Apple Inc. (NASDAQ:AAPL), Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) Google and Meta Platforms, Inc. (NASDAQ:META) will have to face lawsuits accusing them of profiting from illegal casino-style apps after a federal judge ruled Section 230 does not shield their payment processing practices.

Judge Rejects Section 230 Defense

On Tuesday, U.S. District Judge Edward Davila in San Jose, California, denied the companies' motions to dismiss claims that they hosted and promoted addictive gambling apps while taking 30% commissions on in-app purchases, reported Reuters.

Davila rejected their central argument that Section 230 of the Communications Decency Act, which protects online platforms from liability for third-party content, covered the allegations.

"The crux of plaintiffs’ theory is that defendants improperly processed payments for social casino apps," he wrote. "It is beside the point whether that activity turns defendants into bookies or brokers."

Allegations Of Addictive Gambling

Dozens of plaintiffs argue that Apple's App Store, Google's Play Store and Meta's Facebook worked together in an illegal racketeering conspiracy by promoting digital slot machine apps that mimicked real-world casinos.

They claim the companies triggered addiction, depression and even suicidal thoughts among users while collecting more than $2 billion in commissions from processed transactions.

The lawsuits seek unspecified compensatory damages.

Davila stated that Apple, Google and Meta can promptly appeal his ruling to the 9th U.S. Circuit Court of Appeals, partly due to the significance of the Section 230 matters.

Apple, Google and Meta did not immediately respond to Benzinga's request for comments.

Tech Giants Face Wider Legal Scrutiny

The ruling adds to mounting legal challenges for Silicon Valley firms.

Apple, earlier this month, faced another class action lawsuit over the alleged use of copyrighted books to train its AI models.

Google was sued this month by Penske Media, owner of Rolling Stone and Variety, over AI summaries.

Meanwhile, Meta last month agreed to distribute payments from a $725 million settlement tied to the Cambridge Analytica scandal.

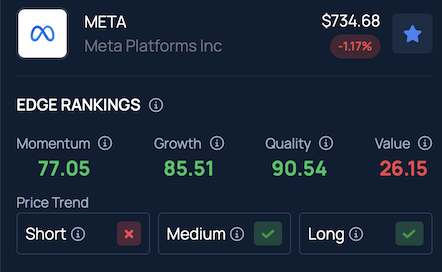

Price Action: After-hours trading saw Meta shares fall 0.14% to $733.33, Apple shares decline 0.44%, Google Class A shares drop 0.23% and Class C shares slip 0.29%, according to Benzinga Pro.

Benzinga's Edge Stock Rankings rate META's stock quality in the 90th percentile, showing how it compares to Apple, Google and other rivals.

Read Next:

Photo Courtesy: Koshiro K on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.