/A%20Palantir%20sign%20displayed%20on%20an%20office%20building%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Palantir (PLTR) shares are up about 1.6% on Tuesday after a senior Bank of America analyst, Mariana Perez Mora, issued a bullish note in favor of the AI-enabled data analytics company.

BofA’s constructive call arrives only a day after the United Kingdom signed a billion-dollar contract with PLTR aimed at accelerating military decision-making, planning, and targeting.

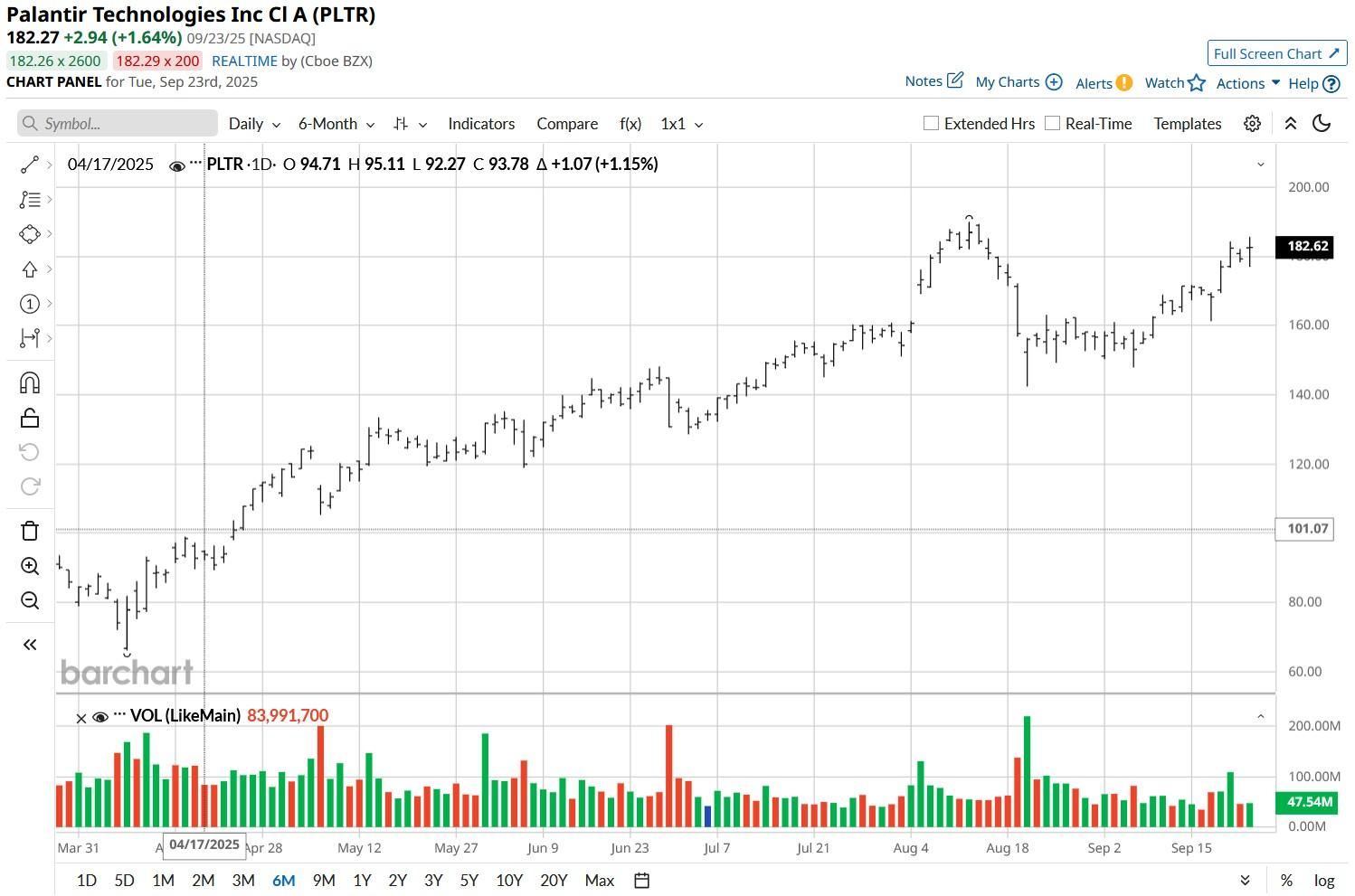

At the time of writing, Palantir stock is up some 180% versus its year-to-date low set in mid-January.

Commercial Traction to Push Palantir Stock Up Further

Mora’s bullish stance on PLTR stock is anchored mostly in the company’s accelerating commercial traction, particularly following its AIPCon 8 event on Sept. 4.

In her research note, the Bank of America analyst highlighted Palantir’s ontology architecture and forward deployed engineers (FDEs) as key differentiators, describing them as the “secret sauce” driving momentum.

The integration of agentic AI capabilities is enabling Palantir Technologies to scale this unique skillset across more use cases, empowering engineers and clients alike, she added.

Mora believes this will drive demand for Palantir’s operating system as more enterprises choose to buy rather than build artificial intelligence infrastructure.

She projects PLTR’s commercial sales to surpass $10 billion by the end of this decade.

Government Sales Remain a Tailwind for PLTR Shares

The second pillar of BofA’s optimism stems from Palantir’s expanding government footprint.

PLTR recently secured its first billion-dollar contract outside the U.S., which built on its existing ties with UK’s National Health Service (NHS) and Ministry of Defence (MOD), indicating rising demand among allies.

Moreover, the company’s Maven Smart System has grown eightfold in the US since early 2024 and was selected by NATO to enhance battlefield intelligence.

Mariana Perez Mora believes other nations will also adopt Maven for its interoperability and data governance, potentially driving Palantir shares up to $215 over the next 12 months.

She projects the firm’s government sales to exceed $8 billion by 2030.

Wall Street Disagrees with BofA on Palantir Technologies

Other Wall Street firm, however, do not share BofA’s view on PLTR stock mostly due to valuation concerns.

The consensus rating on Palantir shares currently sits at “Hold” only with the mean target of about $156 indicating potential downside of more than 13% from here.