/Quantum%20Computing/A%20concept%20image%20showing%20a%20ray%20of%20light%20passing%20through%20cyberspace_%20Image%20by%20metamorworks%20via%20Shutterstock_.jpg)

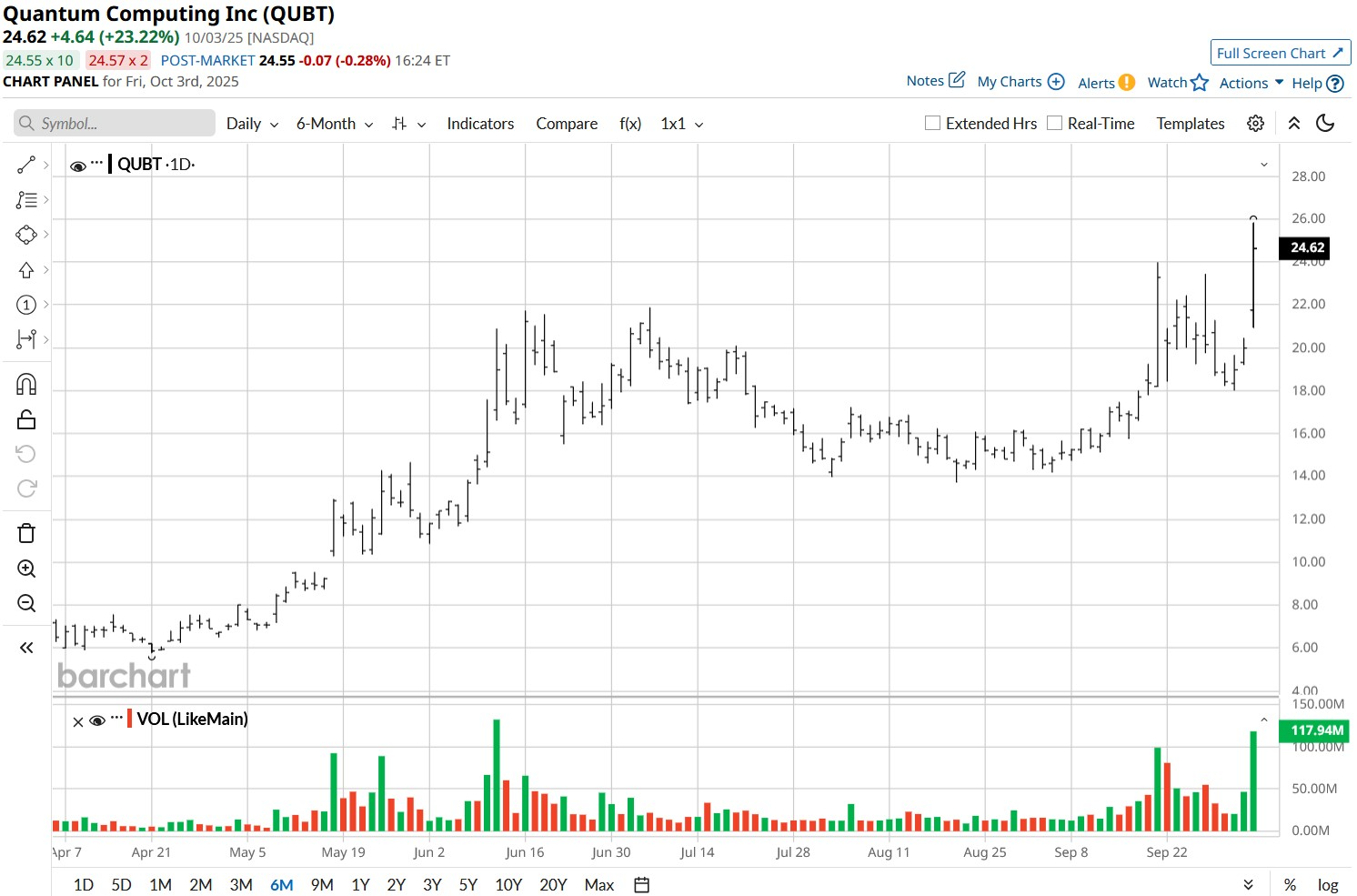

Quantum Computing (QUBT) shares closed roughly 20% higher on Oct. 3 after an Ascendiant Capital analyst issued a bullish note in favor of the Hoboken-headquartered firm.

On Friday, Edward Woo maintained his “Buy” rating on QUBT shares and raised his price objective to $40, indicating potential upside of another 80% from current levels.

Including Friday’s surge, Quantum Computing stock is up more than 400% versus its year-to-date low in early March.

Why Is Ascendiant Capital Bullish on Quantum Computing Stock?

Edward Woo recommends owning QUBT stock for the long term primarily because the company is committed to “putting quantum into the hands of a billion people.”

Its early positioning in a fast-growing industry, its differentiated assets, and its Tempe-based thin film lithium niobate foundry, which is already fulfilling “numerous orders” were among other big reasons cited for the bullish view.

According to the Ascendiant Capital analyst, Quantum Computing is “well-positioned to capture and drive a meaningful market share and industry growth,” particularly as rising data generation fuels demand for high-performance computing.

QUBT’s debt-free balance sheet and expectations that the quantum technology will be a $72 billion market by 2035 suggests Quantum Computing shares will likely prove lucrative for investors over time.

QUBT Shares Run the Risk of a Sharp Drawdown

Despite Woo’s optimism, caution is warranted in owning QUBT shares as their valuation currently looks rather disconnected from the fundamentals.

Quantum Computing is going for a price-sales (P/S) ratio of more than 10,000x at writing, light-years ahead of the best-of-breed AI stocks, even including Nvidia (NVDA), at about 35x only.

Additionally, the Nasdaq-listed firm generated just $61,000 in revenue in its latest reported quarter, reinforcing it still has a lot to prove in terms of execution.

In short, with minimal revenue and unproven scalability, the quantum computing stock risks a sharp correction if investor sentiment shifts or execution falters.

Wall Street Warns of Significant Downside in Quantum Computing

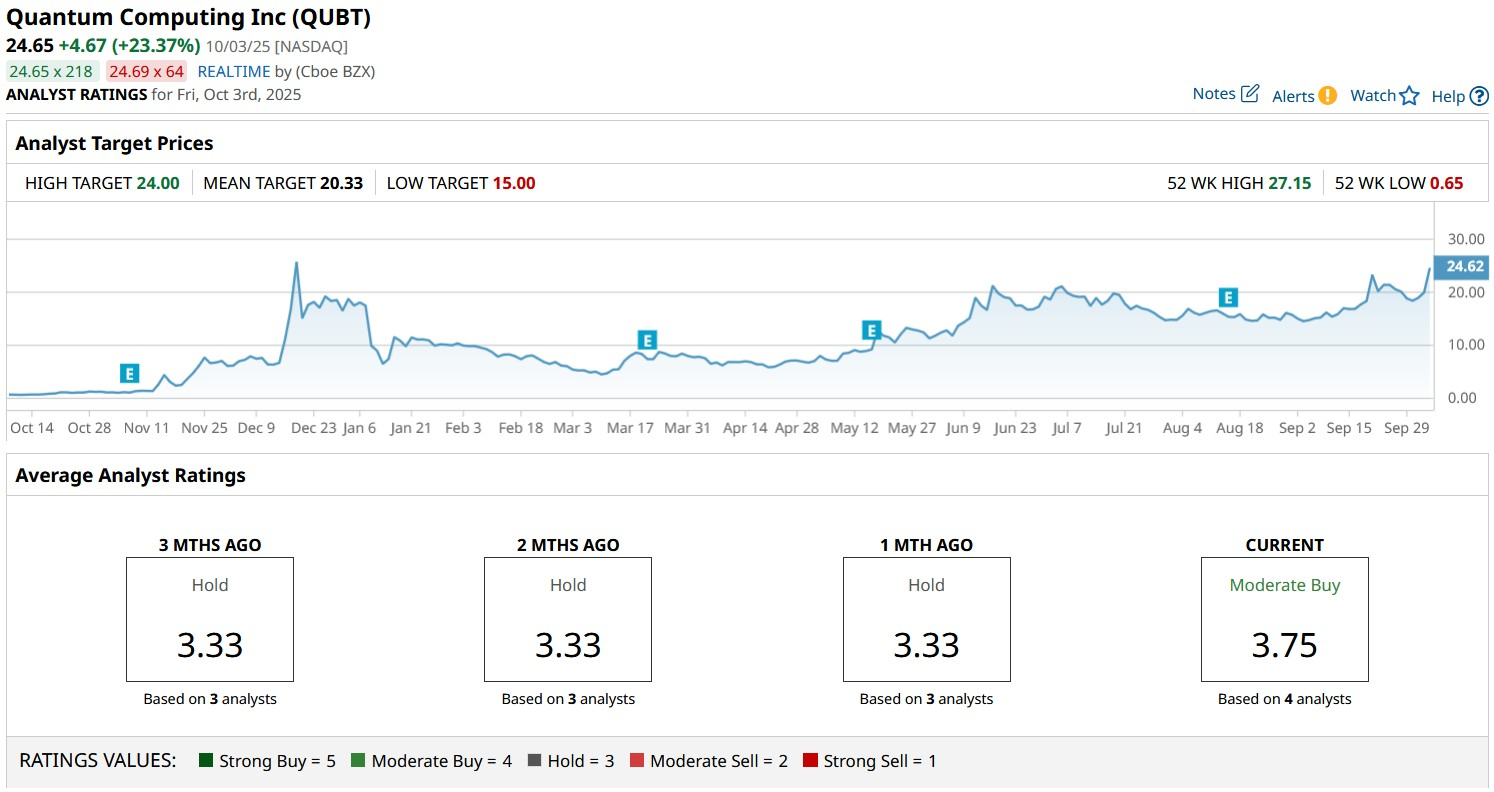

Wall Street’s consensus estimates also currently suggest QUBT stock is alarmingly overvalued at current levels.

While the consensus rating on Quantum Computing shares remains at “Moderate Buy,” the mean target of $20.33 indicates potential downside of roughly 8% from here.