Zillow Group (Z) is a leading real estate technology company, recognized as one of the most visited real estate websites in the United States. Its platform provides comprehensive tools and information for buying, selling, renting, and financing homes, serving consumers and industry professionals with brands like Zillow, Trulia, StreetEasy, HotPads, and dotloop.

It was founded in 2004, and it is headquartered in Seattle, Washington.

Zillow Powers Through in 2025

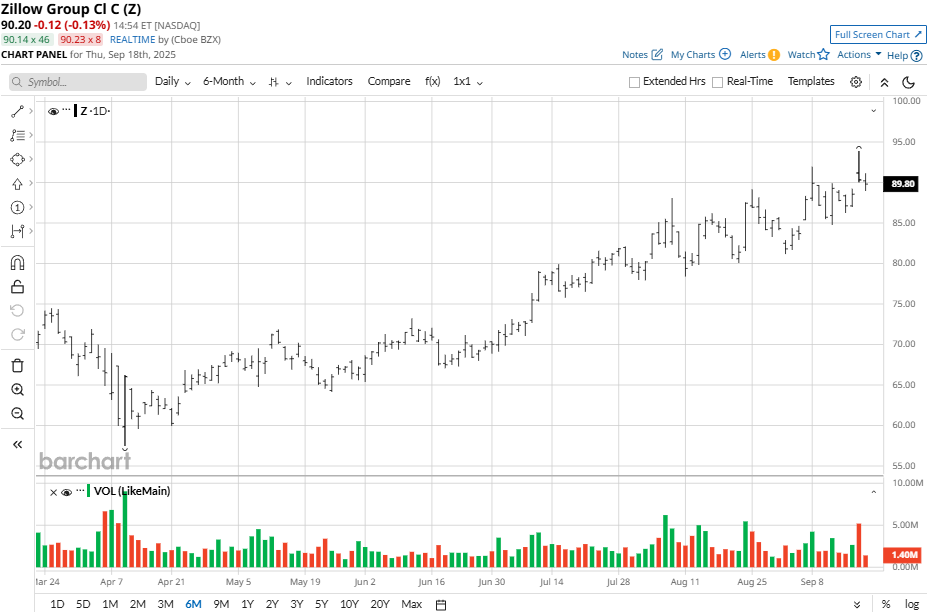

Zillow’s stock displayed robust performance in 2025, rising 6.2% in the past month, 29% in six months, 21% year-to-date (YTD), and 37.9% year-over-year (YoY). This run far outpaces the Nasdaq Composite ($NASX), which returned about 16.5% over the same one-year period.

Z stock’s surge is backed by strong revenue growth, record liquidity, and expanded market share in rentals and mortgages, reinforcing investor confidence.

Zillow Group’s Q2 Results

Zillow reported Q2 2025 revenue of $655 million, up 15% YoY and surpassing analyst estimates of $647 million. Adjusted earnings per share landed at $0.40, missing consensus expectations of $0.44, as increased costs weighed on margins despite solid rental and mortgage growth. The robust top-line results reflected broad strength in for-sale, mortgage, and rental segments, with rental revenues alone surging 36% YoY.

Diving deeper, Zillow’s residential revenue grew 6% to $434 million, while mortgage revenues jumped 41% to $48 million, driven by a 48% spike in purchase loan origination volume. Adjusted EBITDA rose to $155 million, representing a 24% margin, and average monthly unique users hit 243 million, up 5% YoY.

The company ended the quarter with $1.2 billion in cash and investments, despite increased spending on sales and marketing. Overall, revenue growth significantly outpaced the gains in transaction value of the residential real estate industry.

Looking ahead, Zillow projects Q3 revenue of $663–$673 million and adjusted EBITDA of $150–$160 million. For the full year, management raised its outlook to mid-teens revenue growth and a rental revenue increase of about 40%, with continued profitability and margin expansion expected.

Zillow Upgraded by Analyst

Bernstein has upgraded Z stock to “Outperform” from “Market-Perform” and raised its price target to $105 from $75, reflecting an upside of 16% from the market rate, citing confidence in improving earnings quality and the potential for interest rates to decline. To the latter point, the Federal Reserve cut interest rates the very same day the report was released.

Analysts recognized Zillow’s recent successful execution of mid-teens revenue growth, strong momentum in its Rentals and Showcase divisions, and the prospect of GAAP EBIT inflecting positively. They believe that Zillow’s operating leverage could outperform in 2027 and 2028, allowing EBITDA to compound at a rate of 25–30%, supported by ongoing mid-teens revenue growth.

Importantly, Bernstein’s note also highlights that upside in earnings could be unlocked if the housing market rebounds, as U.S. existing home sales are currently 20–30% below normal levels. The analysts now feel more confident about Zillow’s valuation and timing due to these developments and anticipate further upside potential if conditions in the broader real estate market improve.

Should You Bet on Z Stock?

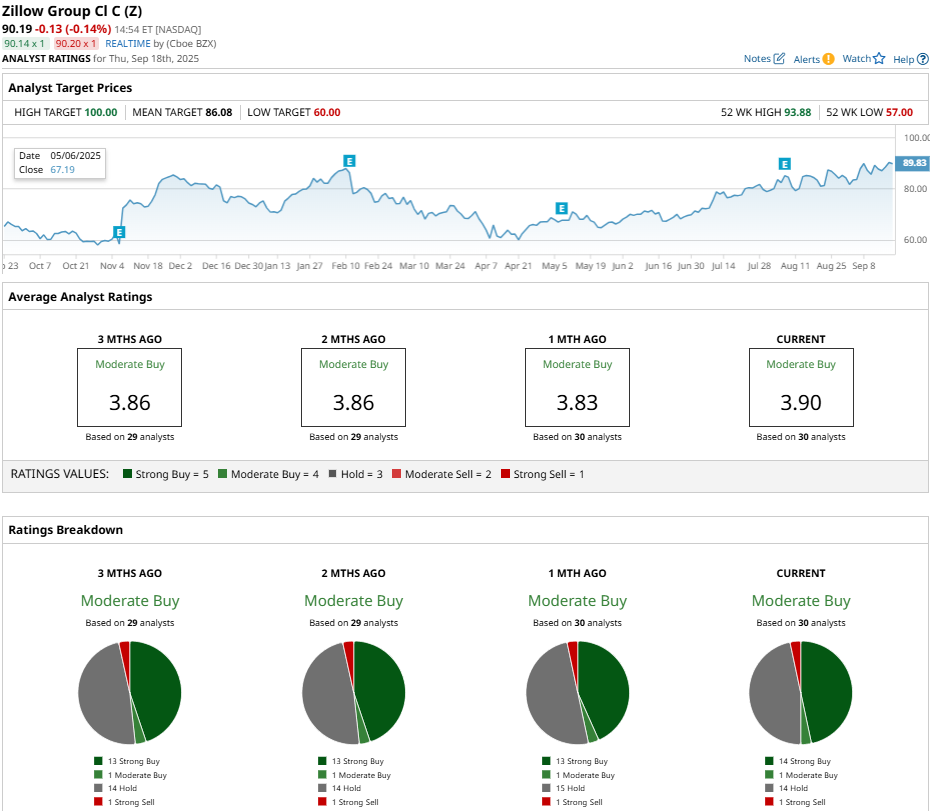

Z stock is trading above its mean price target of $86.08, reflecting slight potential downside, but analysts still convey confidence with a consensus “Moderate Buy” rating.

Z’s stock has been analyzed by 30 market experts so far, receiving 14 “Strong Buy” ratings, one “Moderate Buy” rating, 14 “Hold” ratings, and one “Strong Sell” rating.