/A%20concept%20image%20of%20a%20self-driving%20car%20image%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

Valued at a market cap of $5.6 billion, Pony AI (PONY) stock has almost tripled in the last four months. This comes as Pony AI is generating significant buzz among analysts as the autonomous mobility company accelerates its robotaxi ambitions.

The China-based firm has emerged as a key player in the rapidly evolving self-driving vehicle market. What sets Pony AI apart is its PonyWorld platform, which generates over 10 billion kilometers of test data weekly. This massive data collection far exceeds human driving capabilities and enables continuous improvement of its virtual driver system, enhancing safety and reliability.

Pony AI has also achieved breakthrough operational efficiency with an industry-leading remote assistant to vehicle ratio of 1:20, compared to 1:3 in the previous year. This improvement reduces operational costs through virtual technology that provides request-based assistance rather than direct control.

Pony AI is betting big on its Gen-7 Robotaxi, which boasts a 70% reduction in costs compared to previous generations. Moreover, it aims to expand its fleet to 1,000 vehicles by the end of 2025, with mass production beginning in the second quarter.

Strategic partnerships with tech giants Tencent (TCEHY) and Uber (UBER) are expanding the company’s reach, integrating robotaxi services into popular platforms like Weixin and the Uber app.

Is the Robotaxi Stock a Good Buy Right Now?

Pony AI delivered impressive second-quarter results, showcasing its rapid commercialization progress, with total revenues surging 76% year-over-year to $21.5 million. The autonomous vehicle pioneer’s robotaxi division led the charge with revenues more than doubling to $1.5 million, while fare-charging services experienced a 300% increase.

Pony AI has successfully ramped production of its seventh-generation robotaxi, with over 200 vehicles rolling off assembly lines since June. This puts Pony AI firmly on track to exceed its ambitious target of 1,000-plus vehicles by year-end, marking a critical milestone in scaling operations.

The company achieved an 18% reduction in vehicle insurance costs while advancing toward a 1:30 remote assistance ratio by year-end. These efficiency gains are crucial for achieving positive unit economics.

Pony AI secured Shanghai’s first fully driverless commercial license and expanded its international footprint with new operations in Dubai, Seoul, and Luxembourg. The company now operates across 2,000 square kilometers in China’s Tier 1 cities.

Registered users surged 136% year-over-year while maintaining customer satisfaction above 4.8 out of 5. With licensing revenues jumping nearly 902% to $10.4 million, Pony AI is diversifying its revenue streams while building toward sustainable profitability in its core robotaxi business.

Is Pony AI Stock Undervalued?

Analysts tracking Pony AI stock forecast sales to increase from $82.4 million in 2024 to $1.22 billion in 2029, indicating annual growth rate of 96%. While still unprofitable, the autonomous vehicle company is forecast to report adjusted earnings of $0.47 and a free cash flow of $214 million in 2029. If the tech stock is priced at 50 times forward free cash flow, which is not too expensive given its growth estimates, it could almost double over the next three years.

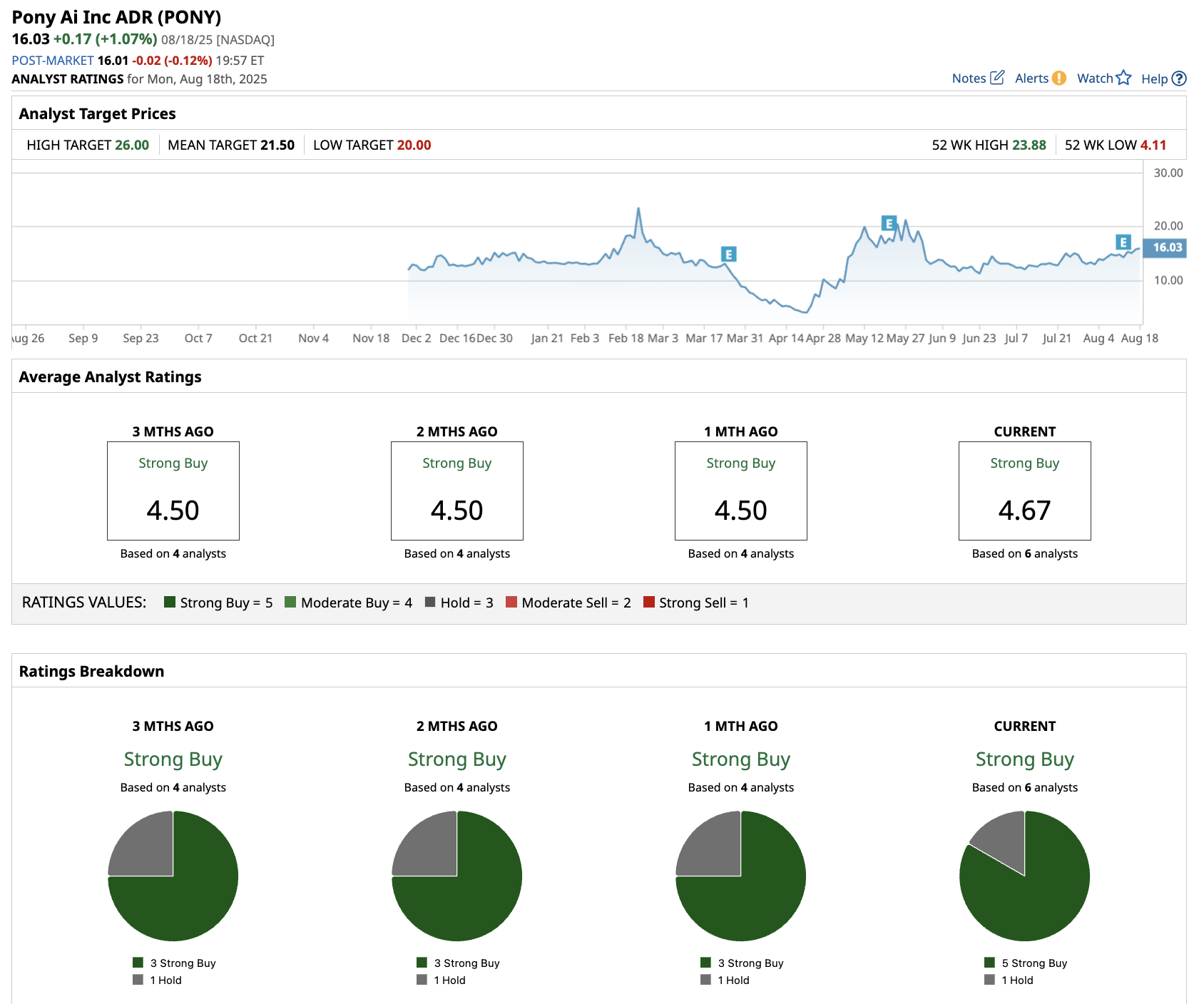

Out of the six analysts covering Pony AI stock, five recommend “Strong Buy” and one recommends “Hold.” The average Pony AI stock price target is $21.50, 38% above the current trading price.