What you need to know

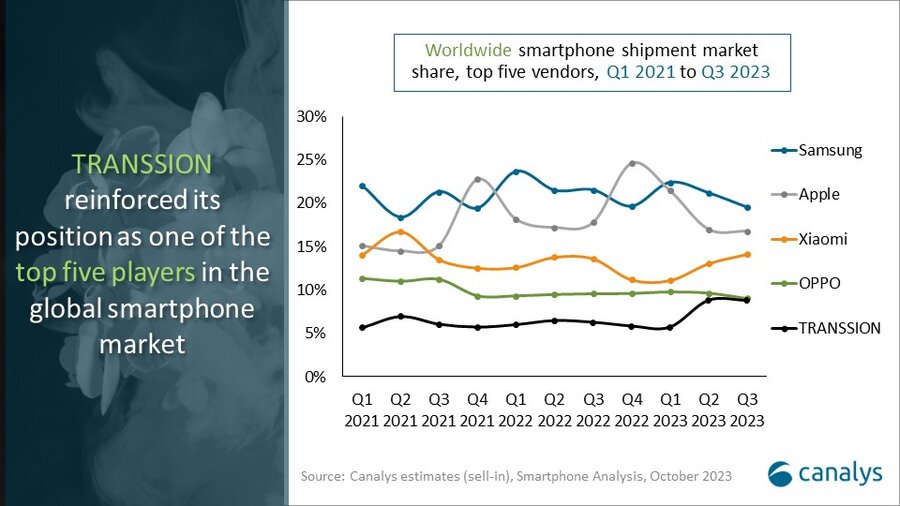

- Worldwide smartphone sales in Q3 2023 hit about 300 million, a 1% dip compared to last year, according to Canalys.

- Apple, Samsung, and OPPO all lost worldwide market share compared to Q3 2022.

- Chinese phone brand TRANSSION claimed the fifth spot previously owned by vivo.

The biggest smartphone brands have tread water or lost ground in worldwide smartphone sales this year, including household names like Samsung and Apple. But a relatively unknown Chinese phone manufacturer leaped into the top 5 companies in the world, claiming nearly the same number of phones sold as OPPO.

Tanssion, the maker of Tecno, Itel, and Infinix phones, climbed from 6% global market share last year to 9% in 2023, a 50% jump, while its larger competitors lost ground.

According to this Canalys report on Q3 2023 sales, Samsung and Apple lead total sales with 20% and 17% market share, yet both have fallen from their 22% and 18% levels in 2022. Xiaomi matched last year's share only by "recovering" from a terrible first half of 2023. OPPO has fallen steadily over the past two years, while fellow BBK brand vivo lost the top-5 slot it's owned for years.

Overall, Canalys analysts say smartphone sales fell a mere 1% compared to Q3 2022, but compared to the declining smartphone market earlier this year, we're now seeing a "slowdown in its decline" thanks to "regional recoveries and new product upgrade demand."

Founded in 2006, Transsion distinguished itself from other Chinese phone makers by establishing a major foothold in Africa and tailoring its phones to users there. It also sells phones in the Middle East and Latin America while recently pushing into India.

Its recent strategy has been to sell reliable phones at aggressively low prices, such as the Tecno PHANTOM V Flip. Our reviewer noted that by selling a $600 foldable, Tecno was "essentially democratizing foldables by significantly lowering the barrier to entry." It also showed off a rollable phone concept at MWC this year, which shows that Transsion is willing to experiment with new form factors rather than simply copy the competition.

We also reviewed the Infinix GT 10 Pro, praising its hardware and design for a sub-$300 price, even if it had some frustrating downsides.

This Q3 2023 report makes an interesting case that Samsung is "reducing exposure in the entry-level segment to focus on profitability," leaving room for brands like Transsion to pounce in "emerging markets."

"These short-term wins might turn into more sustainable long-term success if Xiaomi and TRANSSION play their cards well," the report concludes.

Apple, which launched the iPhone 15 series with about eight days left in the quarter, benefitted from pre-orders last quarter but is guaranteed to gain shares next quarter. Still, after iPhone 14 Pro sales shot Apple's market share higher last year, it seems Apple may come back down to Earth a bit this year.

Samsung, meanwhile, will have to count on the Galaxy S23 FE and Black Friday sales to tide itself over until early 2024 and the Galaxy S24 launch. And OPPO will have to hope that its OnePlus 12 and Find N3 Flip launches will help it bounce back by the end of the year.