Apple stock rose on Monday after the U.S. and China agreed to a cooling-off period on tariffs. But the consumer electronics giant still faces an overhang related to challenges to its lucrative services business.

Apple reported minimal tariff impact in the March quarter, but had predicted $900 million in added costs to the June quarter from tariffs. But that was before the U.S. and China on Monday slashed their respective tariffs for a 90-day negotiation period.

On the stock market today, Apple stock rose 6.3% to close at 210.79. With the rise, Apple climbed back to its 50-day moving average line, a key support level.

Wedbush Securities analyst Daniel Ives said the U.S.-China trade deal was a "best case scenario."

"With U.S./China clearly on an accelerated path for a broader deal, we believe new highs for the market and tech stocks are now on the table in 2025 as investors will likely focus on the next steps in these trade discussions which will happen over the coming months," Ives said in a client note.

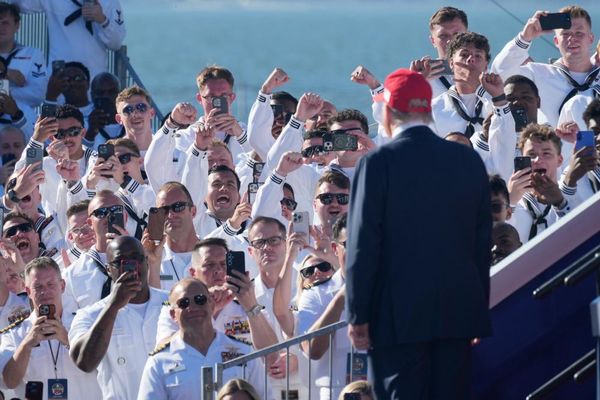

President Donald Trump told reporters that he spoke with Apple Chief Executive Tim Cook after the U.S. and China agreed to suspend most tariffs for 90 days. Trump said he thinks Cook will commit to increasing investment in the U.S., above his earlier $500 billion pledge.

"He's going to be building a lot of plants in the United States for Apple," Trump said. "And we look forward to that."

Apple Services Business In Focus

Elsewhere on Wall Street, Morgan Stanley analyst Erik Woodring discussed the bull vs. bear debate on Apple's services business. Legal cases are threatening revenue and profits for Apple's App Store and its internet search businesses.

"For nearly a decade, Apple's Services business has been a reliable ballast for growth, margins and a premium multiple," Woodring said in a client note. "However, an opaque June-quarter Services guide and recent, cautious legal headlines (App Store/Google Traffic Acquisition Costs) are fueling more debate than ever over the risk to Services growth."

A judge's ruling in a lawsuit brought by Epic Games has forced Apple to allow alternative app stores and payment methods in the U.S. The ruling also bars Apple from charging commissions and other fees on payments made outside its App Store.

Meanwhile, a U.S. Department of Justice antitrust case against Alphabet unit Google threatens a deal that makes Google the default search engine on Apple's iPhone. Google pays Apple about $20 billion a year under the arrangement.

Apple Stock Has Middling Composite Rating

Woodring believes Apple's services business is more vulnerable than ever, but also that the risks from those legal cases have been overblown.

"At the same time, these concerns have resulted in investor sentiment turning overwhelmingly negative," he said.

Woodring reiterated his overweight, or buy, rating on Apple stock with a price target of 235.

In other news, the Wall Street Journal reported Monday that Apple is considering raising iPhone prices this fall with its latest handsets.

The Cupertino, Calif.-based company hopes to tie the price increases to new features and design changes with the iPhone 17 series rather than tariffs, the Journal said.

Apple stock has a middling IBD Composite Rating of 60 out of 99, according to IBD Stock Checkup. IBD's Composite Rating combines five separate proprietary ratings into one easy-to-use rating. The best growth stocks have a Composite Rating of 90 or better.

Follow Patrick Seitz on X, formerly Twitter, at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.