Surging demand for high-end semiconductor chips used in artificial intelligence has caused Nvidia's revenue and earnings to soar, causing its stock price to skyrocket by 190% in 2023.

The year-to-date returns are impressive, but it's been tough going since summer. Most of Nvidia's gains happened in the year's first six months, long before U.S. restrictions on selling its AI chips to China took effect in October.

Nvidia's stock price initially tumbled on worry over a steep drop-off in Chinese revenue. Shares have recently traded higher alongside a rally in the S&P 500, but plenty of question marks remain that likely have investors wondering if shares are still a buy.

The stock's recent volatility has caught the eyes of Real Money Pro analyst Bruce Kamich, one of the few analysts who correctly predicted in September that Nvidia's share price would fall to $400.

Kamich latest analysis has led him to set a surprising price target for Nvidia's shares. However, his recommendation may disappoint some investors.

Nvidia's skyrocketing AI demand

ChatGPT's successful launch last December led to a flurry of corporate and government interest in training and operating artificial intelligence solutions.

A generative AI application, ChatGPT allows users to search, parse, and create content in ways that are more dynamic than traditional search engines. Companies are already using large language models like ChatGPT to improve upon customer service, but AI's benefits will likely be far broader, impacting how many companies do business.

Related: Fund manager who predicted the S&P 500 rally issues new 2024 target

For example, JP Morgan is using AI to hedge financial risks. Manufacturers are evaluating AI's potential to improve quality and supply chains. Drug developers are experimenting with its ability to improve how new medicine is developed, and retailers like Walmart are using AI to reduce theft.

AI's potential is wide-ranging, so big money is being shifted to AI initiatives, pressuring existing technology infrastructure that's ill-equipped to deal with the hefty demands of AI workflows.

As a result, enterprises and cloud network companies like Amazon's AWS are knee-deep in upgrading networking equipment that can be used to train and run AI apps quickly and cheaply.

Because Nvidia's graphics processing chips, such as the A100 and H200, are better suited to AI than traditional CPUs, its sales and profit have catapulted higher.

In the third quarter, Nvidia's revenue totaled $18.1 billion, up from $13.5 billion in the second quarter and $5.9 billion in Q3 2022.

Importantly, because these chips sell for far more than they cost to manufacture, third-quarter earnings skyrocketed 593% year-over-year to $4.02 per share.

Nvidia faces a big AI market challenge

Nvidia's high-end chips are sold worldwide, and because a lot of the world's technology is manufactured in China, sales there account for over 20% of Nvidia's data center revenue.

While that's good for the company, the U.S. government isn't too keen on the potential for China to use these advanced chips in AI projects that could conceivably threaten national security. As a result, the Department of Commerce announced this fall that it is immediately restricting sales of high-end AI chips to China.

More From Wall Street Analysts:

- Analyst who correctly predicted 8% mortgage rates has a new target

- Analyst who warned Google's stock could fall has a new price target

- Analyst who forecast the S&P 500’s rally has a new target for 2024

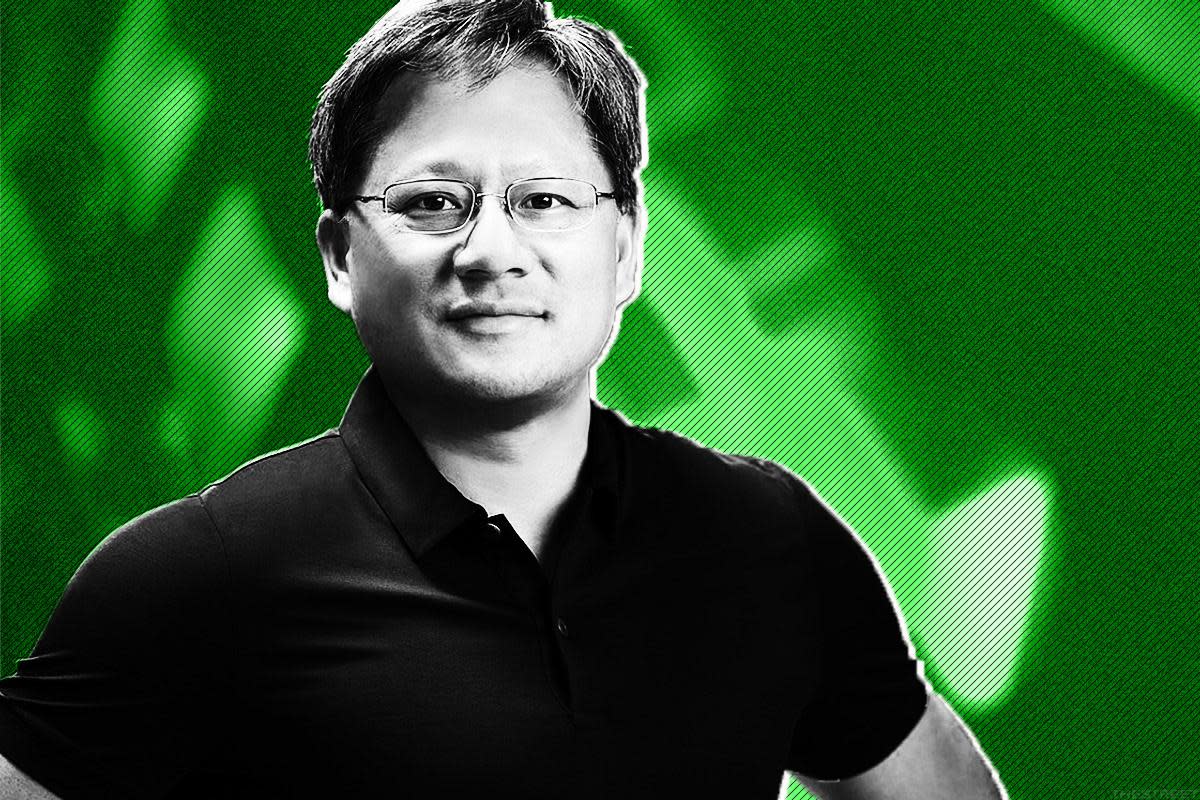

Previously, CEO Jensen Huang designed throttled-down versions of its chips to stay within performance thresholds outlined by the Commerce Department. However, those chips are no longer eligible for sale to China under the government's new guidelines, and finding another workaround may not be as easy.

In an SEC filing on Oct. 18, Nvidia said:

"The Interim Final Rule amends ECCN 3A090 and 4A090 and imposes additional licensing requirements for exports to China and Country Groups D1, D4, and D5 (including but not limited to Saudi Arabia, the United Arab Emirates, and Vietnam, but excluding Israel) of the Company’s integrated circuits exceeding certain performance thresholds (including but not limited to the A100, A800, H100, H800, L40, L40S, and RTX 4090). Any system that incorporates one or more of the covered integrated circuits (including but not limited to NVIDIA DGX and HGX systems) is also covered by the new licensing requirement. The licensing requirement includes future NVIDIA integrated circuits, boards, or systems classified with ECCN 3A090 or 4A090, achieving certain total processing performance and/or performance density."

In November, reports surfaced that Nvidia was having trouble integrating newly designed chips that comply with restrictions into server platforms. As a result, the availability of those AI chips for the China market has been pushed back to Q1, 2024.

Nvidia's price charts result in a new target

In August, Nvidia's stock price was above $500. However, concerns over China and a weak stock market contributed to its shares sinking to roughly $400 in October, near the target outlined by Kamich in September.

Since then, Nvidia's shares have rallied back and are once again flirting with August's highs. The move up prompted Kamich to revisit his analysis, resulting in new price targets.

A technical analyst, Kamich has been studying price and volume for clues into the aggregate sentiment of investors, including big money with access to resources everyday investors can't imagine.

His updated analysis paints a mixed picture for shares, raising question marks that make him nervous about risk to reward.

"NVDA is trading above the rising 50-day moving average line and the rising 200-day moving average line," writes Kamich. "The On-Balance-Volume (OBV) line shows a slight rise in the past few months even though the trading volume has been neutral. The Moving Average Convergence Divergence (MACD) oscillator has moved sideways around the zero line in recent months."

On-balance-volume (OBV) is essentially up minus down day volume, while the moving average convergence divergence (MACD) oscillator is a momentum indicator.

Ideally, more volume on up than down days and positive momentum would add conviction that the path of least resistance for Nvidia shares is higher. Unfortunately, that's not the case yet.

That's disappointing because his latest daily and weekly point-and-figure price targets suggest significant upside potential. The daily P&F chart suggests upside to $591, while the weekly chart calculates a target of $726, up over 50% from the close on Dec. 20.

Those targets are eye-popping. However, one drawback of point-and-figure charts is they don't predict when a stock will reach a specific price target.

Since P&F targets aren't guaranteed, and Nvidia's price and volume trends aren't resoundingly bullish, Kamich's view of the risk-to-reward associated with shares is downbeat despite the alluring price targets.

"Can NVDA breakout over $500? Maybe, but it has stalled there a number of times. With the averages stretched to the upside, the risk, in my mind, is to the downside," concludes Kamich.

Want to turbocharge your portfolio? Learn from the investing legends and get actionable insights. Start your Real Money Pro membership today.