/Aptiv%20PLC%20on%20building%20by_%20filmestria%20via%20iStock.jpg)

With a market cap of $18 billion, Aptiv PLC (APTV) is a technology company that serves the transportation, aerospace and defense, telecommunications, and industrial markets. The company designs and manufactures advanced vehicle components and technologies, focusing on electrical architecture, connectivity, and autonomous driving solutions.

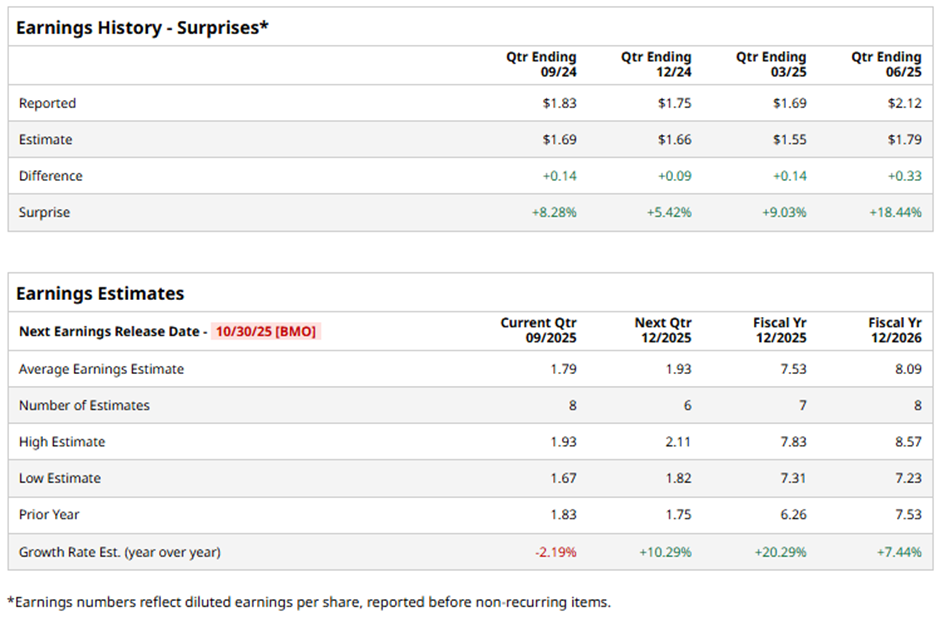

The Schaffhausen, Switzerland-based company is expected to announce its Q3 2025 results before the market opens on Oct. 30. Ahead of this event, analysts expect Aptiv to report an adjusted EPS of $1.79, down 2.2% from $1.83 in the year-ago quarter. However, it has exceeded Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the supplier to report an adjusted EPS of $7.53, a 20.3% increase from $6.26 in fiscal 2024.

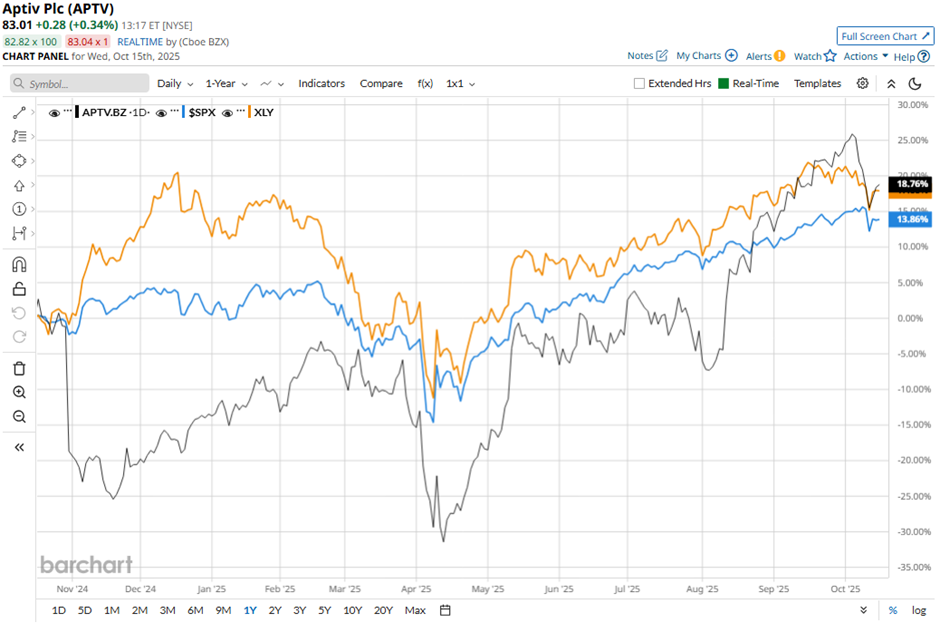

Shares of Aptiv have returned 19.6% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 14.7% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 18.8% increase over the period.

Shares of Aptiv rose 2.9% on Jul. 31 after the company forecasted annual adjusted EPS of $7.30 to $7.60, surpassing analysts’ estimates. The gain was also driven by stronger-than-anticipated Q2 2025 results, with adjusted EPS of $2.12, and a 3% rise in net sales to $5.2 billion. Investor confidence grew as Aptiv benefited from robust demand for driver-assistance and infotainment systems despite tariff pressures and higher costs.

Analysts' consensus view on APTV stock is moderately optimistic, with an overall "Moderate Buy" rating. Among 22 analysts covering the stock, 14 recommend "Strong Buy," one suggests "Moderate Buy," six indicate “Hold,” and one advises "Strong Sell." The average analyst price target for Aptiv is $94.11, indicating a potential upside of 13.4% from the current levels.