Saudi Aramco is so profitable that it won’t have any trouble paying for a $69 billion acquisition.

The world’s biggest oil producer agreed last week to buy a 70 percent stake in chemical maker Sabic from Saudi Arabia’s sovereign wealth fund. Aramco will mostly use its own cash for the purchase, with half of the payment due to the Public Investment Fund when the deal closes and the rest staggered until 2021.

The oil giant plans to raise debt to help pay for the acquisition, giving investors a first look at its official accounts since its nationalization in the late 1970s. The details of how Aramco will finance the purchase of Sabic -- known formally as Saudi Basic Industries Corp. -- are based on data from Moody’s Investors Service, Fitch Ratings, the company’s bond prospectus and a person who viewed a presentation to prospective bondholders.

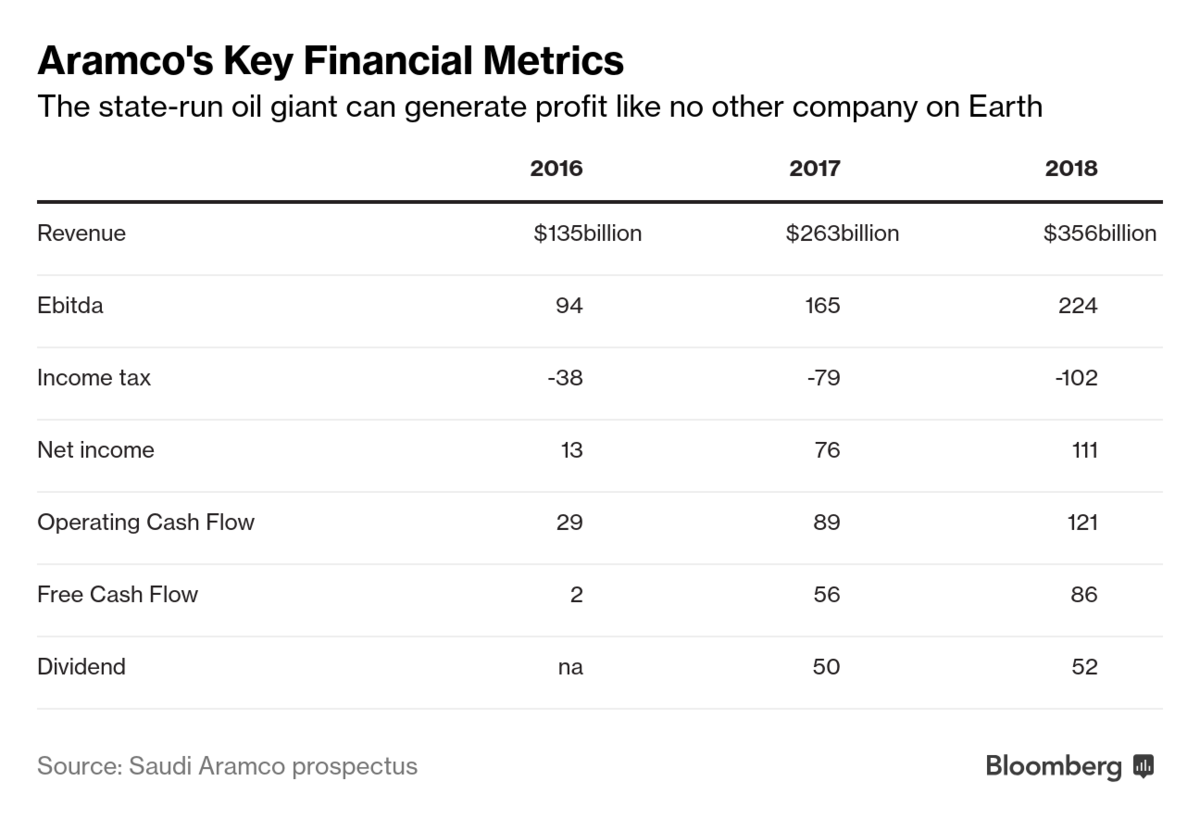

The Saudi oil producer, officially known as Saudi Arabian Oil Co., has $48.8 billion in cash and generated cash flow from operations of $121 billion last year. Both ratings services gave Aramco the fifth-highest credit rating, and said the Sabic acquisition won’t affect that assessment.

Read more: Aramco Unveils Financial Secrets of World’s Most Profitable Firm

By transferring the Sabic stake to Aramco, Saudi Arabia’s government will effectively be able to tap into Aramco’s oil earnings to boost its sovereign-fund investments and help diversify the economy after delaying the oil producer’s planned initial public offering.

The Sabic deal is expected to close in 2020, and Aramco will consolidate the chemical producer in its accounts the same year, according to the prospectus. Sabic will continue to trade on the Saudi stock exchange after Aramco acquires the majority stake.

--With assistance from Archana Narayanan.

To contact the reporters on this story: Anthony DiPaola in Dubai at adipaola@bloomberg.net;Netty Ismail in Dubai at nismail3@bloomberg.net

To contact the editors responsible for this story: Nayla Razzouk at nrazzouk2@bloomberg.net, Amanda Jordan

©2019 Bloomberg L.P.