The veteran crypto founder Mo Shaikh isn’t afraid to be brash. When asked why his new venture capital firm was called Maximum Frequency, or MF, Ventures, he said the name was a “nice play on letters.” Which letters? The same ones for “motherf–ker,” he implied, laughing.

“It kind of takes that level of grind and focus to really be a founder,” he told Fortune. In other words, to be a great founder requires “f–k you” energy.

On Tuesday, Shaikh, the cofounder of the well-known blockchain development company Aptos Labs, announced that he and three former colleagues had raised $50 million for a new venture fund that will focus on crypto companies. “We want to help each founder hit their maximum frequency,” he said.

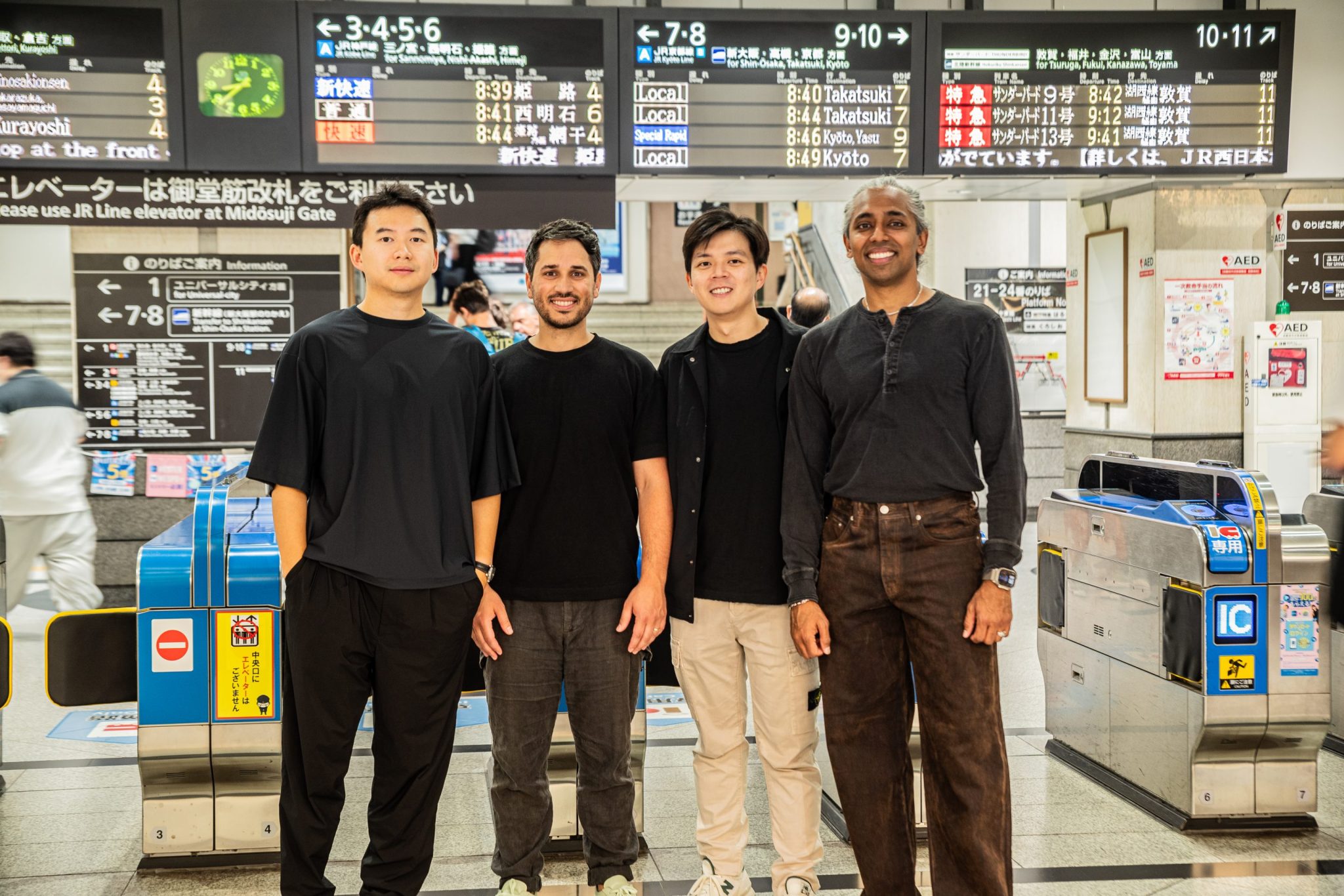

Once a novelty in venture capital, crypto-focused funds are now commonplace, and Maximum Frequency will join a landscape defined by the likes of Paradigm, Dragonfly, and Haun Ventures, among others. Shaikh’s three other cofounders are Neil Harounian, the first employee Shaikh hired at Aptos Labs and the startup’s former head of ecosystem; Alexandre Tang, the former head of APAC institutions at Aptos Labs; and Jerome Ong, the former APAC ecosystem lead.

While Shaikh wouldn’t disclose from whom he had raised the money, he did say the fund’s limited partners include family offices in the U.S., East Asia, and Southeast Asia. The four cofounders have also put their own money into the fund, Shaikh said, declining to specify how much. “We do have skin in the game,” he said.

Meta to Maximum Frequency

The new company comes amid a sluggish period for crypto venture capital. Despite soaring prices for cryptocurrencies like Bitcoin and Ethereum, venture investments in crypto dropped 55% to $6.8 billion from the first to second quarter of this year, according to data from Pitchbook. And VCs more broadly are struggling to raise new capital. The sector raised $50 billion from limited partners in the first half of 2025. That puts the venture capital industry on a much slower pace than 2024, when it raised nearly $190 billion over the entire year, per Pitchbook.

Still, the four cofounders of Maximum Frequency Ventures believe they can fight the headwinds.

Shaikh is a crypto and finance veteran. He started his career at financial behemoths like the accounting firm KPMG and the asset manager BlackRock. In 2020, he landed a gig at Meta to work on strategic partnerships for the social media giant’s now-scuttled blockchain project.

In late 2021, shortly before Meta publicly gave up on its crypto ambitions, the Big Tech giant gave Shaikh and his colleague Avery Ching its blessing to use Meta’s proprietary software to launch a high-speed blockchain, which the two dubbed Aptos. The project was a venture darling, and the duo raised more than $400 million for their company Aptos Labs, according to data from Pitchbook.

But, after about three years at the startup, Shaikh stepped down as CEO in December and Ching took his place. While Shaikh initially said he was stepping away to focus on “a new chapter,” he didn’t specify in any more detail why he was leaving. He declined to comment further to Fortune. Aptos continues to be one of the major blockchains and its cryptocurrency has a market capitalization of nearly $3 billion.

Shaikh and his cofounders are now focused on building and supporting companies along with other founders. And it’s their background working at a high-profile startup they believe will separate them from other crypto VCs, said Shaikh and cofounder Neil Harounian. “There aren’t really any funds in crypto that incubate,” added Harounian.

As opposed to other VCs who, they argue, passively write checks into startups, the four cofounders will actively work with founders to build out their businesses—and even start companies in house. So far, Maximum Frequency Ventures has deployed $5 million into six startups, Shaikh said. While the crypto venture firm hasn’t yet announced the deals, he said the founders they’ve backed are geographically diverse, from Texas to Abu Dhabi to South Korea. The team has specifically focused on looking for founders in Asia as opposed to only in the U.S., said Shaikh.

“We’re very hands on. We’re very active,” he said. “It’s a quality game, not a quantity game.”