/Apple%20Inc%20logo%20on%20Apple%20store-by%20PhillDanze%20via%20iStock.jpg)

Apple’s (AAPL) stock performance this year hasn’t been worth noticing. For much of the year, the iPhone maker lagged behind the broader market, weighed down by trade disputes and tariff-related uncertainties. Year-to-date, AAPL shares are still down roughly 7%, while the S&P 500 Index ($SPX) has climbed about 9.7%. However, the stock is gaining momentum. Apple has risen more than 9% in the last five trading days.

The turnaround has been driven by two key developments. First, Apple delivered a solid third-quarter performance, showing resilience and the capacity to generate growth even in a challenging environment. Second, the company expanded its U.S. investment and announced a new American manufacturing program, a move widely interpreted as a step to ease tariff concerns. By boosting its U.S.-based production, Apple is addressing tariff risks and aligning itself more closely with domestic policy priorities. This is particularly important given President Donald Trump’s past criticism of Apple’s reliance on overseas manufacturing.

Apple’s recent steps have been seen as a careful balancing act, strengthening its manufacturing footprint in the U.S. while maintaining a global supply chain that has been key to its margins. The market’s positive reaction suggests investors are encouraged by Apple’s ability to adapt to political and economic pressures.

With market sentiment improving for Apple stock, will the momentum sustain?

Apple’s Growth Drivers Remain Intact

Despite the macro challenges, Apple’s products see solid demand, and its services business continues to post robust growth. This is evident from its latest quarterly results. Apple reported a record June quarter revenue of $94 billion, up 10% from a year ago, with growth in every geographic region.

On the hardware front, product sales climbed to $66.6 billion, an 8% year-over-year increase, powered by robust demand for the iPhone and Mac. The company’s ecosystem remains a key strength, with the active installed base of devices hitting all-time highs across every product category and region.

The iPhone generated $44.6 billion in revenue, 13% higher than last year, reflecting strong sales of the iPhone 16 lineup. Growth was broad-based, with every region contributing and many emerging markets posting double-digit increases. The number of iPhones in active use set a new record, and Apple achieved its best-ever June quarter for customer upgrades.

Mac sales also impressed, surging 15% to $8 billion. The segment witnessed gains across every region, with particularly strong growth in Greater China, Europe, and the rest of the Asia Pacific. Like the iPhone, the Mac installed base is now at its highest level ever, supported by strong demand from both new and upgrading customers.

Not every category was in growth mode. iPad revenue came in at $6.6 billion, down 8% due to tough comparisons with last year’s product launches. Still, the iPad’s installed base reached another record, and more than half of buyers were first-time customers, which is a promising sign for future growth. Wearables, Home, and Accessories saw a 9% decline to $7.4 billion, also reflecting difficult year-ago comparisons. But here too, Apple continues to expand its reach, with the Apple Watch installed base hitting a new high and more than half of new watch buyers coming from outside the existing customer base.

The services segment was once again a star performer, delivering revenue of $27.4 billion, up 13% year-over-year. This growth was broad-based, with significant gains in cloud services, thanks to rising iCloud subscriptions. Customer engagement remains on an upward trajectory, with both transacting and paid accounts hitting all-time highs, and paid subscriptions growing at a double-digit pace to surpass 1 billion across Apple’s platforms.

Looking ahead, Apple expects momentum to continue into the current quarter. Management projects total company revenue growth in the mid- to high single digits year-over-year, with services likely to sustain their double-digit growth pace.

Is Apple Stock a Buy Right Now?

Apple’s iPhone and Mac remain highly desirable, setting the stage for solid growth. Moreover, Apple’s tight-knit ecosystem and the rising contribution of its services division provide a solid base for revenue growth that can help in navigating the broader economic uncertainty. However, trade tensions and tariffs remain a potential headwind and could continue to impact its margins in the short term.

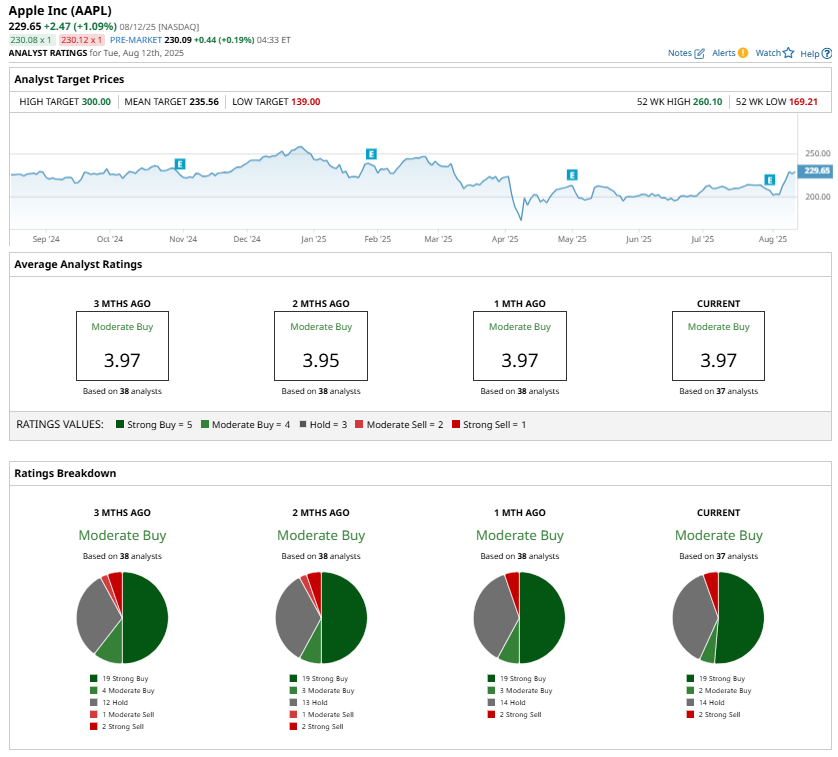

On Wall Street, sentiment toward the stock is cautiously optimistic, with analysts maintaining a “Moderate Buy” consensus rating. However, with shares trading at a forward price-earnings ratio of 31x and earnings growth projected at just 6.7% for fiscal 2026, much of the positives are already reflected in its current price.