/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

Drone company AIRO Group (AIRO) is down from the highs post its successful IPO in June, despite analysts favoring the company’s prospects. Does that mean that the stock can be a solid buy on its dip?

About AIRO Group Stock

AIRO Group, headquartered in Albuquerque, New Mexico, is an aerospace and defense company that operates across four key segments: Drones, Avionics, Training, and Electric Air Mobility.

Its drone division produces artificial intelligence (AI) powered surveillance systems used by NATO and Ukrainian forces. The avionics arm, through Aspen Avionics, supplies flight systems for military and civilian use. AIRO also provides U.S. Department of Defense (DoD) pilot training and develops hybrid/eVTOL aircraft for cargo and urban air mobility.

With a global footprint that includes offices in the U.S., Canada, and Europe, AIRO integrates cutting-edge aviation technologies to serve both the commercial and defense sectors. The company currently has a market capitalization of $446.05 million.

AIRO’s stock went public following an IPO process in June. The company had priced its offering at $10, below the analyst estimate of $14 to $16. It closed the offering on June 16, offering 6,900,000 shares of its common stock, which included the 900,000 additional shares that the underwriters had the option to purchase. The company raised $69 billion through its IPO in gross proceeds. The stock started trading on the Nasdaq Global Market on June 13.

Since then, the stock has had a volatile time on Wall Street. Over the past month, it has been down by 5%. The stock reached a one-month high of $25.36 on July 21, but is now 5.3% off this high. However, over the past five days, it has gained 15%, boosted by its second-quarter results. On the other hand, AIRO shares gave up some of their gains on Aug. 15, down 3.6% intraday.

AIRO Group’s Q2 Results Were Better Than Expected

On Aug. 14, AIRO reported its first-ever quarterly results as a public company, with second-quarter results for fiscal 2025 exceeding market expectations. The company’s revenue for the quarter was $24.55 million, representing a 151% increase from the same quarter in the prior year. This surpassed the $14 million that Wall Street analysts were expecting by a wide margin.

At the heart of this growth was AIRO’s Drone revenue, which grew 216% year-over-year (YOY) to $22 million. This was, in turn, driven by deferred orders from the first quarter in this segment. The company also reported a 91% YOY growth in its Training segment revenue to $1.10 million, due to increased activity under multiple indefinite delivery/indefinite quantity (IDIQ) contracts.

AIRO’s adjusted EBITDA grew from $580 thousand to $4.70 million YOY. Its bottom line grew from a loss per share of $0.34 to a net income per share of $0.30, while Wall Street analysts were expecting an EPS of $0.11.

As of June 30, AIRO’s cash and cash equivalents stood at $40.30 million. The company also appears focused on expansion, as it is set to undertake an expansion of its U.S. operations footprint through the planned addition of a new manufacturing and engineering development facility to meet the demand for its flagship product, the RQ-35 ISR Drone.

What Do Analysts Think About AIRO Group Stock?

Analysts are optimistic about AIRO post its IPO. Analysts at BTIG initiated their coverage of the stock in July with a “Buy” rating and a price target of $26. BTIG analysts believe the company can gain market share amid global security concerns, particularly in its Drones segment. Additionally, its Avionics and Training segment could also create valuable synergies for its Drones and EAM businesses.

Analysts at Mizuho assigned the drone stock an “Outperform” rating, accompanied by a $31 price target. Mizuho analysts cited AIRO’s more than $250 million drone backlog and plans to expand in the U.S. and NATO countries as a reason for this rating. Cantor Fitzgerald analysts initiated coverage of the stock with an “Overweight” rating and a $35 price target, citing the company’s prospects as a growth opportunity in the defense technology sector. Cantor, BTIG, and Mizuho had acted as joint lead book-running managers for AIRO Group’s proposed offering.

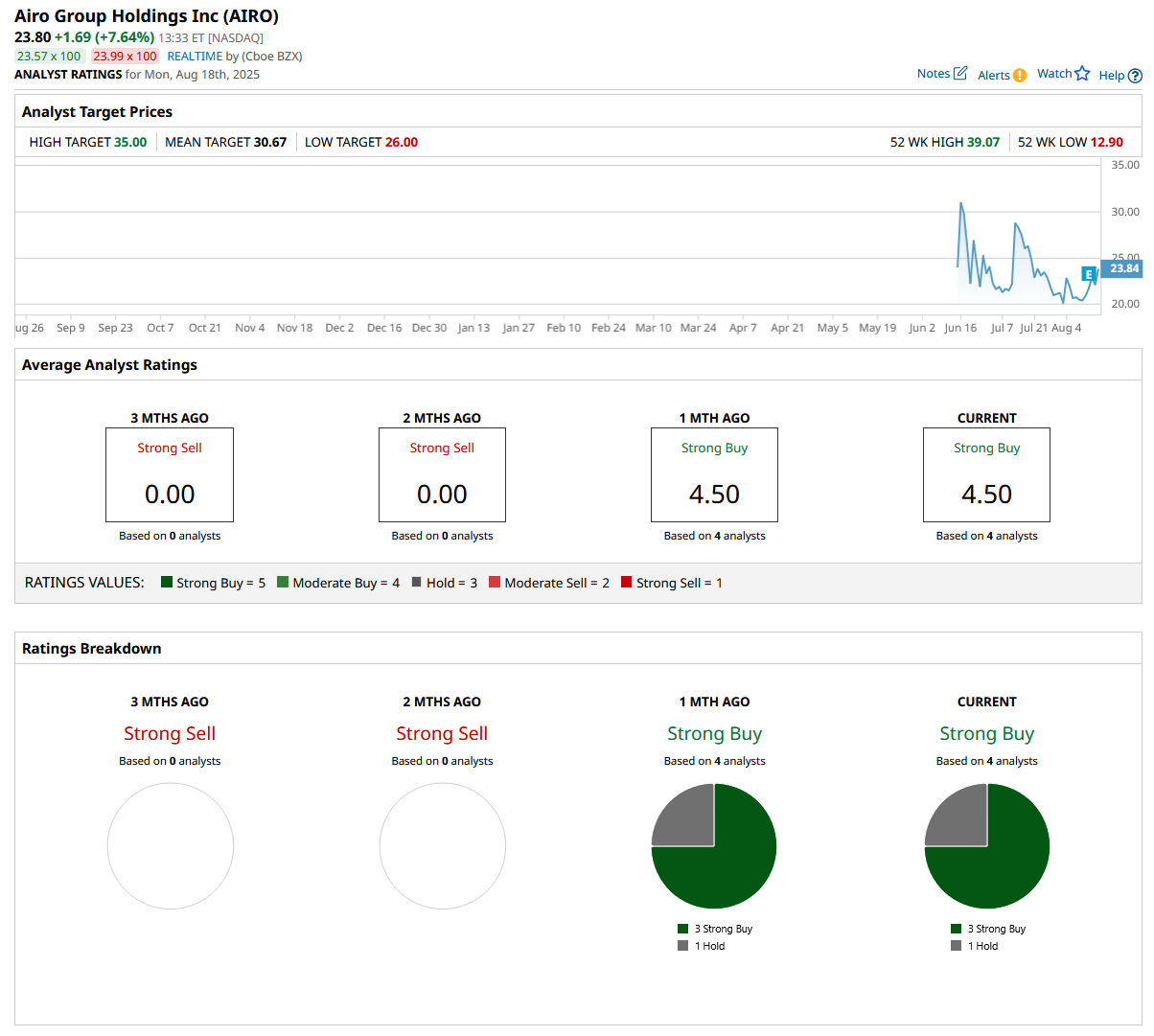

Wall Street analysts are bullish on AIRO, giving it a consensus “Strong Buy” rating overall. Of the four analysts rating the stock, a majority of three analysts have given it a “Strong Buy” rating, while one analyst is cautious with a “Hold” rating. The consensus price target of $30.67 represents a 38.7% upside from current levels. The Street-high Cantor Fitzgerald-given price target of $35 indicates a 58.3% upside.

Key Takeaways

Analysts expect AIRO Group’s stock to surge due to its prospects in the drone market and expansion plans. The market itself is growing. According to a report by Fact.MR, the global drone land surveying market is expected to grow at a CAGR of 24.1% over the next 10 years to reach a market value of $6.59 billion by the end of 2033.

While far from the level of AeroVironment (AVAV) and Kratos Defense & Security Solutions (KTOS), AIRO Group is robustly growing. Following its earnings beat, the stock might be a solid buy for investors with a risk appetite.