Valued at a market cap of $82.1 billion, Apollo Global Management, Inc. (APO) is a leading global alternative asset manager. The firm specializes in private equity, credit, real estate, infrastructure, and sustainable investments, serving institutional and individual investors worldwide.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Apollo Global Management fits this criterion perfectly. With a contrarian and value-driven approach, Apollo manages diverse strategies across industries and geographies, focusing on both private and public markets.

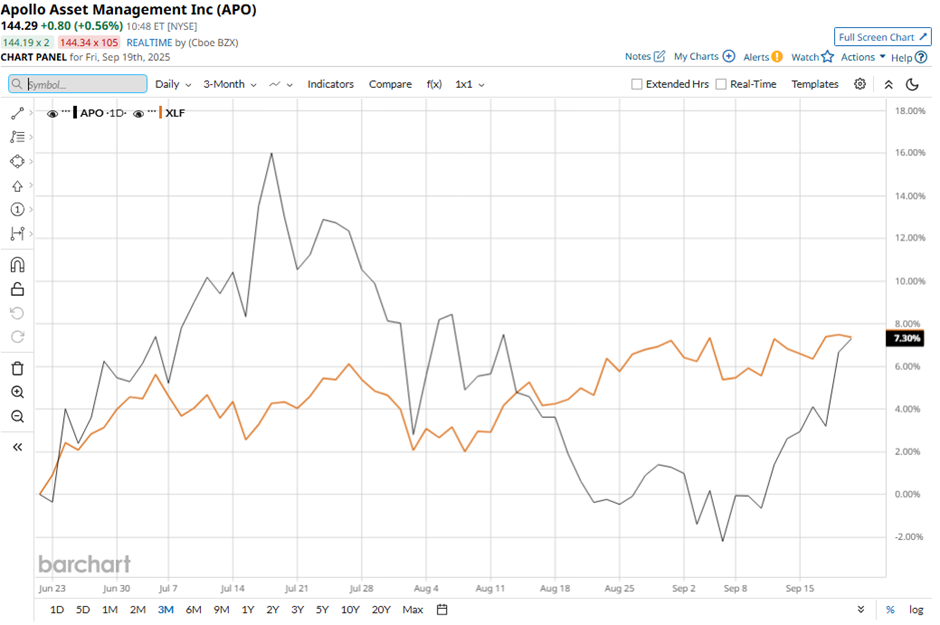

The New York-based company's stock has dipped 23.8% from its 52-week high of $189.49. Shares of Apollo have gained 8.4% over the past three months, outpacing the Financial Select Sector SPDR Fund’s (XLF) 7.5% rise over the same time frame.

In the longer term, APO stock has soared 18.6% over the past 52 weeks, slightly outperforming XLF’s 18.2% increase over the same time frame. However, shares of the company have declined 12.7% on a YTD basis, underperforming XLF’s 11.7% return.

Despite a few fluctuations, the stock has been trading below its 200-day moving average since March.

Shares of Apollo Global Management rose 2.5% on Aug. 5 after the company posted strong Q2 2025 results, with adjusted EPS of $1.92, beating the consensus estimate and improving from $1.64 a year earlier. Results were fueled by a 36.1% year-over-year increase in total AUM to $840 billion, driven by $98 billion of inflows from Asset Management and $81 billion from Retirement Services, as well as a 22.2% rise in fee-earning AUM to $638 billion. Revenues also impressed, climbing 17.5% to $1.1 billion, which topped estimates.

In contrast, rival KKR & Co. Inc. (KKR) has outperformed APO stock on a YTD basis, rising marginally. Nevertheless, KKR stock has gained 11.8% over the past 52 weeks, lagging behind Apollo’s performance during the same period.

As APO stock has slightly outperformed over the past year, analysts remain bullish about its prospects. The stock has a consensus rating of “Strong Buy” from 22 analysts' coverage, and the mean price target of $167.28 is a premium of 15.9% to current levels.