Applied Digital (APLD) stock has been on a solid run, soaring 130% in just three months and hitting a fresh 52-week high of $16.92 on Aug. 18. Moreover, APLD stock is up about 280% over the past year, thanks to its exposure to rapidly growing segments in technology, including high-performance computing (HPC) and artificial intelligence (AI).

APLD: From Crypto Roots to AI Infrastructure Leader

Applied Digital develops and operates next-generation data center infrastructure across North America. While the company initially gained traction by providing infrastructure services for crypto mining, a business that still accounts for its current revenue base, the company has expanded into larger, more lucrative opportunities.

Where Applied Digital is drawing the most attention today is in its HPC and AI infrastructure business. The company is building out an AI-focused campus in Ellendale, North Dakota, known as Polaris Forge. Construction is already underway on two massive data centers, one with 100 megawatts (MW) of capacity and another with 150 MW. Together with a third planned 150 MW facility, they will comprise the Polaris Forge 1 campus. These data centers are designed specifically for high-power GPU workloads, making them well-suited to meet the demands of next-generation AI applications.

APLD’s $3 Billion Bet: Polaris Forge 2

Notably, much of the recent excitement around APLD stock is the company’s plan for Polaris Forge 2, a $3 billion, 280 MW AI Factory near Harwood, North Dakota. The project is expected to break ground in September 2025, with initial capacity slated to come online in 2026 and full buildout anticipated by early 2027. The campus could expand well beyond its initial 280 MW, positioning the company as a long-term leader in AI infrastructure. Thanks to the announcement, APLD stock closed about 16% higher on Aug. 18.

Applied Digital Secured a Long-Term Contract with CoreWeave

Applied Digital stock also got a significant boost from another milestone announcement, a 15-year lease agreement with CoreWeave (CRWV). Under the deal, Applied Digital will provide 250 MW of IT load from its Ellendale campus, a commitment projected to generate roughly $7 billion in revenue over the life of the contract. With reliable, long-term cash flows secured, the partnership de-risks Applied Digital’s growth trajectory and strengthens its position in the AI and HPC infrastructure space.

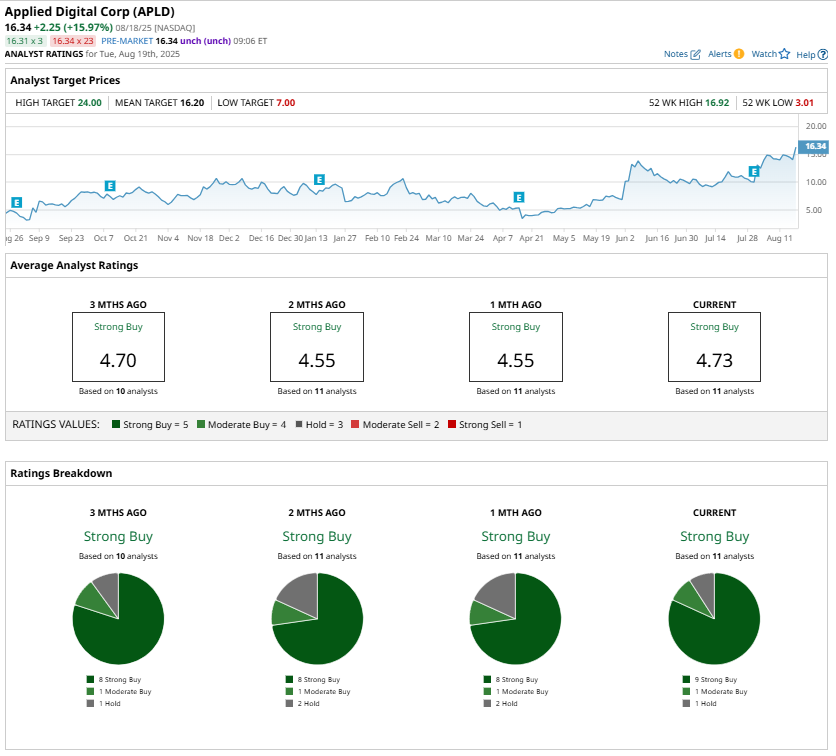

With AI adoption accelerating, Applied Digital is strategically positioned to capture rising demand for purpose-built data centers. Analysts remain bullish on APLD stock given its multi-gigawatt pipeline. Further, the highest price target for APLD stock is $24, reflecting about 54% upside from current price levels.

What Could Push APLD Stock to $24?

Applied Digital will capitalize on the booming demand for AI and HPC infrastructure given its growing capacity, competitive advantages, and increasing client base.

Its deepening partnership with hyperscale customers augurs well for growth. After successfully onboarding CoreWeave, Applied Digital has also completed diligence and onboarding with two additional North American hyperscalers. These partnerships will drive significant growth for APLD, giving the company a strong foothold in a market that requires immense capital and expertise to enter. These barriers make it difficult for new competitors to catch up.

Looking ahead, management expects a sharp increase in revenue beginning in the quarter ending August 2025. This growth is tied to the technical fit-out of its first Polaris Forge 1 building, a key milestone that should accelerate the company’s ability to serve clients at scale. Applied Digital’s track record of design and construction, combined with its multi-gigawatt development pipeline, places it in a strong position to meet the rising demand from hyperscalers who are aggressively pursuing land, power, and data center capacity.

With the CoreWeave lease alone, Applied Digital is already about halfway toward its target of generating $1 billion in annual net operating income within the next three to five years.

Wall Street remains bullish on APLD, with a “Strong Buy” consensus rating. Its multi-gigawatt development pipeline, long-term contracts, and growing demand from AI-driven workloads will likely accelerate its revenue growth rate, pushing Applied Digital stock toward the $24 level and beyond.