/Chipotle%20Mexican%20Grill%20lunch%20by-%20dennizn%20via%20Shutterstock.jpg)

On Wednesday, Chipotle (CMG) is expected to report earnings, which should provide plenty in the way of headlines for investors in this name (and those who may not be invested in this restaurant chain) to chew on.

It's been a mixed earnings season thus far, with strength seen in certain pockets of the economy (financials), while some tech companies and those operating in other sectors are seeing less-favorable dynamics play out. In the world of restaurant chains like Chipotle, the earnings outlook also appears to be mixed.

I thought that a recent report issued by investment bank UBS on Chipotle this past week was worth checking out. Let's dive into why analysts at UBS think Chipotle's numbers may leave plenty to be desired, particularly on a guidance basis moving forward.

Analysts Are Becoming Increasingly Cautious

This is a trend I've been noticing, not only with Chipotle, but with other high-flying stocks that seemingly couldn't do anything wrong in years past. Investors and analysts are starting to read the tea leaves when it comes to the strength of the economy and underlying demand from consumer spending and coming to the conclusion that same-store sales metrics and other key industry metrics within the quick-service restaurant category could be under pressure in the quarters to come.

While Chipotle's management team has put forward strong guidance in the past, analysts at UBS think that the company's forward outlook this coming quarter could be diminished, in part due to cyclical and structural pressures on the company.

The chart above showing the overall analyst consensus for CMG stock tells a similar story. While the company's share price has declined considerably in recent weeks, Chipotle's overall consensus price target of just shy of $55 per share hasn't moved much. This suggests many on Wall Street (and Main Street, for that matter) are waiting to hear more from the company around how things are actually progressing at this blue-chip restaurant operator.

Now, the current price target of $54.55 set by Wall Street does imply upside of around 33% from here, which is fantastic. But such upside would really get Chipotle's stock price back to where it was in July. For an even greater price increase, I think we'll need to see strong numbers come through for a couple of consecutive quarters. The market appears to believe currently that such a situation isn't as likely as it may have been a couple of months ago.

What Do the Fundamentals Say?

Earnings forecasts are certainly important to watch, and one could definitely make a cogent argument that forward-looking guidance and expectations matter more than past results.

That said, looking at Chipotle's trailing results and its corresponding multiples, I don't get the feeling that CMG stock is overvalued here.

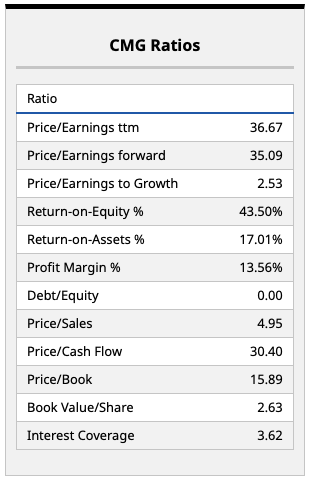

Quite the contrary. With a cash flow yield of more than 3% and a price-earnings (P/E) ratio on a trailing basis around 37 times (with one of the best growth rates in its sector), Chipotle's stock price looks attractive on a relative basis.

And given Chipotle's strong profit margin of more than 13% and its incredible return on equity metric of 43.5%, I do think investors will benefit from buying this stock on dips and holding for the long term.

In other words, if we see the kind of dip UBS analysts and others think could be on the table following this company's upcoming earnings report, I'd be personally interested in adding some CMG stock to the portfolio. That's a decision each individual investor will need to make, but I think the backdrop, at least right now, remains strong with this company.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.