/amazon%20holiday%20delivery%20boxes%20by%20Cineberg%20via%20iStock.jpg)

Analysts at the leading financial services firm, Morgan Stanley, sounded bullish about e-commerce giant Amazon's (AMZN) expansion of robotics to fulfill its orders. The firm forecasts annual savings of about $2-$4 billion for Amazon as it highlighted the company's plans to have about 40 next-generation robotics warehouses by 2027.

The firm also lauded the company's efforts in AI by stating that investors are “under-appreciating AMZN’s GenAI advances in its Retail business, with robotics-driven efficiencies near the top of the innovation list.”

Future Efficiencies to Be Driven by Robotics & AI

Morgan Stanley's assertions about efficiencies in Amazon's operations being driven by robotics and AI are certainly not unfounded. To that end, Amazon has rolled out more than 1 million robots across its operations and also unveiled DeepFleet, a fresh generative AI model tailored for its logistics. The company says this setup will sharpen robot teamwork throughout the fulfillment chain, shaving 10% off transit times and driving down overall expenses.

Beyond those gains, recent news reports highlight Amazon's blueprint to replace 600,000 positions with automation, all while aiming to double merchandise volume by 2033. It's reasonable to figure a good portion of those shifts will lean on robotic systems or AI-driven tools.

Then there is Zoox, Amazon's autonomous ride-share venture, the trailblazer in running a driverless operation with a custom robotaxi from the ground up. What sets Zoox apart is its from-scratch driverless blueprint with no steering wheel or pedals in sight, an interior where passengers face one another, and zero space carved out for a human operator. The vehicle even shifts direction seamlessly, front to back or vice versa.

On the surface, Zoox might look like it's squaring off against heavyweights such as Google's (GOOG) (GOOGL) Waymo or Tesla's (TSLA) upcoming Robotaxi play. Sure, the ride-hailing arena is ripe for grabs, but Amazon has a clear shot at repurposing it internally for last-mile deliveries, layering on yet another edge to its supply chain.

Thus, looking ahead, the overall pattern is straightforward: Amazon's robot fleet will keep expanding, with each iteration smarter than the last, causing the ripple effects on trimming costs to practically draw themselves.

Financials in “Prime” Health

The AWS outage may have caused many headlines, but in my recent piece, I have made the case that it was just a blip on the radar, as the company's myriad of businesses have resulted in its revenue and earnings growing at CAGRs of 15.80% and 39.90%, respectively, over the past five years.

However, price performance has been muted this year, as the AMZN stock is almost flat on a year-to-date (YTD) basis.

Meanwhile, that has not stopped the $2.4 trillion market cap company from consistently topping Wall Street forecasts on earnings for more than two straight years, and the pattern held firm in the latest period with outperformance on both top- and bottom-line figures.

For the second quarter of 2025, net sales climbed to $167.7 billion, marking a solid 13% rise from the year before, a noteworthy achievement given the company's enormous footprint. AWS led the charge with a 17.5% surge to $30.9 billion. Meanwhile, North American revenue grew 11% to $100.1 billion, and the international arm posted even stronger 16% gains, reaching $36.8 billion.

On the profitability front, earnings per share advanced 33.3% year-over-year (YoY) to $1.68, handily clearing the expected $1.33. Looking ahead, management projected third-quarter net sales between $174.0 billion and $179.5 billion, putting the midpoint at an 11.2% annual increase.

Encouragingly, the balance sheet stayed robust too, with operating cash flow hitting $32.5 billion, up from $25.3 billion a year earlier. Overall, Amazon wrapped up the June quarter holding $57.7 billion in cash and carrying zero short-term debt.

Wall Street shares that optimism, penciling in forward revenue expansion of 10.77% and earnings growth of 37.83%, figures that dwarf the sector averages of 3.02% and 6.48%. The next earnings update, covering Q3, lands on Oct. 30.

Analyst Opinion on AMZN Stock

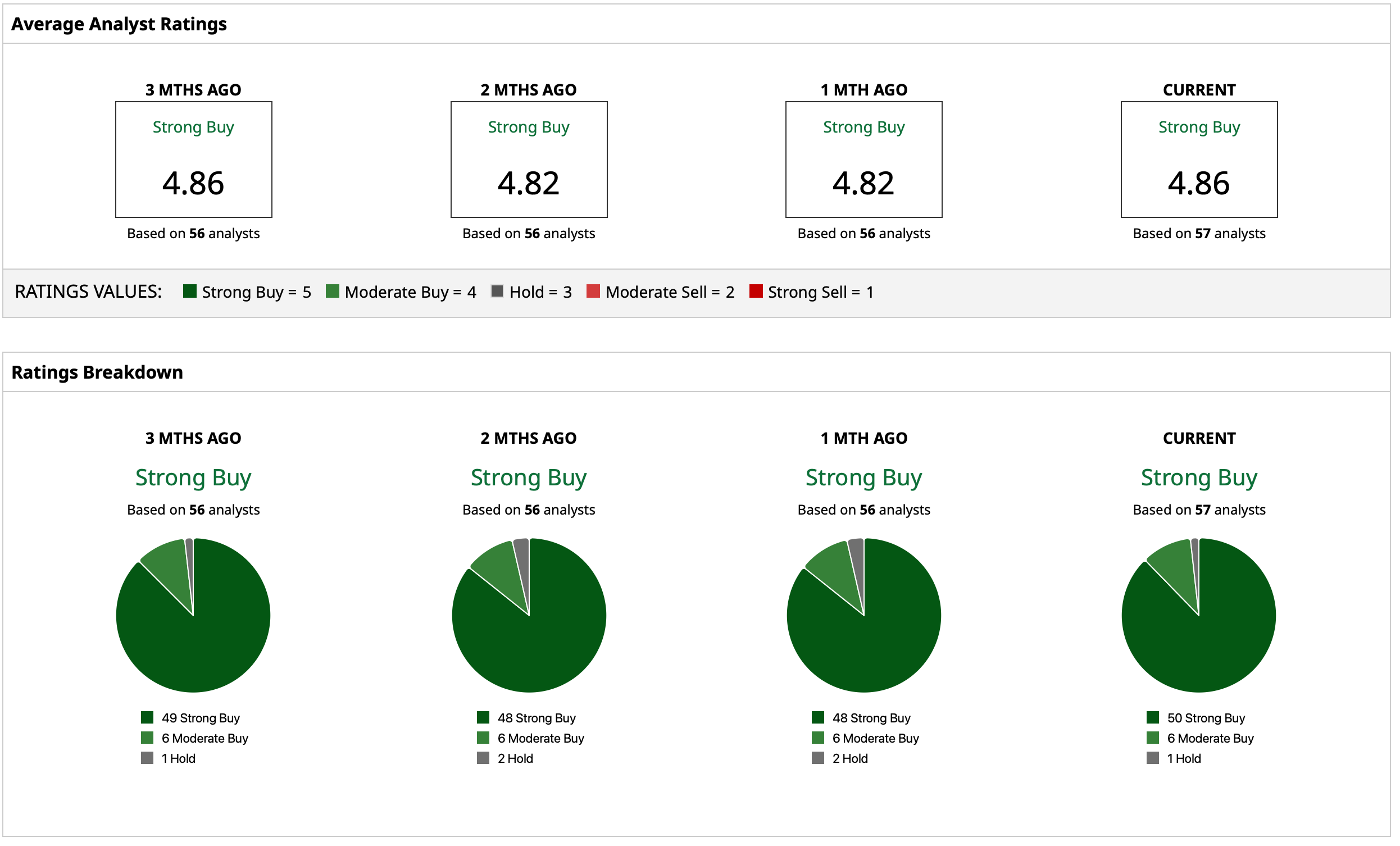

Thus, analysts have deemed AMZN stock a consensus “Strong Buy” with a mean target price of $267.30, which denotes an upside potential of about 23% from current levels. Out of 57 analysts covering the stock, 50 have a “Strong Buy” rating, six have a “Moderate Buy” rating, and one has a “Hold” rating.