/Aon%20plc_%20building%20photo-by%20J2R%20via%20iStock.jpg)

Dublin, Ireland-based Aon plc (AON) is a professional services firm that provides a range of risk and human capital solutions. Valued at a market cap of $80.5 billion, the company offers insurance and reinsurance brokerage, pension administration, healthcare consulting, and workforce management services.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and AON fits the label perfectly. The company's strength lies in its global scale, deep expertise in risk management, and strong client relationships across industries. By combining advanced analytics with decades of experience, AON helps organizations manage risk more effectively, protect assets, and enhance workforce resilience, making it a trusted partner in navigating complex global challenges.

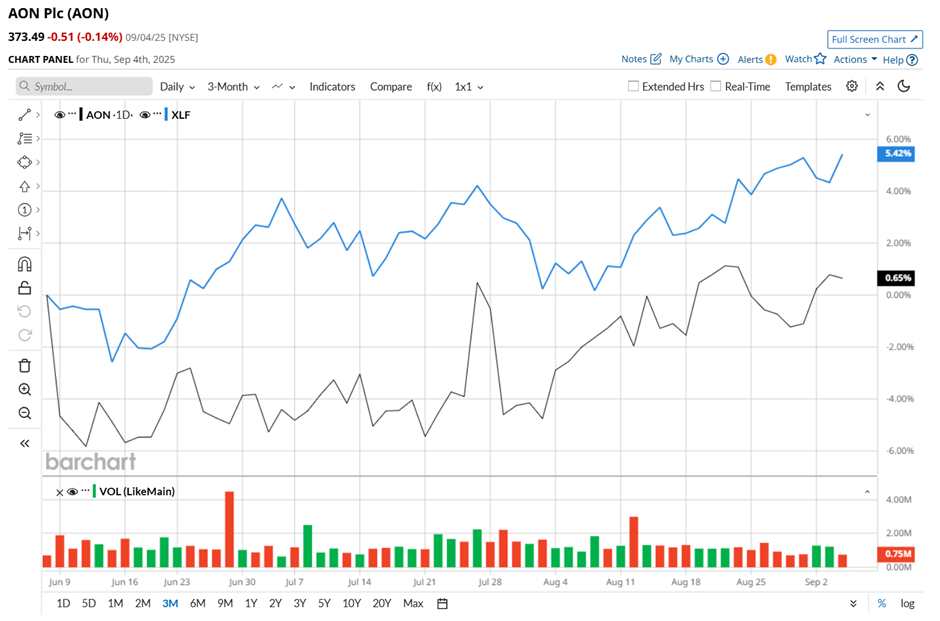

The insurance company stock has slipped 9.6% from its 52-week high of $412.97, reached on Mar. 3. AON stock has gained marginally over the past three months, underperforming the Financial Select Sector SPDR Fund’s (XLF) 6.4% return during the same time frame.

In the longer term, AON stock has gained 7.2% over the past 52 weeks, lagging behind XLF's 18.9% uptick over the same time period. Moreover, on a YTD basis, shares of AON are up 4%, compared to XLF’s 11.9% rise.

AON stock has been trading below its 50-day and 200-day moving averages since April. However, the stock has remained above its 50-day moving average since August.

On Jul. 25, Shares of AON surged 4.6% after its Q2 2025 earnings release. The company’s revenue grew 10.5% year-over-year to $4.2 billion, while its adjusted EPS advanced 19.1% from the year-ago quarter. Strong demand for AON’s advisory and solutions, fueled by a more complex business environment and the growing need to unlock new sources of capital, supported this growth. Moreover, its adjusted operating margin expanded by 80 basis points, further highlighting its solid operational performance.

AON has considerably outpaced its rival, Marsh & McLennan Companies, Inc. (MMC), which declined 9.7% over the past 52 weeks and 2.9% on a YTD basis.

Despite AON’s underperformance relative to the sector, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 23 analysts covering it, and the mean price target of $411.79 suggests a 10.3% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.