Anthony Scaramucci, strategic advisor of AgriFORCE Growing Systems Ltd. (NASDAQ:AGRI), sounded optimistic on Avalanche (CRYPTO: AVAX) on Monday, deeming it as the “Swiss army knife” among Layer-1 networks.

AGRI stock is racing ahead of the pack. See if it is worth your attention here.

Scaramucci’s Big Bet On Avalanche

Skybridge Capital founder Anthony Scaramucci, who will serve as the company’s strategic advisor, said that they made a “big bet” on Avalanche due to its tokenization potential.

“Lots of big corporate CTOs are picking up Avalanche as part of their story to tokenize their funds or potentially even tokenize their assets,” he said.

Scaramucci also highlighted the importance of subnets, interoperable networks within Avalanche’s ecosystem that can be tailored to specific use cases.

“I often say that Avalanche is like a Swiss army knife of Layer-1 networks, so it’s got a lot of flexibility,” he added.

See Also: Crypto Isn’t The Real Threat – It’s Regulatory Chaos

Is This AVAX’s Moment?

The rebranding and capital raise strategy comes in the wake of growing interest in the Avalanche network. Scaramucci endorsed the Layer-1 network last month, stating that its "moment is coming.”

He said last year that AVAX, often dubbed an Ethereum (CRYPTO: ETH)-killer, is part of his cryptocurrency portfolio and among the "high-quality, great core assets” in the long term.

Avalanche, which launched in 2020, seeks to provide scalable and secure infrastructure for decentralized applications and smart contracts.

Notably, BlackRock’s tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund, expanded its use to the Avalanche blockchain.

Price Action: At the time of writing, AVAX was trading up 4.78% to $33.29, according to data from Benzinga Pro. The coin has surged 27% over the last month.

AgriFORCE shares slipped 7.08% in after-hours trading after closing 134.44% higher at $5.650 during Monday’s regular trading session.

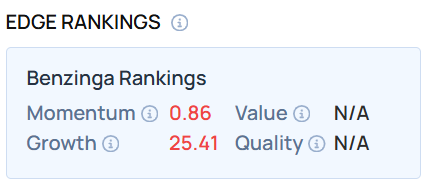

The stock lagged on the Momentum and Growth parameters as of this writing. Visit Benzinga Edge Stock Rankings to compare it with leading cryptocurrency treasury firms, such as Strategy Inc. (NASDAQ:MSTR) and Bitmine Immersion Technologies Inc. (AMEX:BMNR).

Read Next:

Photo Courtesy: Al Teich On Shutterstock

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.