The artificial intelligence revolution has made shares of AI companies’ top Wall Street performers this year. Interest in leveraging generative AI apps has soared since OpenAI’s ChatGPT demonstrated how quickly and simply large language models can search, parse, and create content.

As a result, companies and governments are spending big money training AI solutions, resulting in significant growth for high-end chips and services from companies like Nvidia and Super Micro Computer that can handle AI’s heavy workloads efficiently.

Investors have responded positively to cloud service providers and enterprise spending on network equipment, sending Nvidia and Super Micro Computer shares surging 247% and 740% in the past year.

AI’s potential isn’t limited to these tech infrastructure plays, though. Recently, investors have set sights on companies that may profit from creating AI solutions, such as C3.ai.

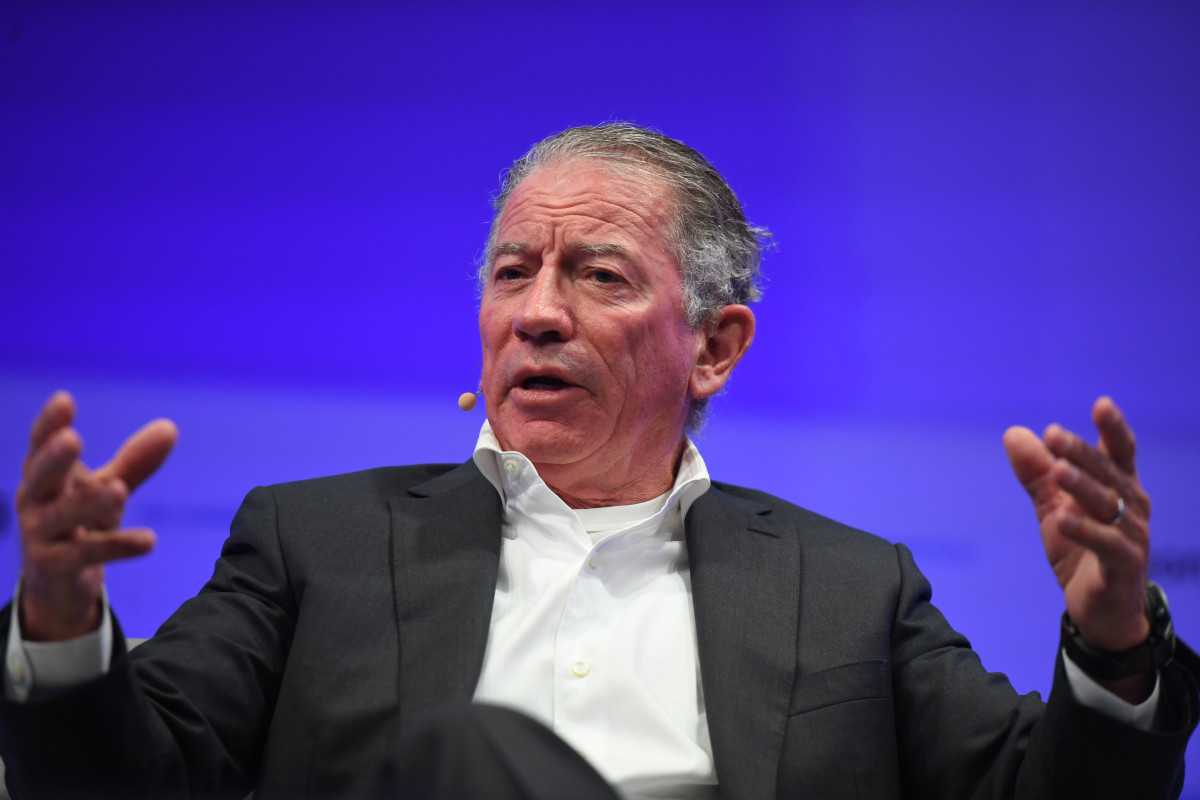

C3.ai, founded by software titan Thomas Siebel, reported its quarterly earnings on Feb. 28, causing shares to surge and analysts to revamp their outlooks.

AI activity is surging

AI only recently went mainstream following ChatGPT becoming the fastest app to have 1 million users sign up after its launch in December 2022.

However, the possibility of machines thinking for themselves isn’t new. Famed mathematician and computer scientist Alan Turing researched how to design AI computers in the 1950s, and Rand Corp, one of the most regarded research companies of its time, created the first AI program in 1956. AI has also been the subject of many books and movies.

Related: Analysts Revamp SoundHound AI stock price targets ahead of earnings

While AI isn’t new, its use is only now gaining real-world attention in the wake of ChatGPT’s success. Many companies and industries are considering how AI may reshape their businesses, making them more efficient and cost-effective.

For example, banks are using AI to hedge risks, pharmaceutical companies are investigating how AI could be used to create better medicine, and retailers are exploring if it can curb theft. Governments are also considering whether AI can reduce wasteful spending and reduce casualties on the battlefield.

The surge in AI app development has led to a retooling of enterprise and cloud service provider networks. Hefty AI workloads are too much to handle for traditional infrastructure based on central processing units or CPUs. So, hyperscalers are plowing billions into computers using more powerful and energy-efficient graphic processing units, such as those made by Nvidia and Advanced Micro Devices.

The positive impact on revenue and profit is funding another wave of investment in next-gen AI infrastructure that could make creating AI solutions easier.

Enterprises and governments line up for AI software solutions

Developing AI solutions isn’t easy. Training AI requires mountains of data, and garnering useful insight requires significant AI experience.

As a result, many enterprises and government agencies are turning to third parties to help them navigate their AI needs and shorten their learning curves.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

Thomas Siebel saw that trend emerging early on. Siebel, the billionaire founder of Siebel Systems, founded C3.ai in 2009 after he sold Siebel Systems to Oracle in 2006. C3.ai offers customers an AI development platform to create their solutions, and it markets dozens of pre-packaged AI solutions that enterprises and governments can use “out of the box.”

Its customers span many of the world’s biggest companies, including Philips, Shell, and Raytheon. It also generates significant business from the U.S. Government, including the Department of Defense.

These users, alongside new customers (the company signed on 50 new accounts last quarter), are accelerating C3.ai’s growth. In its most recent quarter ending Jan. 31, sales increased by 18% to $78.4 million, its fourth consecutive quarter of improving year-over-year revenue growth. Government revenue increased 100% year-over-year last quarter.

While C3.ai still loses money, top-line growth, leveraged against fixed costs, has improved the company’s pathway to profitability. It lost 13 cents last quarter, and Wall Street expects its loss per share to improve from 69 cents in fiscal 2024 to 34 cents in fiscal 2025.

Analysts update C3.ai stock forecasts

Wall Street analysts anticipated sales of $76.1 million and a loss of 28 cents per share. Given C3.ai beat those estimates, analysts are now revamping their models, resulting in updated outlooks.

"Customer engagement grew 80% year-over-year. Our significant first mover advantage in Enterprise AI is generating tailwinds as market interest in adopting AI accelerates,” said Siebel.

Following its quarter, C3.ai’s management boosted the low end of its full-year fiscal 2024 revenue to $306 million from $295 million, slightly above the consensus analysts’ forecast of $305.5 million.

The improved outlook led Canaccord to bump its C3.ai stock price target by $4 to $31. Its analysts cited strength in subscription revenue, which increased by 20% in the quarter and accounts for about 90% of total revenue.

Morgan Stanley also weighed in, inching its price target up $1 to $21. However, analysts think shares are pricey, given shares are trading at about 12.3 times revenue and annual revenue growth is still below 20%.

More impressed, however, is Wedbush Securities. Their team, including analyst Dan Ives, lifted their C3.ai price target by $5 to $40, reiterating their “Outperform rating.”

The updated forecast is supported by better-than-expected quarterly results and the potential for ongoing investments to allow it to penetrate global markets further.

"C3 continues generating strong deal flow in the pipeline, seeing 73% y/y growth due to rising opportunities for C3’s Enterprise AI platform and Generative AI solutions," wrote Wedbush to clients on Feb. 29. "We view this quarter as a step in the right direction for C3 as the company’s entire product portfolio continues generating unprecedented demand."

Related: Veteran fund manager picks favorite stocks for 2024