Apple Inc. (NASDAQ:AAPL) saw its entry-level iPhone 17 model dominate pre-orders on China’s JD.com platform, with the 256GB configuration receiving the most orders among all new iPhone models after pre-orders launched on Friday.

Check out the current price of AAPL stock here.

Apple has postponed pre-orders for the iPhone Air in China due to regulatory issues with eSIM approval, according to a report by South China Morning Post. However, U.S. customers can still expect to receive their iPhone Air models by the launch day on September 19.

Value Proposition Drives Demand

The iPhone 17 has become popular due to its improved value. Priced at $799, the same as the iPhone 16, though analysts speculated potential price hikes before the launch. It offers several upgrades like a bigger 6.3-inch screen with slimmer bezels, 120Hz ProMotion support, and double the base storage at 256GB.

These display improvements bring the base model closer to pro specifications, addressing a key differentiator that previously pushed consumers toward premium tiers.

Wall Street Raises Price Targets Post-Launch

Earlier, Wall Street analysts praised Apple’s iPhone 17.

Bank of America Securities (NYSE:BAC) analyst Wamsi Mohan upgraded Apple’s price target from $260 to $270, maintaining a Buy rating. Mohan cited stronger health and AI integration in the iPhone 17 lineup, raising fiscal 2026 revenue estimates to $448 billion and EPS to $8.05.

Rosenblatt analyst Barton Crockett lifted Apple’s target from $223 to $241 with a Neutral rating, noting stronger battery life and upgraded 48MP cameras across models. Goldman Sachs’ Michael Ng maintained a $266 target, emphasizing that Apple’s elimination of 128GB storage tiers effectively increases average selling prices by $100.

Market Position Remains Strong

Apple controls 25.71% of the global smartphone market, while Samsung Electronics Co. (OTC:SSNLF) comes in at 20.96%. In the U.S., Apple dominates with a 57.24% market share, compared to Samsung's 22.25%. In the third quarter, iPhone revenue rose to $44.58 billion, up from $39.3 billion last year, highlighting the iPhone as the main driver of Apple’s growth.

Price Action: According to Benzinga Pro data, Apple closed at $234.07 on Friday, up 1.76%, but dropped slightly to $233.99 in after-hours trading.

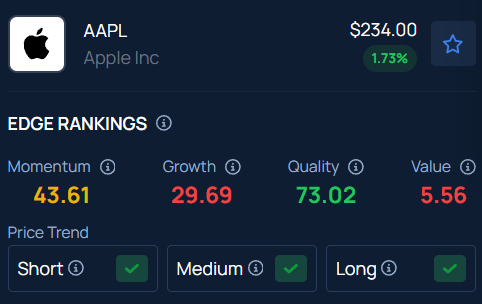

Benzinga's Edge Stock Rankings indicates AAPL has a positive price trend across all time frames. Here is how the stock fares on other parameters.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: jamesteohart / Shutterstock.com