One of the most forgotten-about sectors many investors may have simply forgotten about is cannabis.

Once touted as a high-growth sector that should benefit from regulatory stability over the long-term, true decriminalization and/or legalization legislation has yet to be pushed for (at least in a meaningful way) in the U.S. As such, outside of the states that allow for legal sales of marijuana and related products, this is still, for the most part, a federally illegal substance, and one that continues to divide the public and investors at large.

That said, there's undeniably a big opportunity here, if we do see legalization attempts pick up internationally (Canada and a few other countries have led the way on this push, approximately seven long years ago).

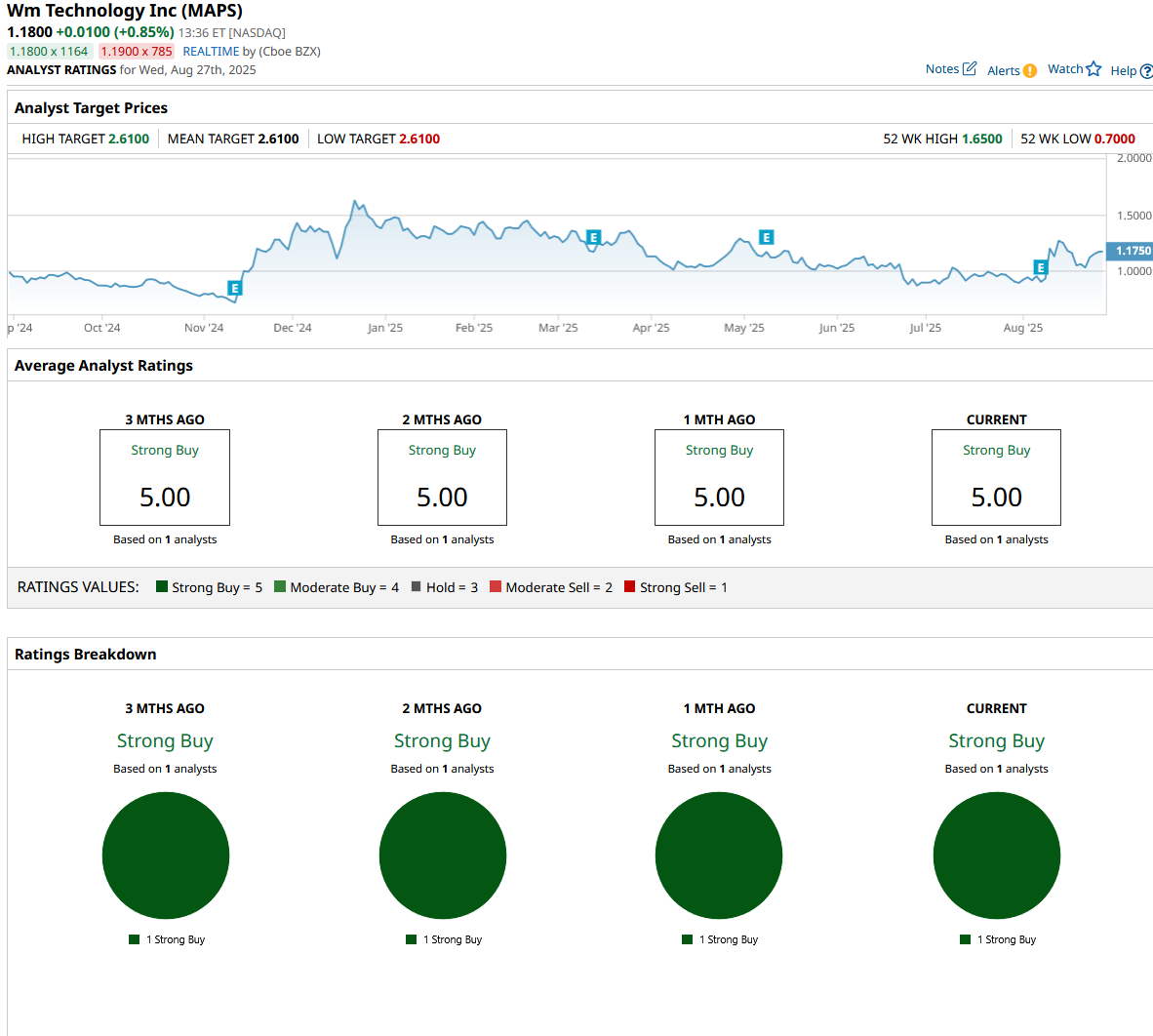

One company a number of analysts appear to be growing bullish on as a way to play this future growth is WM Technology (MAPS). Let's dive into what the company does, and why this stock is getting a “Strong Buy” rating from analysts at Westpark Capital, along with a juicy $2.61 price target.

The Bull Case for MAPS Stock

Interestingly, this outsized $2.61 price target that was reiterated just a couple of weeks ago suggests that nothing's changed for MAPS stock, at least in the minds of the analysts covering it.

WM Technology provides mission-critical SaaS and marketplace solutions to the cannabis industry. Analysts and a number of observant market participants looking to play the rising interest in the cannabis sector (following headlines that the Trump administration may be looking to change the classification of cannabis at some point in the future) continue to focus on picks-and-shovels way to play this sector. As a leading provider of the key software that enables clientele growth, and with a growing portfolio of tech-driven products that should drive such growth over time, MAPS stock certainly is an intriguing way to play this trend.

Now, the company has seen some hiccups over the past year, with revenue actually declining 2% as growth continues to normalize in the cannabis space. That said, the company's adjusted EBITDA did surge 16% year-over-year (YoY), and the company's margins expanded to 26% from 22% during the same quarter a year prior. I'd call that a win.

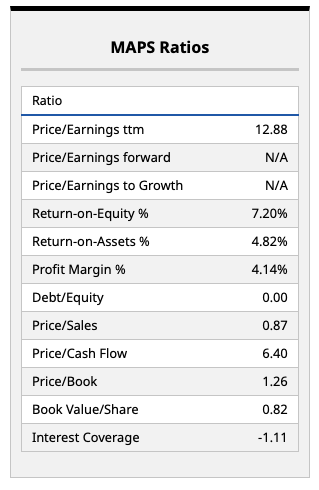

So, really the fundamental case around WM Technology really boils down to an investor's future outlook for this sector. In terms of most valuation metrics, at its current state, this is a company that certainly looks cheap (particularly if growth picks up once again in the months to come):

What Do the Analysts Think?

As is the case with many under-covered stocks in the market, WM Technology only has this one price target and rating to go by. As such, the $2.61 price target is what investors have to work with.

That said, the Westpark analysts who cover this name do point out some strong client growth (4% YoY this past quarter) is encouraging, as is the company's future growth expectations. WM Technology forecasts it will be able to grow its earnings by more than 30% per year, with revenue growth coming in much more muted (at around 6.5%). As such, this is really a margin and earnings growth story. That's a story I can personally get behind.

The thing is, WM Technology also appears to be a “show me” story at present. Until the cannabis sector really does kick into high gear (we've been waiting for that for years), this is a stock that could also certainly languish around (or below) the $1 mark for some time.

In any case, this will be an interesting stock to watch, and I'll keep it on my radar to provide readers with updates as they come.