Nvidia (NVDA) shares edged higher Tuesday after the tech giant unveiled a series of new chips and software products that look likely to tighten its grip on the $1 trillion market for AI technologies.

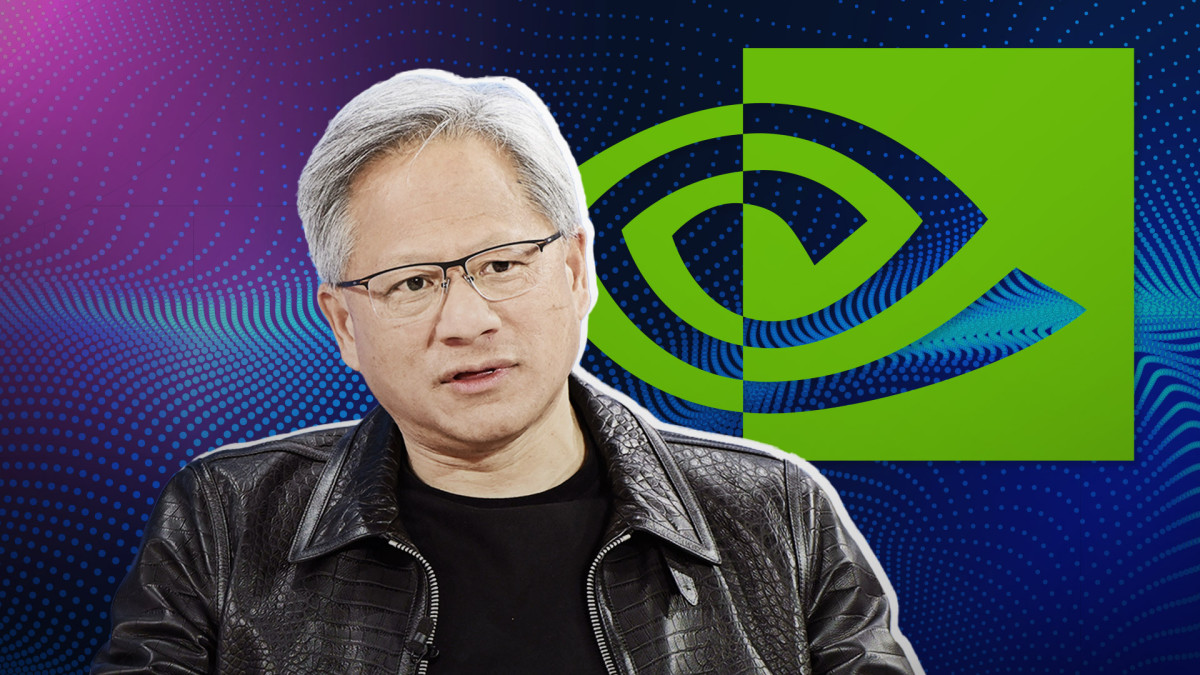

Currently boasting an estimated 80% share of the market for AI-powering processors, Nvidia revealed its latest iteration last night at a flagship event in San Jose, highlighted by a keynote address from CEO Jensen Huang.

The new Blackwell GPU architecture, named after the African American mathematician David Harold Blackwell, performs AI tasks at more than twice the speed of Nvidia's current Hopper chips, the tech group said, while using less energy and providing more bespoke flexibility. It's expected to hit the market sometime next year.

“Blackwell’s not a chip, it’s the name of a platform,” Huang said during his speech to a packed house at the SAP Center. "Hopper is fantastic, but we need bigger [graphics-processing units]."

Goldman Sachs analyst Toshiya Hari, who boosted his price target on Nvidia by $125 to $1,000 a share, said he came away from the speech with a "renewed appreciation" for Nvidia's AI ambitions.

Silicon Valley's 'most ambitious project'?

Hari also affirmed the stock's place on the investment bank's closely tracked 'Conviction Buy' list, citing what he called a "unique ability to innovate at data-center scale (as opposed to at the GPU or chip level)" as well as its "compelling position as one of the key enablers and beneficiaries of the ongoing build-out of generative AI infrastructure.”

Meanwhile, Rosenblatt Securities analyst Hans Mosesmann described the Blackwell launch as "likely the most ambitious project Silicon Valley has ever witnessed."

Others touted the new chips' potential to transform the broader potential for AI modeling and inference while adding further distance between Nvidia and its chipmaker rivals.

“Blackwell appears likely to be strong, and the company’s continued push not just on chips but on broader software and hardware ecosystems remains unmatched (and in our opinion, hard to stand against)," said Bernstein analyst Stacy Rasgon, who carries a buy rating with a $1,000 price target on Nvidia stock.

Related: Jensen Huang outlines a huge future for Nvidia

Nvidia declined, at least for the moment, to offer pricing details for the new Blackwell chips, but analysts see the potential for an average selling price around 40% higher than the current range for H100 chips, which go for between $30,000 and $40,000 each.

Baird analyst Tristan Gerra said the "very significant performance step up means Blackwell will likely trigger a strong refresh rate while making it exceedingly more difficult for ASIC architectures to compete."

"We hear B100 pricing will be close to 40% higher than H100, representing a key top-line catalyst for Nvidia next year,” said Gerra, who carries a $1,050 price target and an overweight rating on Nvidia stock.

Nvidia is leaving rivals in the dust

Wells Fargo analyst Aaron Rakers also noted that the new Blackwell GPUs will likely offer a significant performance premium to Nvidia's closest competitor, the MI300x, made by Advanced Micro Devices (AMD) . He added that Huang's presentation underscored the group's ability to innovate and monetize.

Rakers lifted his price target by $130 to $970 a share while reiterating an overweight rating.

Susquehanna analyst Christopher Rolland also saw the Blackwell launch cementing Nvidia's AI leadership. He added $200 to his group price target, taking it to $1,050 per share.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

Morgan Stanley analyst Joseph Moore, who remains overweight Nvidia with a $795 price target, said the Blackwell launch puts more distance between the tech giant and its chipmaking contenders.

“While there were no big surprises, the performance of the Blackwell family will raise the bar yet again, with aggressive claims on the rack scale product," Moore's team wrote. "The company also continues to push forward in services, omniverse, and robotics."

Nvidia shares were last marked 0.97% higher in mid-day trading and changing hands at $892.91 each, a move that leaves the stock up more than 85% for the year with a market value of $2.2 trillion.

Related: Veteran fund manager picks favorite stocks for 2024