/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Surging interest in artificial intelligence (AI) and cloud computing has pushed technology stocks sharply higher this year. In 2025, the global cloud market is expected to surpass $400 billion in annual revenues, driven by strong demand from generative AI and the steady move of enterprises to cloud platforms.

Industry leaders like Amazon (AMZN) Web Services and Microsoft (MSFT) Azure still dominate the space, but Oracle (ORCL) has gained attention as it secures multi-billion-dollar contracts and quickly builds out its AI infrastructure.

ORCL stock has surged 97.23% over the past six months, even after a recent dip, placing it close to reaching a $1 trillion market cap before the end of the year. This sharp rally, however, has attracted scrutiny. A recent report from Rothschild downgraded the stock to “Sell,” warning that the market may be overestimating Oracle’s growth prospects, even with its highly visible role in projects like Stargate.

With Oracle trading at stretched valuations and analysts divided between strong growth potential and concerns about overpricing, can Oracle’s AI-driven expansion truly support its market value, or have investors already bid the stock too high based on expectations? Let’s take a look.

Cracks in Oracle’s Momentum

Oracle, best known for its database software, cloud services, and enterprise applications, has steadily shifted toward a cloud-first model with a stronger focus on infrastructure and AI. That move has fueled significant gains, with the stock up 66.82% over the past 52 weeks and 68.92% year-to-date (YTD), raising concerns that its market value may be running ahead of business fundamentals.

Valuation is a clear concern. Oracle trades at a forward P/E of 59.70x, more than double the sector average of 25.10x, showing that investors are paying a steep premium for growth that may already be accounted for.

Even so, the company continues to return value to shareholders with a dividend yield of 1.80%, higher than the tech sector average of 1.37%. The most recent payout was $0.50 per share on July 10, 2025, with a forward payout ratio of 36%. Oracle has also marked one year of consecutive dividend increases, providing a modest safety net in the face of its elevated valuation.

The latest fiscal first quarter 2026 results add more detail to the picture. Revenue rose 12% year-over-year (YoY) to $14.9 billion, with cloud sales reaching $7.2 billion, up 28%. Infrastructure revenue climbed 55% to $3.3 billion, while SaaS applications brought in $3.8 billion, up 11%. Both Fusion Cloud ERP and NetSuite delivered $1.0 billion in sales, growing in the mid-teens. At the same time, GAAP EPS slipped 2% to $1.01, while non-GAAP EPS increased 6% to $1.47. Oracle also reported remaining performance obligations of $455 billion, a sharp jump of 359%.

Oracle’s Real Growth Trajectory

The expansion of Oracle Fusion Cloud Service through its partnership with Infobip brought direct WhatsApp and SMS integration, giving businesses on Oracle Cloud Marketplace more ways to connect with customers. By combining live chat with popular messaging channels, Oracle improved its ability to support real-time, personalized communication on a single platform.

Growth in security came from a partnership with Centroid Systems and Stellar Cyber, which introduced managed security services built on Oracle Cloud Infrastructure. This allowed Oracle to meet the growing need for integrated cybersecurity within cloud environments while expanding its role in the MSSP market.

In healthcare, Oracle set up the AI Center of Excellence for Healthcare to help providers put AI to work across clinical, operational, and financial areas. The program provides hospitals and health systems with resources and know-how to get more out of AI, whether improving patient outcomes or streamlining day-to-day operations.

Clinical research also received attention with upgrades to Oracle Clinical One Data Collection. The improvements made it easier to connect with electronic health record systems and integrate directly with Oracle Safety One Argus. These updates simplify data collection, tighten safety reporting, and speed up clinical trials, which can help bring therapies to market faster and strengthen Oracle’s ties to pharmaceutical partners.

Analyst Views on Oracle’s Future

Oracle’s next earnings report is expected in November 2025, with analysts forecasting $1.30 per share for the current quarter, up from $1.15 a year ago, a gain of 13.04%. Looking further ahead, Wall Street projects full-year earnings of $5.38 in fiscal 2026, which would be a growth of 22.27% compared to the prior year.

Even with those solid expectations, sentiment shifted after Rothschild & Co. Redburn’s Alex Haissl initiated coverage on Sept. 25, with a “Sell” rating and a $175 price target. With Oracle trading around $308 at the time, this pointed to nearly 40% downside. Haissl argued that the market is “materially overestimating” the value of Oracle’s contracted cloud revenues. He also described Oracle’s involvement in large-scale AI projects like Stargate as being more like a financier than a true cloud provider, making its revenue economics very different from established players in the sector and harder to justify at current valuations.

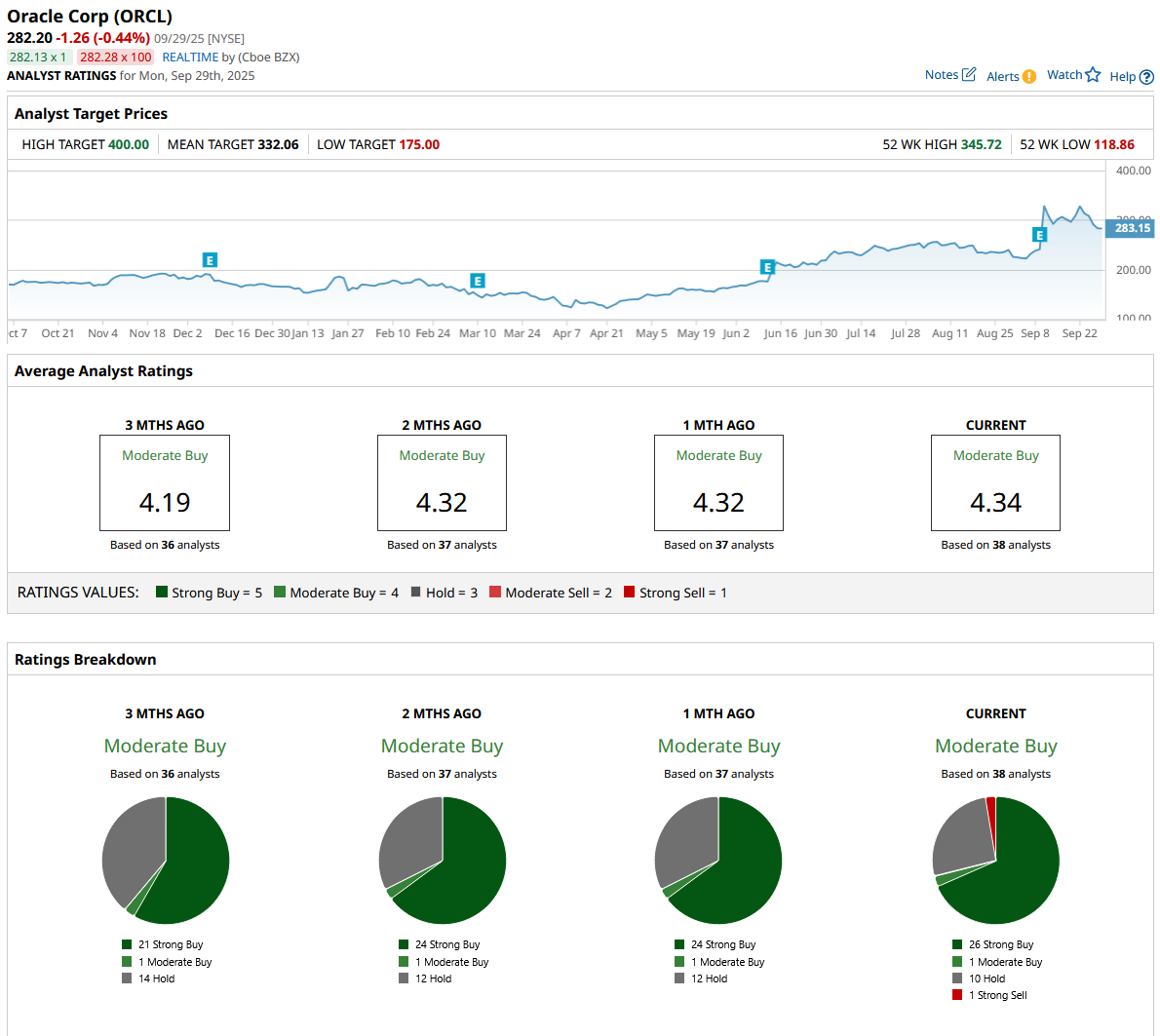

Most of Wall Street, however, remains more optimistic. Out of 38 analysts surveyed, the consensus rating is still a “Moderate Buy,” with an average price target of $332.06. Based on Oracle’s current price, that target signals an expected upside of 17%.

Oracle’s rally has been nothing short of remarkable, but the cracks in its valuation make Rothschild’s caution difficult to ignore. Yes, the company is delivering on cloud, AI, and healthcare fronts, and most analysts still see room for upside, but a forward P/E north of 57x leaves very little margin for error. While Wall Street stays broadly optimistic, the sharp “Sell” from Rothschild highlights that expectations may be running ahead of reality. In the near term, ORCL shares are more likely to cool off or consolidate than extend their blistering run, especially if earnings momentum falls short of the hype.