The resurgence of cryptocurrency has reshaped the trading landscape. With Bitcoin (BTCUSD) and Ethereum (ETHUSD) regaining momentum, altcoins are rallying, and U.S. regulators are striking a softer tone under the Trump administration, brokerages are scrambling to plug digital assets into their core business. What was once treated as an optional add-on is now viewed as a key driver of order flow and revenue growth. Into this shift steps Webull Corporation (BULL), a platform that has quietly built itself into a formidable player.

Webull’s evolution is sharp—from a niche data service to the second-largest mobile-first brokerage in America, serving millions of retail investors. Its edge lies in execution speed, sleek design, and an all-in-one trading ecosystem tailored for high-velocity retail activity.

The company had announced reintroducing 24/7 crypto trading last month, which would cover over 50 assets from Bitcoin to Solana (SOLUSD), marking a return to form after a two-year pause. The relaunch, tested successfully in Brazil and backed by restructuring, is expected to lift trading volumes as retail demand converges with crypto access on one platform.

Given catalysts like those, Rosenblatt initiated coverage with a "Buy" rating, pointing to crypto-driven revenues as a fresh catalyst for growth. And with the Street pounding the table on this under-the-radar stock, let’s take a closer look at BULL.

About Wedbull Stock

Headquartered in Saint Petersburg, Florida, Webull is a digital-first broker giving retail investors direct access to equities, options, and ETFs through its licensed platform. Its market capitalization currently stands at $7.2 billion.

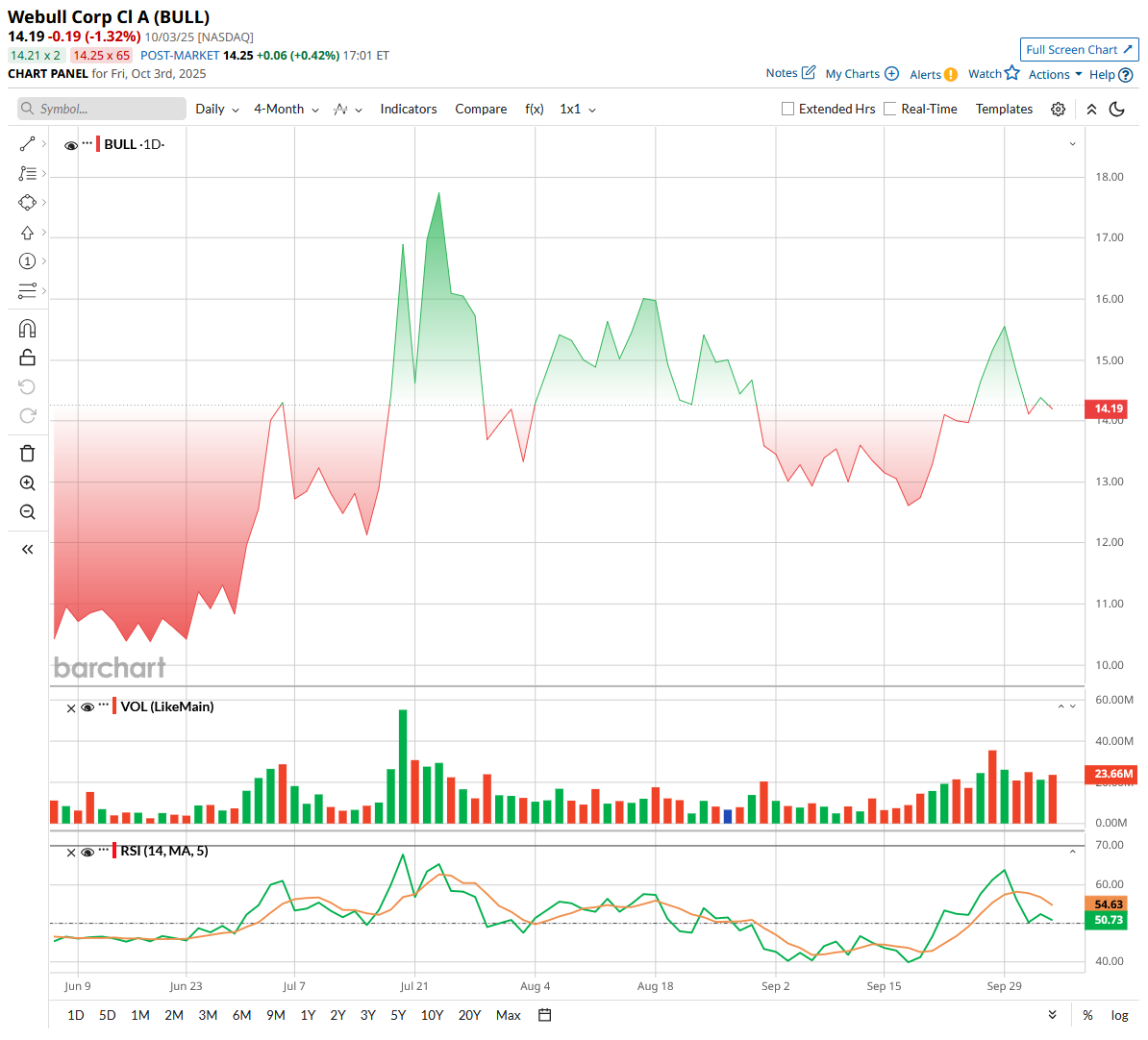

The company debuted via a SPAC merger on April 11, sparking a surge in investor attention, and briefly hitting $79.56 before momentum cooled. Today, trading around $14, BULL has shown resilience—up 9% in the past month and just about flat over three months, while climbing by 19% from its 52-week low of $9.54.

Technically, the story gets interesting: rising volume suggests renewed investor appetite, while the 14-day RSI, now pushing around 60, signals strengthening bullish momentum. The chart shows classic volatility with sharp swings, but the recent uptick hints at a stabilizing base.

Priced at 235 times forward adjusted earnings and 17.8 times sales, BULL is definitely not cheap, trading above the sector average—but that’s the point. The investors are quietly baking in outsized growth, fresh crypto revenues, and a swelling user base.

Webull’s First Report as a Public Company Shines Bright

On Aug. 28, Webull unveiled its Q2 2025 earnings results after the closing bell, and the numbers were impressive—the newly public brokerage is hitting its stride. In its first quarter as a listed company, Webull not only extended its streak of three consecutive quarters of operating profitability but also set a fresh record for customer assets, now sitting at an all-time high. Driving the momentum were strong trading volumes, rising net deposits, and a retail trading environment the company described as the most favorable since the pandemic boom.

Revenue growth surged ahead of expenses once again, fueling robust operating profits. Total revenue climbed 46% year-over-year (YoY) to $131.5 million, with trading-related revenue up an impressive 63% annually. Meanwhile, expenses grew just 20% to $108.2 million, mostly tied to transaction charges and heavier marketing spend. Adjusted operating profit reached $23.3 million, or $0.05 per share, while adjusted net income swung to $15.4 million from a -$1.5 million loss a year ago.

Customer assets surged 64% to an all-time high of $15.9 billion, with net deposits up 37% YoY. Funded accounts grew 9% to 4.73 million, while registered users jumped 18% to nearly 25 million.

Trading activity was equally strong, with options contracts reaching 127 million and equity notional volume climbing 58% to $161 billion. The company also noted that its revamped options pricing model continues to pay off, driving revenue faster than contract growth.

Looking ahead, Webull sees no slowdown. Assets under management have already surpassed $18 billion midway through Q3, and July was the firm’s highest revenue month ever. Management expects another solid quarter barring major market shocks. With crypto trading relaunched, global expansion underway, and a growing base of active traders hungry for sophisticated tools, Webull believes it is well-positioned to keep accelerating.

Analysts monitoring the digital retail trading platform project Webull’s bottom line to dip by 71.4% YoY to $0.06 per share in fiscal 2025, before rebounding sharply with an 83.3% annual jump to $0.11 in fiscal 2026.

What Do Analysts Expect for BULL Stock?

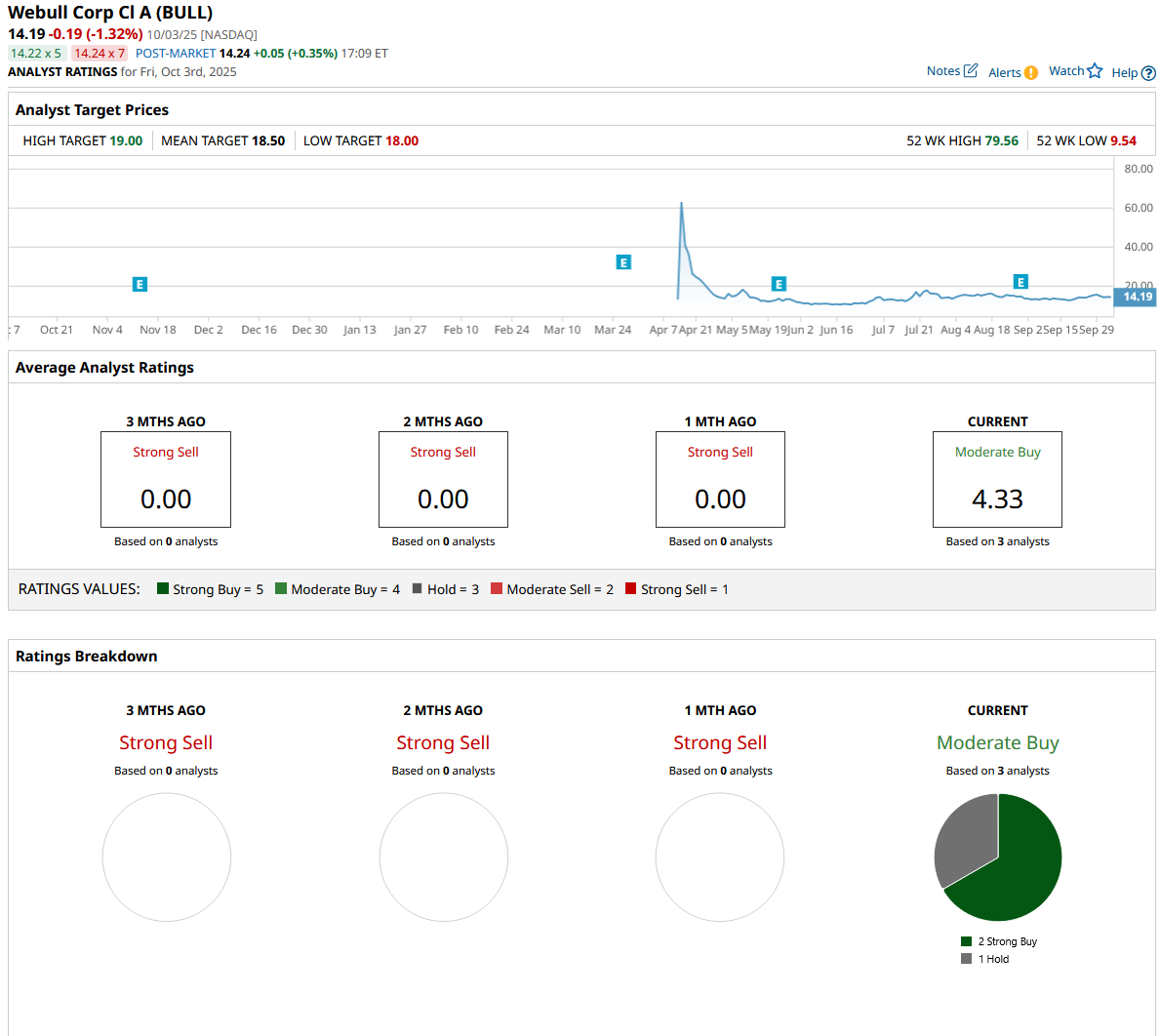

Chris Brendler of Rosenblatt is betting big on BULL, starting coverage with a “Buy” rating with a target price of $19, framing the stock as a quiet but powerful growth story. His thesis leans on two pillars—crypto and international expansion—both backed by shifting market conditions.

In his note, Brendler pointed out that crypto once made up nearly a fifth of Webull’s revenue. While the analyst does not expect that level to return soon, he still views crypto as a core growth driver, especially with U.S. regulations turning friendlier in 2025.

But the bigger opportunity, he argues, lies overseas. Webull already holds licenses in 14 regions—including Hong Kong, Singapore, Japan, the UK, and Australia—markets earlier in the retail participation curve and less saturated with competition. Brendler believes these regions represent Webull’s most significant medium-term catalyst, even as domestic share gains remain strong.

Rosenblatt highlighted Webull’s rise from a niche data shop to the #2 mobile-first brokerage in the U.S., fueled by zero commissions, sleek tech, and a top-rated app that resonates with active traders. With tailwinds from “retailification,” prediction markets, and crypto, the firm projects Webull sustaining over 25% annual revenue growth through 2027, well above consensus. While BULL is not trading cheap, Rosenblatt calls the multiple attractive compared to prominent names like Robinhood (HOOD), especially given Webull’s smaller base, operating leverage, and faster growth profile.

BULL is not exactly a household name on Wall Street, but analysts are quietly warming up. The stock has a consensus “Moderate Buy” rating overall from the three analysts offering recommendations. Out of those, two advise a “Strong Buy” rating and one has a “Hold.”

Meanwhile, the mean price target of $18.50 suggests the stock could surge as much as 30%. Rosenblatt’s street-high target of $19 implies BULL could rally as much as 34% from today’s close, putting fresh momentum behind this under-the-radar play.

Final Thoughts on BULL Stock

Webull’s return to crypto trading after a two-year pause is definitely turning heads. Streamlining access by bringing Webull Pay directly into the main app removes a barrier that frustrated users before, and that could drive stronger adoption. For traders, it’s a fresh avenue to ride the volatility of digital currencies without juggling multiple apps. From a revenue standpoint, higher engagement and trading volume are definitely in play.

But let’s be real—ease of access does not equal guaranteed gains. BULL is not suddenly the golden ticket—it is still a SPAC-born stock with volatility. The market can swing fast, volatility bites both ways, and regulatory or tech hiccups can derail momentum. One could think of BULL more like a hands-on space for traders to try out different approaches rather than a buy-and-forget stock. Investors might have to do their homework well, manage position size, and use stop losses to trade BULL wisely.

Analysts like Rosenblatt see promise here. The crypto relaunch and hourly contract offerings could lift earnings, though sustained growth is not guaranteed. BULL’s SPAC-born journey remains far from a straight line, where every spike or pullback tells a story about adoption, investor confidence, and the market’s judgment on crypto-driven revenues. Patience, technical cues, and active monitoring could be keys for now.

.jpg?w=600)