/Analog%20Devices%20Inc_%20logo%20on%20phone%20with%20purple%20backdrop-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Wilmington, Massachusetts-based Analog Devices, Inc. (ADI) designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems products. Valued at $147 billion by market cap, the company's products are used in communications, computer, industrial, instrumentation, military, aerospace, automotive, and high-performance consumer electronics applications. The global semiconductor leader is expected to announce its fiscal first-quarter earnings for 2026 in the near future.

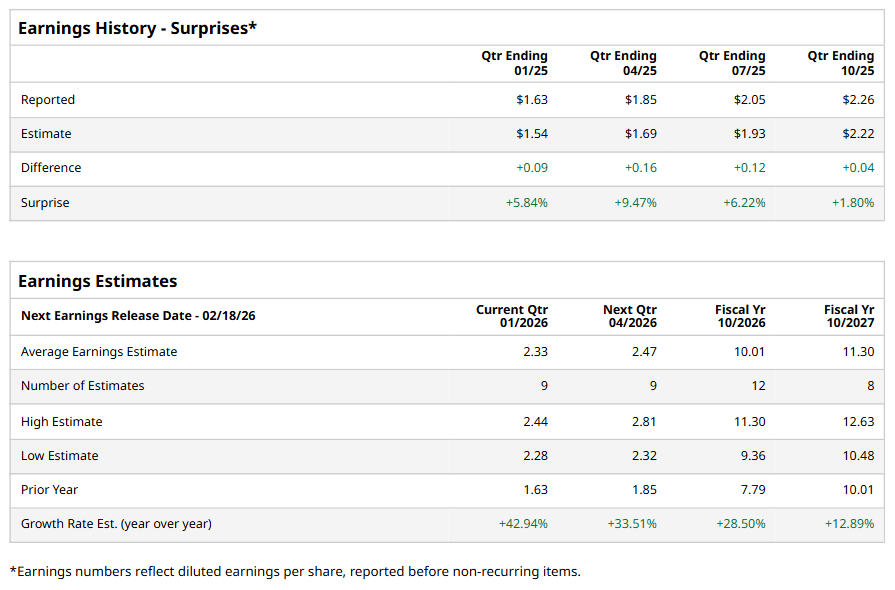

Ahead of the event, analysts expect ADI to report a profit of $2.33 per share on a diluted basis, up 42.9% from $1.63 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect ADI to report EPS of $10.01, up 28.5% from $7.79 in fiscal 2025. Its EPS is expected to rise 12.9% year over year to $11.30 in fiscal 2027.

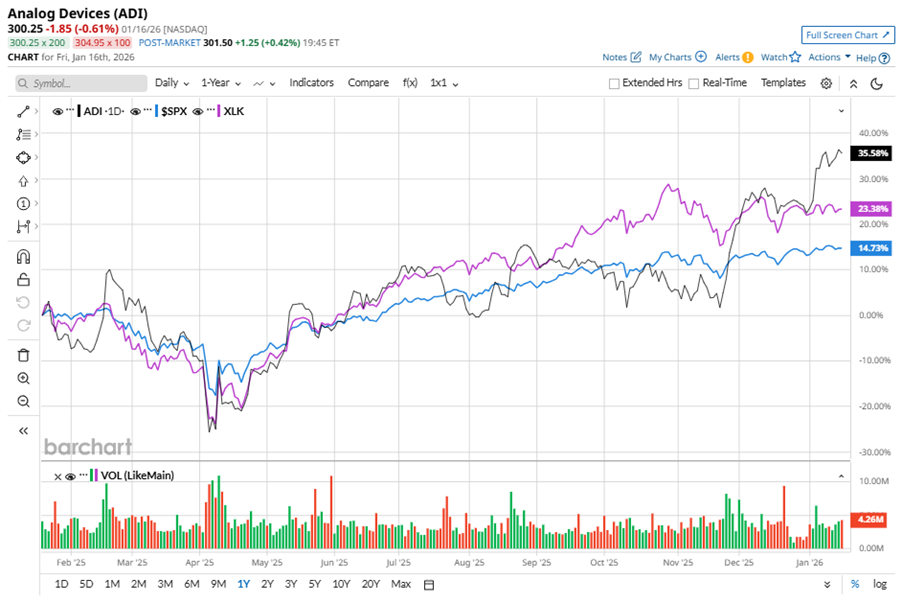

ADI stock has outperformed the S&P 500 Index’s ($SPX) 16.9% gains over the past 52 weeks, with shares up 39.6% during this period. Similarly, it outperformed the Technology Select Sector SPDR Fund’s (XLK) 26.4% gains over the same time frame.

On Nov. 25, 2025, ADI shares closed up more than 5% after reporting its Q4 results. Its adjusted EPS of $2.26 beat Wall Street expectations of $2.22. The company’s revenue was $3.1 billion, topping Wall Street forecasts of $3 billion. For Q1 2026, ADI expects its adjusted EPS to range from $2.19 to $2.39, and revenue in the range of $3 billion to $3.2 billion.

Analysts’ consensus opinion on ADI stock is bullish, with a “Strong Buy” rating overall. Out of 33 analysts covering the stock, 22 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” and eight give a “Hold.” While ADI currently trades above its mean price target of $299.76, the Street-high price target of $375 suggests an upside potential of 24.9%.

.jpg?w=600)