly acquired assets cover key electric vertical takeoff and landing (eVTOL) technologies, including ducted fans, battery management and flight controls. Lilium had previously invested over $1.5 billion to develop this technology.

The move can be seen as a significant step in consolidating Archer’s position as a leader in the eVTOL market. Investors have responded positively to the news, potentially seeing the acquisition as a cost-effective way for Archer to bolster its technological capabilities and accelerate its product roadmap.

Archer shares surged on Wednesday after the successful patent bid was announced. The stock climbed as high as $14.30 on Thursday before pulling back. Shares were up about 2% at last check.

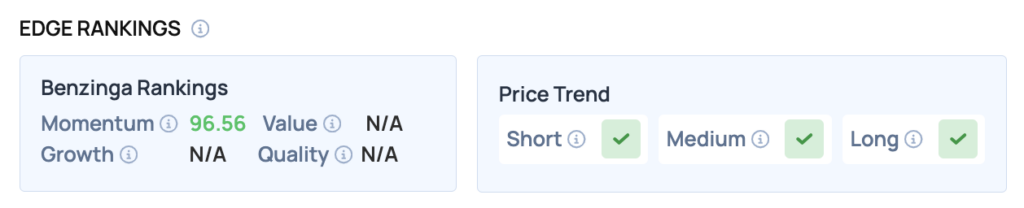

Benzinga Edge Rankings: The positive market reaction is further reflected in the stock’s Benzinga Edge Momentum score, which stands at an impressive 96.56.

ACHR Price Action: Archer shares were up 2.14% at $13.31 at the time of publication on Thursday, according to data from Benzinga Pro. The stock is approaching its 52-week high of $14.62, reflecting strong bullish momentum.

From a technical perspective, the stock is significantly above its 50-day moving average of $9.91, representing a substantial 38.7% premium. This indicates a robust bullish trend, with the 200-day moving average at $9.55 further confirming the strength of the upward movement.

Read Also: Trump’s Stealth Move May Be Behind The Biggest Gold Boom Since 1979

How To Buy ACHR Stock

By now you're likely curious about how to participate in the market for Archer Aviation – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock