With a market cap of $7 billion, APA Corporation (APA) is a leading independent energy company engaged in the exploration, development, and production of natural gas, crude oil, and natural gas liquids. With operations spanning the U.S., Egypt, the North Sea, and offshore Suriname, APA plays a significant role in global energy markets.

Shares of the Houston, Texas-based company have underperformed the broader market over the past 52 weeks. APA stock has declined 37.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained over 17%. In addition, shares of APA Corporation have dropped 15.6% on a YTD basis, compared to SPX's 8.2% rise.

Looking closer, the oil and natural gas producer stock has also lagged behind the Energy Select Sector SPDR Fund's (XLE) 5.5% dip over the past 52 weeks.

Shares of APA climbed 4.5% following its Q1 2025 results on May 7. The company posted adjusted EPS of $1.06 and revenue of $2.6 billion, beating analysts' estimates. The company reported adjusted production of 398,000 BOE/day and achieved significant cost efficiency, lowering full-year development capital guidance by $150 million. APA also doubled its 2025 expected run-rate savings to $225 million and announced a promising Sockeye-2 discovery well in Alaska with superior reservoir quality.

For the current fiscal year, ending in December 2025, analysts expect APA's adjusted EPS to decrease 22.6% year-over-year to $2.92. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

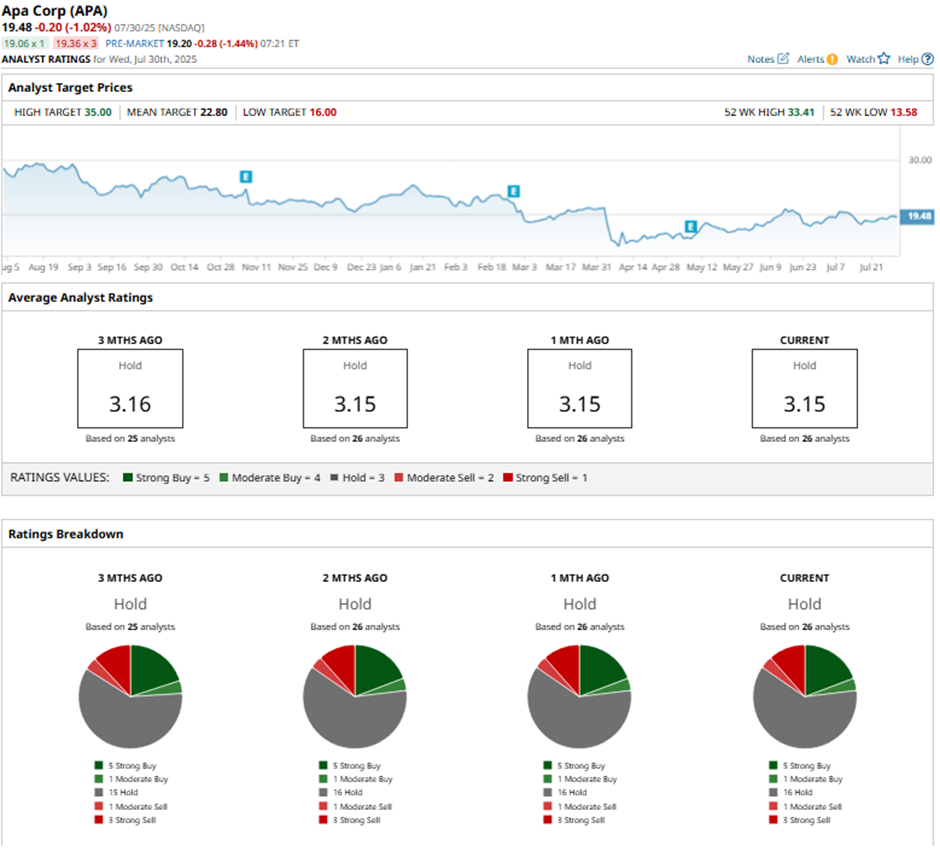

Among the 26 analysts covering the stock, the consensus rating is a “Hold.” That’s based on five “Strong Buys,” one “Moderate Buy,” 16 “Hold” ratings, one “Moderate Sell,” and three “Strong Sells.”

On Jul. 22, Raymond James raised its price target on APA to $26 and maintained an “Outperform” rating, citing oil price recovery and stable management activity despite ongoing macro uncertainty.

As of writing, the stock is trading below the mean price target of $22.80. The Street-high price target of $35 implies a potential upside of 79.7% from the current price levels.