The world's biggest tech stocks have powered much of the S&P 500's recent record run, as well as the all-time highs printed last week by the Nasdaq, but some investors are starting to see parallels to the one of the most spectacular downturns in market history.

The last tech-market bubble, which saw internet and related stocks surge at the end of the 1990s, began its long collapse 24 years ago after the Nasdaq hit its then record 5,132.52 points on March 10, 2000.

The Nasdaq, in fact, shed a staggering 75% of its value over the next 18 months, a collapse that cost investors an estimated $5 trillion in lost wealth.

Much has been written about the speculative nature of the tech bubble's expansion – famously attributed to "irrational exuberance" by former Treasury Secretary Alan Greenspan – and its ultimate demise but both are tightly connected to the lack of revenue and earnings generation of many of the companies that eventually collapsed.

Some analysts, noting that the composition of semiconductor stocks to the overall value of the S&P 500 has reached a peak last seen during the dot-com era, suggest that a new bubble is forming in a market that relies increasingly on a small number of stocks for its broader performance.

TheStreet

AI chipmaker Nvidia (NVDA) , for example, the third biggest stock on the S&P 500 in terms of market value, has surged more than 82% so far this year. It has notched significantly higher gains than any of its so-called Magnificent 7 peers and outpaced by more than 10 times the 7.5% advance for the broader benchmark.

Stocks in general are also exhibiting bubble-like qualities, according to data from Bank of America's weekly Flow Show report, which notes that the S&P 500's gain of 25% over the past five months has been replicated only 10 times since the 1930s.

Magnificent 7 may actually be cheap: analyst

The market's key volatility gauge, the VIX index, is also trading near the highest levels since November of last year, which occurred just after the market began its long tech-led advance in late October.

JPMorgan analyst Mislav Matejka, however, rejects the notion that the Magnificent 7 stocks are overvalued, and argues in a client note published Monday that the collective of the market's biggest tech stocks are, in fact, trading at their cheapest levels in around five years.

The Magnificent 7 is generally considered to include Microsoft (MSFT) , Apple, Amazon (AMZN) , Alphabet (GOOG) , Meta Platforms (META) , Tesla (TSLA) as well as Nvidia.

“There is a concern over the very strong outperformance of the Magnificent 7, but we note that the group is currently trading less stretched than a few years ago, given earnings delivery,” the strategist wrote in a note.

“This is not to say that the group is immune to profit disappointments ahead, but in the case of general earnings disappointment, these stocks could still hold out better than traditional cyclicals reliant on strength in the economy," the JPMorgan analyst added.

Related: Analyst revamps S&P 500 price target after record rally

Jeffrey Buchbinder, chief equity strategist at LPL Financial, notes that six of the Magnificent 7 stocks (Tesla is excluded) powered a more than nine percentage point contribution to S&P 500 earnings growth over the fourth quarter.

"More specifically, S&P 500 earnings per share would have declined 4.5% in the quarter if not for these six companies. Add them in and that decline becomes a 4.8% increase," Buchbinder said.

Big earnings contribution, with more to come

"If that wasn’t impressive enough, expectations for 2024 results for this group were lifted significantly," he added. "So not only did this group grow earnings significantly last quarter, but their already very strong outlooks were strengthened further by a healthy dose of management optimism."

JPMorgan's Matejka, in fact, noted more concern about the value of stocks in cyclical sectors such as autos, retail and travel, citing a shift in their pricing trends tied to an expected slowdown in consumer spending.

That, in turn, could deepen the market's reliance on the Magnificent 7, given the earnings they're likely to generate and the likely outperformance of investments in growth over value stocks.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

"Strong results were needed to help justify rich valuations, and corporate America came through," LPL's Buchbinder said of the fourth-quarter-earnings season, which generated around $476.1 billion in share-weighted profits, according to LSEG group data.

"If companies can deliver near-consensus earnings estimates in 2024, buoyed by big tech, and the Federal Reserve can engineer a soft landing as inflation continues to gradually ease, then we believe stocks stand a good chance of not only adding to year-to-date gains through year-end, but also keeping the price-to-earnings [multiple] around 20, which we view as fair based on LPL Research’s macroeconomic outlook," he added.

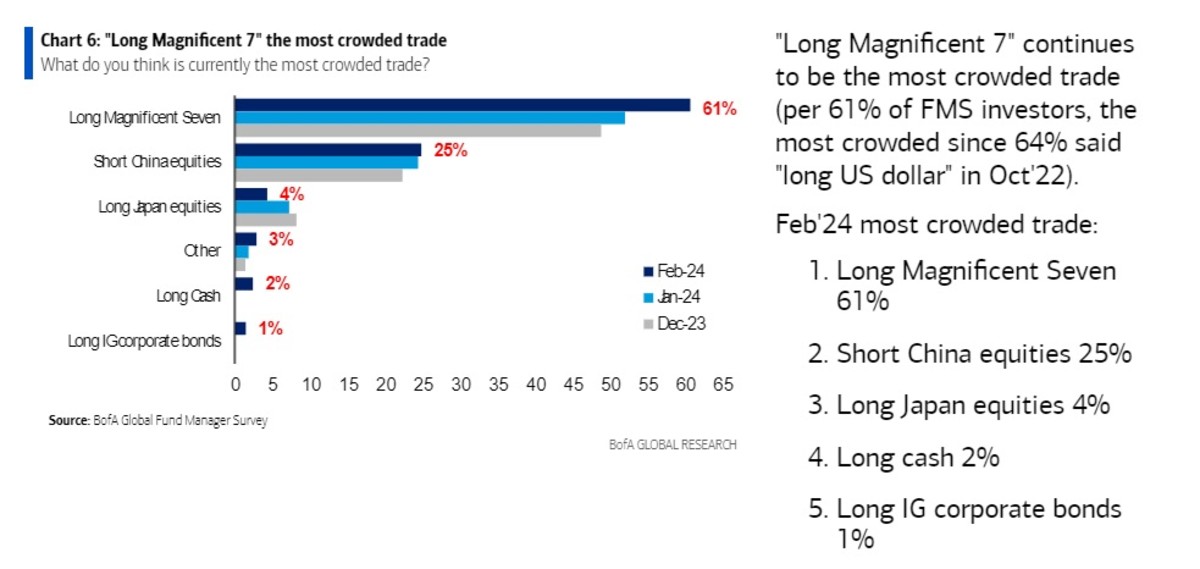

That said, Bank of America's benchmark Global Fund Manager Survey for the month of February noted that while allocations to U.S. stocks are at the highest levels since November 2021, going long the Magnificent 7 is considered by far to be the "most crowded" trade in the market.

Louis Navellier of Navellier Calculated Investing, however, notes that the Magnificent 7 leadership is changing, thanks in part to year-to-date declines in Apple (AAPL) and Tesla. He sees the artificial-intelligence-investment theme and the trillions of dollars sitting in global money market funds as driving continued gains over the first half of the year.

"I expect that March will be characterized by wave after wave of positive analyst earnings revisions since the fourth-quarter earnings surprises were so strong," he said.

"In other words, the 'melt-up' will persist and be fueled by $8.8 trillion in money market assets on the sidelines that are expected to meander back into the stock market over the next several months."

Related: Veteran fund manager picks favorite stocks for 2024

.png?w=600)