Nvidia was one of the stock market's best-performing stocks in 2023, climbing by a jaw-dropping 239% because of surging demand for its artificial intelligence semiconductor chips.

The performance was awe-inspiring, but look more closely. You will discover that most of the returns happened in the first half of 2023. The stock has traded sideways since mid-August, including a retreat since mid-December because of new restrictions on selling AI chips to China and a delay in launching new chips that meet the government's updated requirements.

The lackluster returns recently likely surprised many, but it didn't shock Real Money Pro analyst Bruce Kamich. In September, he predicted Nvidia's shares would slide to $400, and on Dec. 20, when many thought the stock would break out to new highs, he said, "The risk, in my mind, is to the downside."

Kamich's forecasts proved to be particularly clairvoyant. Nvidia bottomed in October near $392, slightly below his target, and shares have stalled following his comments in December, despite the S&P 500 rallying into year's end.

Given Kamich's hot hand, investors may want to pay attention to what he thinks happens to Nvidia's stock next.

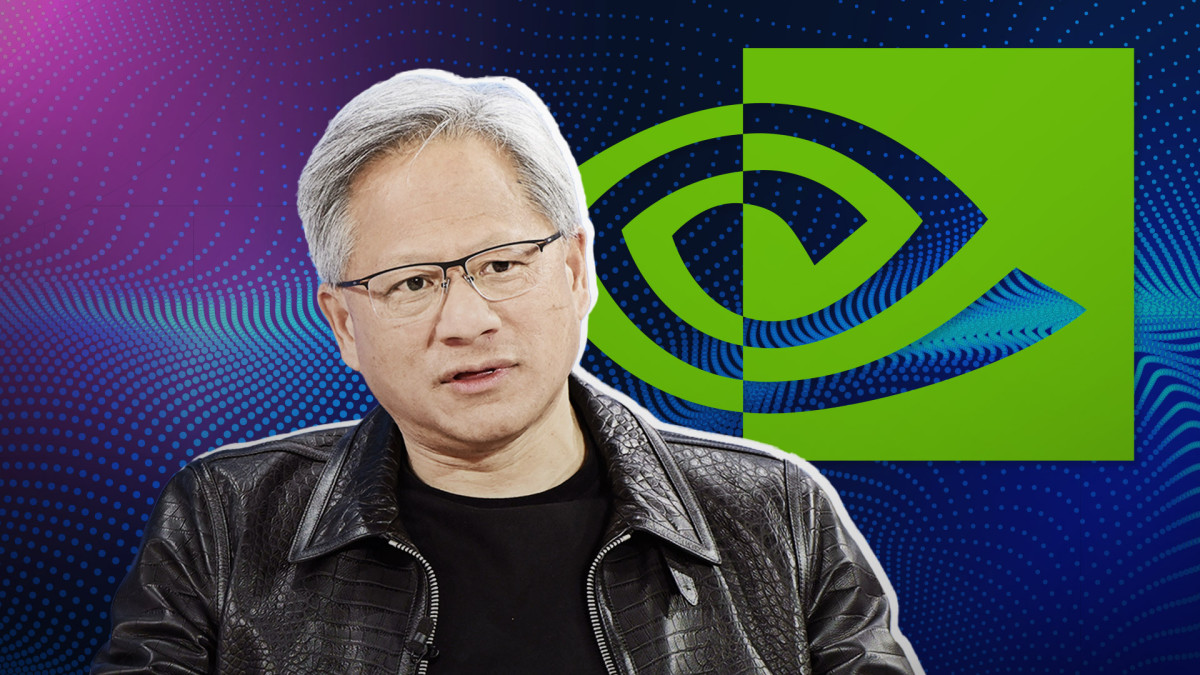

Wu Jun/VCG via Getty Images

Nvidia sales surge on AI spending growth

Artificial intelligence isn't new. The famous mathematician and computer scientist Alan Turing explored the possibility of designing AI computers in the 1950s, the Rand Corporation wrote the first AI program in 1956, and countless science fiction books and movies have considered the possibility of machines that can think over the years.

While AI's roots stretch back decades, it's only recently that it's achieved widespread adoption, thanks to the successful launch of OpenAI's ChatGPT, a large language model capable of searching, parsing, and creating content. Over 100 million signed up to use ChatGPT in its first few months.

Related: Analyst says this skyrocketing tech giant will go higher in 2024

The rapid embrace of ChatGPT has opened up a torrent of AI investment by governments and enterprises eager to tap into AI's potential. For example, the U.S. Defense Department is experimenting with using AI on the battlefield, financial service companies like JP Morgan Chase are using it to hedge financial risks, and drugmakers are considering whether it can design better medicines.

The potential for AI to reimagine how governments and companies operate has resulted in a significant need for more powerful and energy-efficient computers capable of handling heavy workloads.

That's been a boon to Nvidia (NVDA) -) because its graphic processing units (GPUs) are far more ideally suited to training and operating AI programs than the central processing units (CPUs) most commonly found in enterprise and cloud networks, such as Amazon's AWS, Google Cloud, and Microsoft's Azure.

Nvidia's revenue skyrocketed 206% to $18.1 billion, and its earnings per share jumped a jaw-dropping 593% to $4.02 in the third quarter.

Nvidia won't report its fourth quarter financials until Feb. 21, but Wall Street expects revenue and earnings per share to be $20 billion and $4.50, respectively. If so, that would be substantially above the $6.1 billion and 88 cents reported in the same quarter one year ago.

Nvidia hits an AI market speedbump

Much of the world's technology is manufactured in China, so it's unsurprising that a significant amount of Nvidia's AI sales growth has been due to rising demand for chips there. In recent quarters, China has accounted for between 20% to 25% of Nvidia's data center revenue.

More Business of AI:

- The ethics of artificial antellligence: A path towards responsible AI

- Google targets Microsoft, ChatGPT with huge new product launch

- AI is a sustainability nightmare – but it doesn’t have to be

The number of AI chips being sold to China and the potential for China to use them to create technology that could undermine U.S. interests has caught the attention of the U.S. Government.

As a result, the Department of Commerce has crafted increasingly more stringent rules to keep the highest-performing AI chips out of Chinese hands, including new restrictions put in place in October.

CEO Jensen Huang previously created throttled-back versions of its chips to meet the Commerce Department's initial performance thresholds. However, those chips fail to qualify under the new rules.

A new workaround is being developed, but Nvidia struggled to integrate these chips into server platforms, forcing it to delay availability.

Nvidia's chart provides a new price target

Nvidia's stock price has attempted to eclipse $500 a few times since summer. However, each try has preceded a retreat rather than new highs, including the recent decline since mid-December.

Kamich revisited his analysis on Jan. 3 to understand whether Nvidia may finally break out above this $500 resistance. He also used a daily point-and-figure chart to calculate a new price target.

A technical analyst with 50 years of stock market experience, Kamich analyzes price and volume to measure investors' aggregate sentiment, including the buying and selling by large fund managers with access to resources unavailable to most individual investors.

Unfortunately, Kamich remains unimpressed by what he sees in Nvidia's charts.

"NVDA is pulling back recently and is closing in on the rising 50-day moving average line," says Kamich. "The weekly trading volume has been weakening. The [On balance volume] OBV line is stalled, and the 12-week momentum study shows us a bearish divergence from July to December. A number of upper shadows around $500 is another bearish clue."

To be bullish on Nvidia's shares, Kamich would want to see on-balance-volume (OBV), which is essentially up minus down day volume, improving and positive momentum.

Kamich's point-and-figure price target is also a concern. Using a daily P&F chart, he calculated a target price of $446. That's about 7% below where shares closed on Jan. 4, so Nvidia shareholders may want to brace for a little more selling.

Want to turbocharge your portfolio? Learn from the investing legends and get actionable insights. Start your Real Money Pro membership today.