Throughout the runup to the 2024 presidential election, one of the key concerns among observing U.S. allies was then-former President Donald Trump's contrarian approach to the Ukraine war. While the popular consensus portrayed the Eastern European nation as a victim of Russian aggression, Trump broadcast a decidedly different perspective. However, his conciliatory tone has recently done an about-face — and it may have serious geopolitical implications.

Last week, the president blasted Russia as a "paper tiger" in a Truth Social post. What's more, the language that he previously utilized to describe Ukraine's desperate situation — and thus the need for the embattled country to make concessions for peace — has now been attributed to the Russians.

"Russia has been fighting aimlessly for three and a half years a War that should have taken a Real Military Power less than a week to win," Trump stated.

Even more startling is the president's rhetorical support of the invaded nation. "After getting to know and fully understand the Ukraine/Russia Military and Economic situation… I think Ukraine, with the support of the European Union, is in a position to fight and WIN all of Ukraine back in its original form."

Interestingly, heading into the U-turn, the Trump administration appeared to be making progress toward an eventual peace deal. In an interview with NBC News, Vice President J.D. Vance stated that the Russians understand that a puppet regime will not be installed in Kyiv and that security guarantees will be a part of any long-term agreement.

However, Trump should not be assumed to be an unabashedly pro-Ukrainian president. So far, the rhetoric hasn't translated into firm commitments for new weaponry, though the administration is considering delivering long-range Tomahawk missiles to Ukraine. Moreover, Trump wants Europe to play a much larger role in its regional conflict.

Still, the reversal in position has been welcomed by many global leaders. Additionally, the pivot may translate to greater demand for defense-related systems and hardware. After all, within Trump's unexpected change of heart was an overt encouragement for NATO to deter Russian expansion.

The Direxion ETF: Thanks to heightened interest toward the arms industry, speculators are looking for ways to profit. One mechanism to do so while sidestepping exotic products is through financial service provider Direxion's specialized exchange-traded funds.

Specifically, those who are aggressively optimistic on the sector may consider Direxion Daily Aerospace & Defense Bull 3X Shares (NYSE:DFEN). This ultra-leveraged fund tracks 300% of the performance of the Dow Jones U.S. Select Aerospace & Defense Index. Among the top holdings are heavyweights like RTX (NYSE:RTX), Boeing (NYSE:BA) and Lockheed Martin (NYSE:LMT), thus offering a diverse canvas of top-tier enterprises.

Fundamentally, Direxion ETFs offer a convenient mechanism for extreme speculation. Typically, those seeking leveraged exposure must engage the options market, which can impose its own set of unique complexities. With leveraged funds, the products can be bought and sold, much like any other publicly traded security.

Another taken-for-granted convenience of Direxion ETFs is that they are debit-based transactions. Essentially, the loss that one suffers from market volatility is limited to whatever was put into the fund. This eliminates the fear of tail risk or the threat of an ever-rising obligatory payment as the underwritten risk gets realized to the extreme ends of the distribution — a common concern for credit-based transactions.

That said, Direxion ETFs aren't devoid of downside dangers. For one thing, leveraged funds — especially the 300% variety — are extremely wild. Without care, unitholders can quickly incur losses. Even with caution, the intense volatility means that circumstances can change in the blink of an eye. Second, these funds are designed for exposure lasting no longer than one day. Holding units longer than that may result in positional decay due to the daily compounding effect.

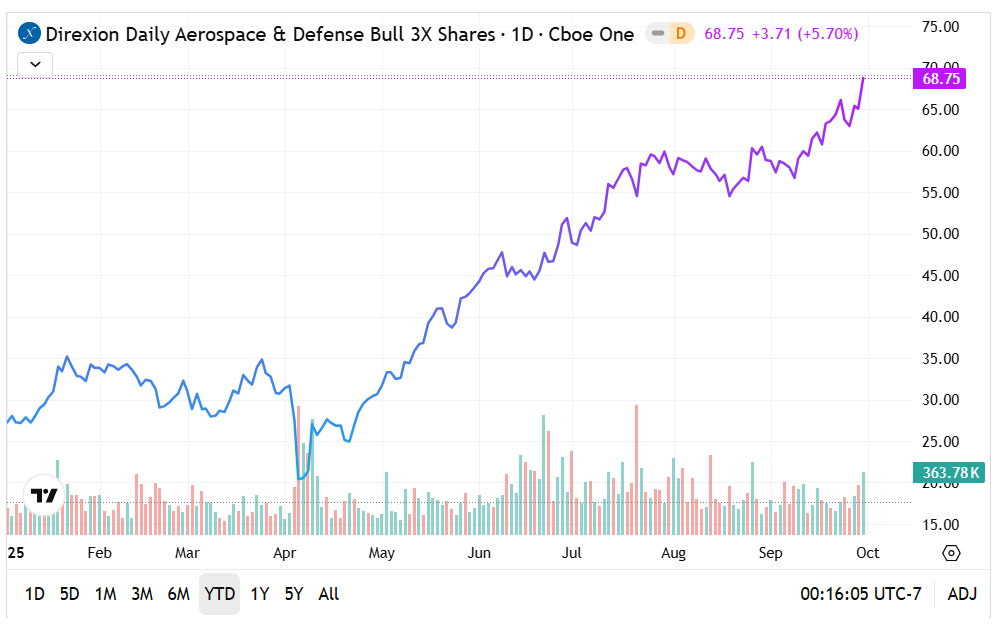

The DFEN ETF: Since the start of the year, the DFEN ETF has gained nearly 150%. Most of this performance came within the past six months, when it moved up over 119%.

- Currently, momentum is robust for the DFEN ETF, with the price action above three moving averages: the 20-day exponential, along with the industry standard 50 and 200 days.

- One characteristic to note is that volume has consistently solid this year, suggesting that the rally may have substance.

- DFEN has currently inked six consecutive up weeks (defined as the return from Monday's open to Friday's close) and is on course for seven. Investors should be mindful of this streak before initiating a position.

Featured image from Pixabay.