The board of a major Australian bank won't be following the lead of its new chief executive and sacrifice some of their fees in the spirit of accountability after a rocky few months.

ANZ was slapped with a record $240 million penalty by the financial regulator in September for "widespread misconduct", including the mishandling of a 2023 bond deal for the federal government.

The bank also had to revamp its long-awaited $1.6 billion technology platform, ANZ Plus, after a botched rollout.

ANZ's board stripped several executives of their short-term variable incentive payments over the issue, including former chief executive Shayne Elliott.

Mr Elliot, who lost $13.5 million in bonuses, fired back by filing legal action in NSW Supreme Court on December 12.

Nuno Matos, who was appointed CEO in May, volunteered not to receive a short-term bonus for 2024/25 in recognition of the bank's problems, even though they pre-dated his arrival.

Sue Howes from the Australian Shareholders Association told ANZ's annual general meeting Mr Matos was leading by example.

"Given this team approach, did directors also consider making some sacrifice of their director fees, given their accountability for the governance of the company and the severe penalties now imposed on the company?" she asked the meeting in Sydney on Thursday.

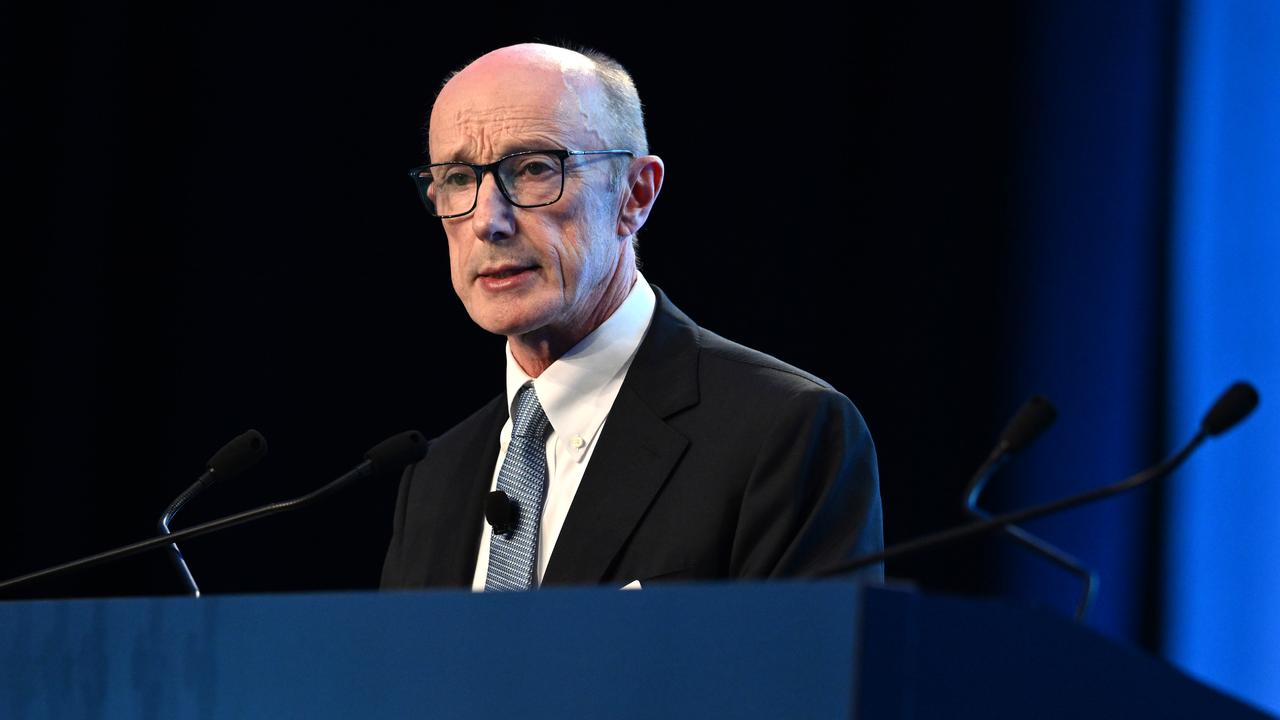

ANZ chairman Paul O'Sullivan rejected the idea, saying the board was doing its job and variable pay for boards might distort their behaviour.

"It's a different type of accountability," he said.

"The question is, did the board lean in on governance? And I've given you several examples where it did and when it didn't see the results coming through, it's made changes."

Earlier in the meeting, Mr O'Sullivan gave a more robust defence of ANZ's board, saying it had acted diligently in monitoring performance, acting independently of management and enforcing accountability.

The board appointed its own independent legal counsel to investigate the bond trading allegations and an external reviewer to look into the issues with ANZ Plus, he said.

"We have driven change, which you've seen with significant refresh of the of the leadership team," Mr O'Sullivan said.

"We've appointed an external person who's got tremendous experience in driving transformation and change within the organisation," he said, referring to Mr Matos.

"So I think your board has actually acted with a degree of strong diligence in these matters."

Shareholders however delivered ANZ an embarrassing "second strike" on executive pay, with just 67 per cent of votes cast in favour of its remuneration report, short of the 75 per cent required.

An automatic resolution on whether to spill ANZ's board was soundly defeated, with nearly 98 per cent opposed, according to an initial tally.

A special resolution put forward by activists on amending ANZ's constitution also failed, with 8.7 per cent support and 90 per cent opposition.

That meant other resolutions on climate change and deforestation were not officially considered by the meeting. They would have failed, although the deforestation item did receive more than 20 per cent support.

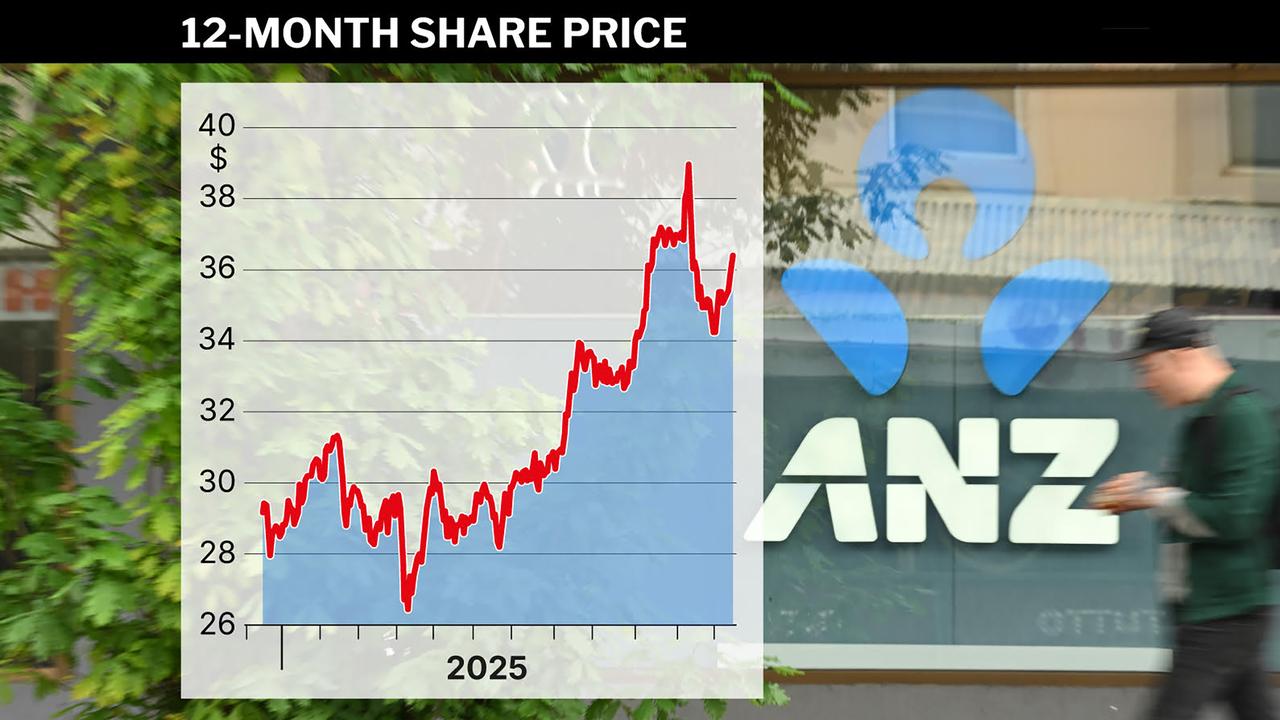

ANZ shares finished down 0.1 per cent to $36.07.