Nvidia’s share price rally is one for the record books. The shocking potential for artificial intelligence to reshape how businesses operate, and people interact with information caught many investors flat-footed early in 2023 when recessionary worry still weighed down tech stocks.

One analyst who wasn’t caught off guard was TheStreet Pro’s Bruce Kamich, an analyst with a 50-year track record of evaluating stocks, bonds, and commodities. Kamich’s unique investment research approach helped him turn positive on the stock last year, and it has led to prescient price targets that have panned out, including his forecast that Nvidia’s stock could eclipse $750 per share.

Given Nvidia’s highly anticipated AI conference this week, shareholders can’t be blamed for wondering if there's more room to run higher or if the conference will mark the top in the tech stock’s epic run.

Kamich recently updated his analysis of Nvidia to help answer that question, including new price points that could cause investors to get uneasy.

Nvidia's AI tsunami

Although AI might seem new, the possibility of computers thinking for themselves someday has long been discussed.

Famed mathematician and computer scientist Alan Turing researched how to design AI computers in the 1950s, and Rand Corp unveiled the first AI program in 1956. Science-fiction books and movies have contemplated the implications of AI many times.

Related: Jensen Huang outlines a huge future for Nvidia

However, while the concept has been around for a while, it's only recently become a mainstream reality.

OpenAI's ChatGPT opened the door to how large language models can be used by everyone when it became the fastest app to 1 million users following its launch in December 2022. The AI app showed how quickly and simply generative AI can be used to search, parse, and create content.

AI's possibilities have caused a tsunami of interest in AI research and development.

Big banks are using it to hedge risks, healthcare companies are investigating if it can be used to create better medicines, retailers are evaluating if it can be used to stop theft, and manufacturers are exploring how it can be used to improve quality and maintenance. The U.S. military is even considering how AI may impact the battlefield.

The flurry of AI training and activity is creating bottlenecks within well-worn network infrastructure primarily built around central processing units, or CPUs. Those machines were fine for most applications but struggled to handle AI's more complex, time-consuming workloads.

As a result, cloud data providers, including the hyperscalers Amazon, Microsoft, and Google's parent Alphabet, are investing in buying new servers packed with more powerful parts, including Nvidia's graphics-processing units or GPUs.

Nvidia's GPUs are highly sophisticated systems weighing over 70 pounds and are made from thousands of technology parts, costing tens of thousands of dollars.

Soaring demand and margin-friendly pricing for these GPUs have caused Nvidia's revenue and profit to skyrocket.

In the fourth quarter, Nvidia's sales increased an eye-popping 265% to $22.1 billion, the third consecutive quarter of triple-digit top-line growth. Because these GPUs are highly profitable, Nvidia's earnings jumped 486% to $5.16 per share.

Nvidia faces challenges in 2024

Nvidia's CEO, Jensen Huang, thinks AI demand growth is a "huge opportunity" for the company. Huang expects the embrace of accelerated computing and generative AI to provide tailwinds for years.

More AI Stocks:

- Analyst reveals new Broadcom stock price target tied to AI

- AI stock soars on new guidance (it's not Nvidia!)

- Nvidia CEO Huang weighs in on huge AI opportunity

"We believe these two trends [accelerated computing and generative AI] will drive a doubling of the world's data-center infrastructure installed base in the next five years," said Huang during the company's fourth-quarter earnings conference call.

Huang says the AI market will be worth "hundreds of billions of dollars" yearly, a belief shared by rivals like Advanced Micro Devices, which launched its first specially designed GPU for AI this year.

AMD's CEO Lisa Su pegs the market for AI chips to be as big as $45 billion in 2024, growing to $400 billion by 2027.

It remains to be seen how much AMD's new AI GPU, the MI300X, cuts into Nvidia's market share, but Su is optimistic.

Previously, she said AMD's data center GPU revenue could be $2 billion this year. Now, she's targeting at least $3.5 billion. Overall, she thinks the AI-GPU market will grow an average of 73% annually to $400 billion through 2027.

More competition isn't the only challenge Nvidia has to overcome this year.

The U.S. government isn't keen on next-gen AI chips being sold to Chinese companies that could one day use the technology against it. Last fall, it enacted stringent performance restrictions for sales into China, significantly limiting sales.

Nvidia is working on a new chip it hopes to market in China, but only time will tell if those efforts will be successful.

Nvidia's AI palooza kicks off new technology

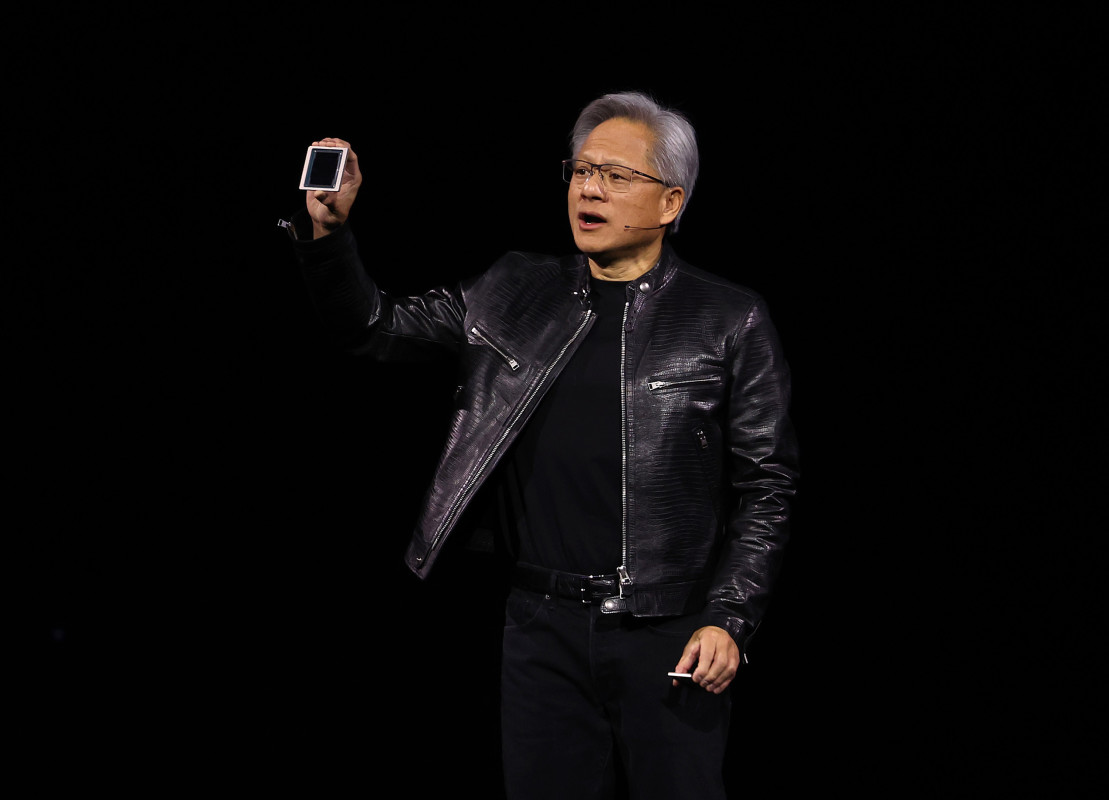

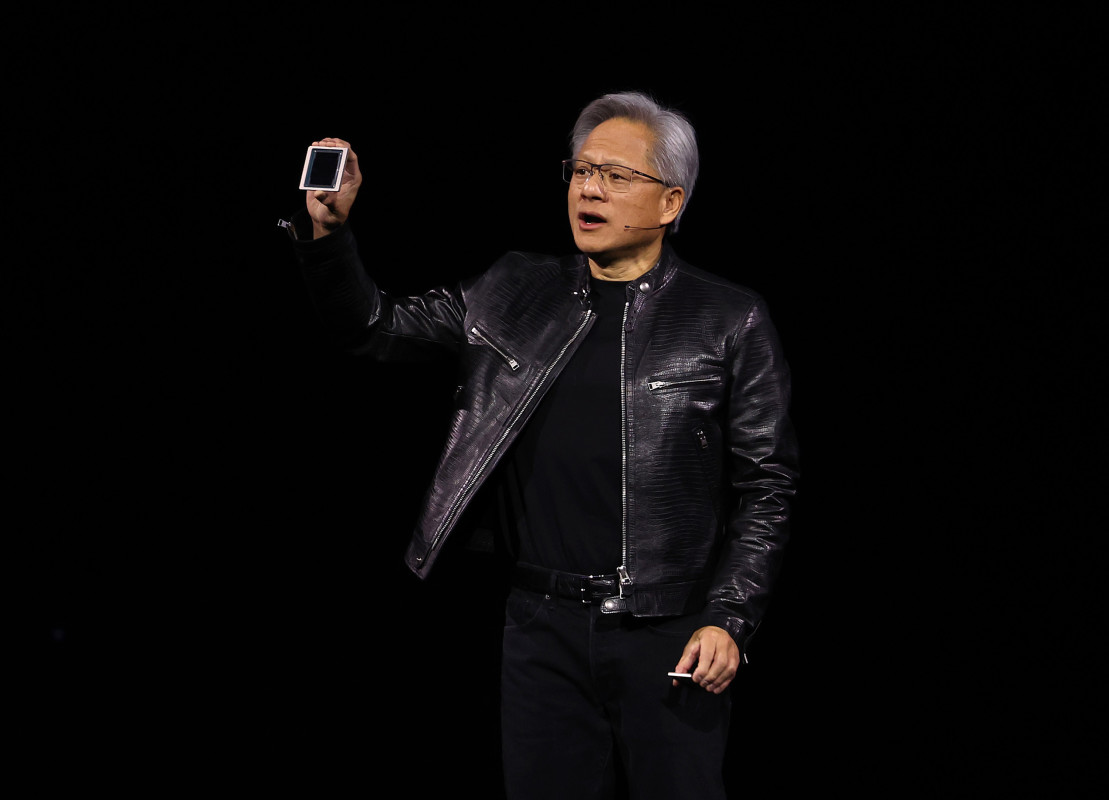

Huang's team is gathered in California from March 18 to March 21 for Nvidia's annual GTC Conference. The gathering features a who's who of AI leaders, all of whom are sharing their latest thoughts regarding AI's potential.

During Huang's keynote speech on March 18, he unveiled Nvidia's new Blackwell GPU platform. The Blackwell GPUs are expected to offer significantly more power than its Hopper platform chips, including the H100 and H200.

Huang says the B100 and B200 will perform 2.5 to 5 times better than the H100. The B200 is expected to launch later this year and cost between $30,000 to $40,000.

Nvidia's CEO also announced other solutions to perform AI tasks faster using less costly energy, including the Nvidia GB200 NVL72; a rack-scale design connecting 36 Grace CPUs and 72 Blackwell GPUs.

Nvidia says its Blackwell chip architecture uses 25% less energy than its Hopper chips.

Nvidia's stock chart reveals key price points

There's a lot to like about Nvidia's future, but investors are correct in wondering how much of the excitement is already priced into its stock.

Kamich previously calculated an Nvidia stock price target of $757 in early February. He recently calculated an upside price target in the "$1,134 area."

However, Kamich is concerned that, in the short term, Nvidia's shares could be flashing a warning.

A technical analyst, Kamich's research is based on price and volume trends. He's used technical analysis to evaluate markets for over 50 years, and his latest review of Nvidia's charts resulted in price levels at which investors may get nervous.

"Notice the large bearish engulfing pattern last week? Notice the heavy trading volume when prices hit $950 per share? Notice how the Moving Average Convergence Divergence (MACD) oscillator narrowed in recent sessions, telling us that the "trend strength" is weakening?" asked Kamich.

A bearish engulfing pattern consists of a small bullish candle followed by a bigger bearish candle that "engulfs" it. MACD is a momentum indicator.

Those potential chart headwinds prompted Kamich to consider what stock prices could trigger those with short-term mindsets to sell.

Using a point-and-figure charting approach, he identified $915, $875, and $855 as prices where "we could see recent buyers of NVDA get anxious." This led him to conclude, "Weakness below $855-$840 could cause further declines."

Of course, P&F targets aren't guaranteed, and anything can happen. Nevertheless, with Nvidia trading at about $900, short-term investors may want to keep Kamich's levels in mind.

Related: Veteran fund manager picks favorite stocks for 2024