/Super%20Micro%20Computer%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) has had a volatile year, but there may be signs of a turnaround in the near future. That's at least what analyst notes seem to suggest following Super Micro Computer's solid fiscal Q2 earnings results, which showed positive growth prospects.

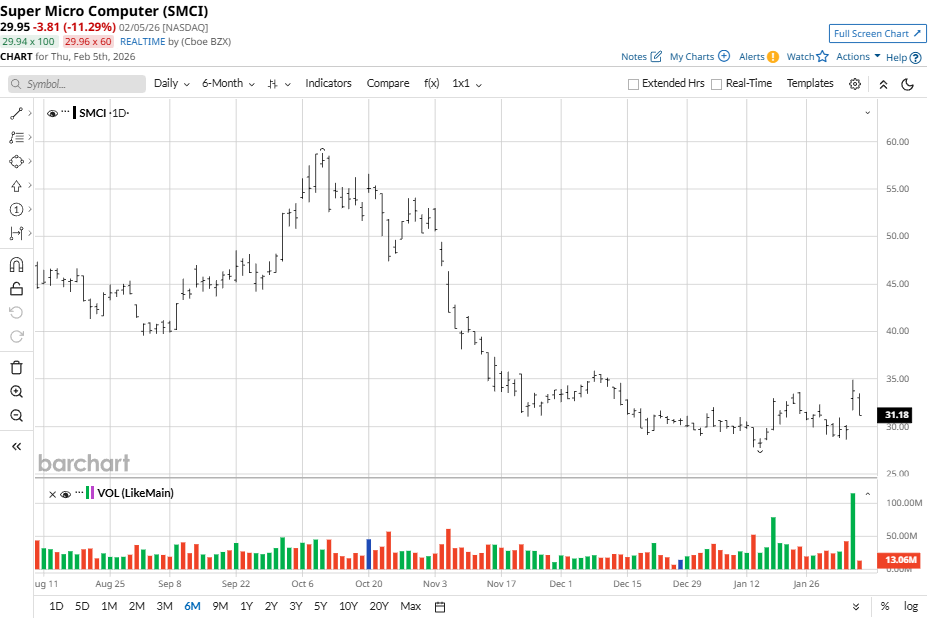

While the stock is down nearly 47% in the past six months, it is up 4% since the beginning of 2026.

About Super Micro Computer

Super Micro Computer builds high-performance servers, storage, and networking gear optimized for artificial intelligence (AI), data centers, cloud computing, 5G, and edge applications. The company offers customizable, modular systems that integrate top chips from Nvidia (NVDA), AMD (AMD), and Intel (INTC).

Supermicro powers massive AI training clusters and hyperscale clouds, helping tech giants like Microsoft (MSFT) and Meta (META) scale operations quickly and sustainably.

Founded in 1993, Supermicro is headquartered in San Jose, California, with major manufacturing centers in Taiwan, the Netherlands, and Asia, and operations spanning over 100 countries.

SMCI Results Beat Expectations

Super Micro Computer reported strong second-quarter 2026 results on Feb. 3. Revenue surged 123% year-over-year to $12.68 billion, smashing analyst estimates of $10.43 billion by 21%. Adjusted earnings per share (EPS) reached $0.69, beating forecasts of $0.49 by 41% and up from $0.59 last year.

Financial highlights included adjusted net income of $486.5 million, up 26% year-over-year and above consensus of $330 million. Gross margin dipped to 6.4% from 11.9% due to scale-up costs, but AI server demand drove the surge. Operating leverage shone through rapid revenue growth amid investments.

For Q3, Super Micro Computer guided for revenue of at least $12.3 billion and adjusted EPS expectations to at least $0.60. The full-year revenue outlook was raised to $40 billion from $36 billion.

Analysts See a Comeback for Super Micro Computer

These quarterly results largely beat estimates, sparking cautiously upbeat analyst notes.

Wedbush analyst Matt Bryson reaffirmed his “Neutral” rating on the stock with a price target of $42, reflecting 37% upside from the market price. Wedbush highlighted a sharp turnaround, saying SMCI finally reversed quarters of missing ambitious sales goals and even declining gross margin forecasts.

Q2 sales beat a high bar at $12.68 billion versus the $10.43 billion expected, met gross margin targets at 6.4%, and lifted the current quarter outlook despite higher commodity costs and supply issues, marking a major shift from prior weakness.

Another analyst to provide an update was Needham’s N. Quinn Bolton, who maintained a “Buy” rating but cut the price target from $51 to $40. That reduced target still signals significant upside from current levels.

Lastly, GF Securities analyst Jeff Pu pitched in with a “Hold” rating and price target of $35, suggesting upside as well. GF Securities noted EPS of $0.69 topped $0.49 consensus despite delays, with margins stabilizing at 6.4%. Management expects cost improvements, but they await clarity on margins and Nvidia GB300/Vera Rubin orders.

Should You Buy SMCI?

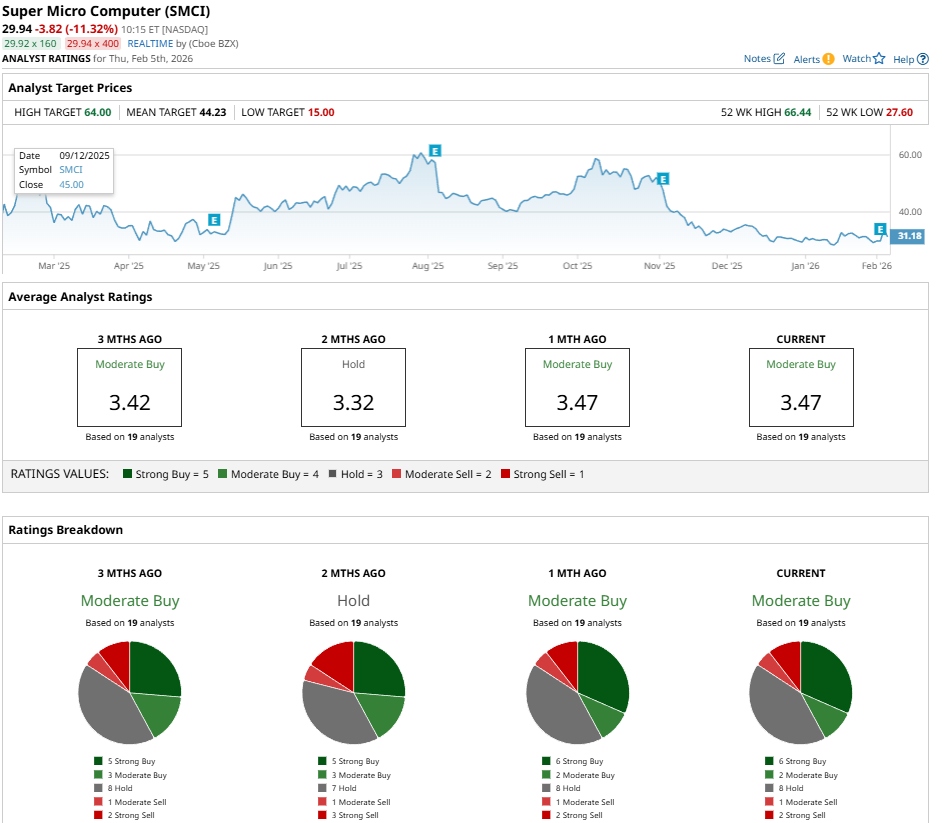

These latest notes show some optimism among analysts, even though pressure remains. On a broader scale, the stock has seen some improvement, as the consensus rating went from “Hold” two months ago to a “Moderate Buy” rating at present, alongside a mean price target of $44.23, representing potential upside from here.

Of the 19 analysts rating SMCI stock, six rate it a “Strong Buy," two gave it a “Moderate Buy," and eight say to “Hold." On the bearish side, one has a “Moderate Sell” rating, and two have “Strong Sell” ratings.