/Computer%20board%20micro%20chip%20green%20by%20blickpixel%20via%20Pixabay.jpg)

In the last several years, I've seen a close correlation between the performance of the Russell 2000 iShares ETF (IWM) and the returns of small-to-medium stocks. I consider Sandisk (SNDK), with a market capitalization of about $69 billion, to be in the upper segment of the medium category. And indeed, the recent, meteoric rise of SNDK has coincided with a major rally by the IWM.

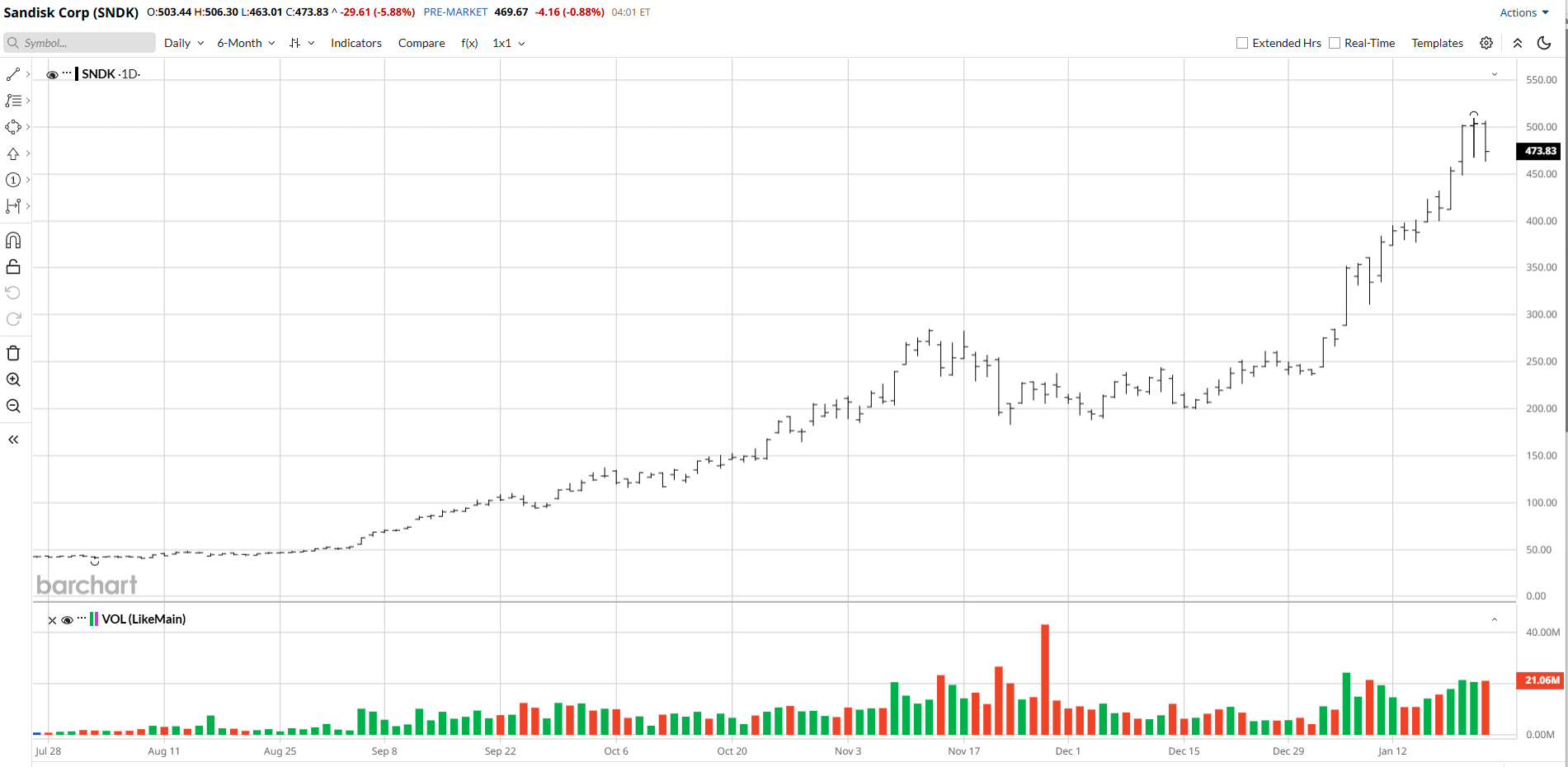

So, with the IWM showing signs of stalling for now amid multiple macro issues and SNDK stock having already soared 169% in the three months that ended on Jan. 23, I believe that SNDK's short squeeze is very likely to moderate significantly, if not cease altogether, at least in the short term.

Moreover, while Sandisk is likely to continue benefiting meaningfully in the next year or two from the strong demand for NAND flash memory sparked by the artificial intelligence (AI) boom, I believe that Micron (MU) is a significantly better pick for investors at this point.

About Sandisk

Sandisk used to be part of Western Digital (WDC), but SNDK was spun off from its parent company nearly a year ago. SNDK specializes in developing NAND flash memory, which is being utilized extensively in devices that utilize AI, like robots and autonomous cars. However, the company's NAND chips are also being used by hyperscalers and in consumer electronics products. With the demand for NAND memory soaring due to the AI boom, NAND prices have jumped, causing SanDisk's operating cash flow to also surge and helping to spark the huge rally by SNDK stock.

Sandisk and the IWM

Although SNDK stock has generally performed very well since its spinoff, the shares were down meaningfully between Nov. 12, 2025, and the end of 2025. Between Jan. 2 and Jan. 23, however, the name soared 100%. During the same period, the IWM advanced by 7.6%. And tellingly, on Jan. 23, the IWM dropped 1.85%, while SNDK stock sank 5.88%.

Further, both the IWM and SNDK appear to have lost significant momentum starting on the afternoon of Jan. 22. The IWM dropped from a high of $271.60 on the latter day to $264.81 as of market close on Jan. 23, while Sandisk's shares fell from a high of $509.50 on Jan. 22, to $473.83 at market close on Jan. 23.

A few macro issues, including strained ties between the U.S. and Europe, President Donald Trump's threat to place a 100% tariff on Canada, a potential U.S. military intervention in Iran, and a looming government shutdown, are probably weighing on IWM stock.

Since the majority of these issues are unlikely to be resolved this week, the IWM is not likely to perform well in the next several trading days. As a result, the momentum of SNDK stock is likely to continue to stall, giving short sellers the opportunity to push its price down significantly.

SNDK Vs. MU

Sandisk appears to face significantly more competition in the flash NAND market than Micron does in the high bandwidth memory (HBM) sector. As I noted in a previous column, Micron's strong growth in recent quarters has been driven to a large extent by its success in the HBMs, which are used to power AI chips. And, of course, the demand for AI chips is through the roof. On the other hand, it appears that SNDK remains largely focused on flash NAND, which is incorporated into solid-state drives used for generative AI.

Electric component maker UniBetter recently listed nine top NAND flash memory companies but only three major HBM manufacturers. Indeed, three companies now control nearly the entire HBM market, with Micron weighing in with a 10% to 15% share.

Consequently, I expect MU stock to perform much better than SNDK stock over the medium-to-long term.

However, to SanDisk's credit, it did note last August that it was developing High Bandwidth Flash (HBF) memory, and it reported that HBF provides “8 to 16x the capacity of High Bandwidth Memory (HBM), while delivering the same read bandwidth at the same price points.”

While HBF could one day rival and even overtake HBM, a number of firms, including SNDK, reportedly do not plan to launch it until late 2027 — at the earliest. Further, an expert believes that the size of the HBF market will not surpass that of the HBM market until 2038. Consequently, I believe that it's difficult to determine whether Sandisk will benefit significantly from HBF. And the technology is unlikely to boost SNDK stock until the end of next year.

Meanwhile, MU stock has a forward price-to-earnings (P/E) ratio of 12.35x, while SNDK weighs in with a much higher forward P/E ratio of 43.4x. And finally, given Micron's market capitalization of $450 billion, it's much less exposed to the volatility of the IWM than SNDK.