Amazon's (AMZN) most recent earnings report for Q1 2025 showed strong performance, with earnings per share (EPS) of $1.59, beating analysts’ expectations of $1.38.

Revenue rose 8.6% year-over-year to $155.67 billion, also surpassing forecasts.

The company’s cloud division, AWS, continued to be a major profit driver, while retail and advertising segments showed steady growth.

Amazon’s stock has shown solid momentum recently, trading around $225 per share as of mid-July 2025.

Over the past three months, it’s surged by 29%, driven by optimism around its AI initiatives and strong cloud growth.

Today, we’re looking at a calendar spread on Amazon stock.

Calendar spreads are an option trade that involves selling a short-term option and buying a longer-term option with the same strike.

Traders can use calls or puts and they can be set up to be neutral, bullish or bearish with neutral being the most common.

When doing bullish calendar spreads, we typically use calls to minimize the assignment risk. Likewise, if the calendar is set up with a bearish bias, we use puts.

Neutral calendars can use calls or puts, but calls are more common.

Let’s look at an example using Amazon.

Amazon Calendar Spread Example

With Amazon stock trading around $225, setting up a calendar spread at $225 gives the trade a neutral outlook.

Selling the August 15 call option with a strike price of $225 will generate around $855 in premium, and buying the September 19, $920 call will cost approximately $1,150.

That results in a net cost for the trade of $295 per spread, and that is the most the trade can lose.

The estimated maximum profit is $580, but that could vary depending on changes in implied volatility.

The idea with the trade is that if AMZN stock remains around $225 for the next few weeks, the sold option will decay faster than the bought option allowing the trade to be closed for a profit.

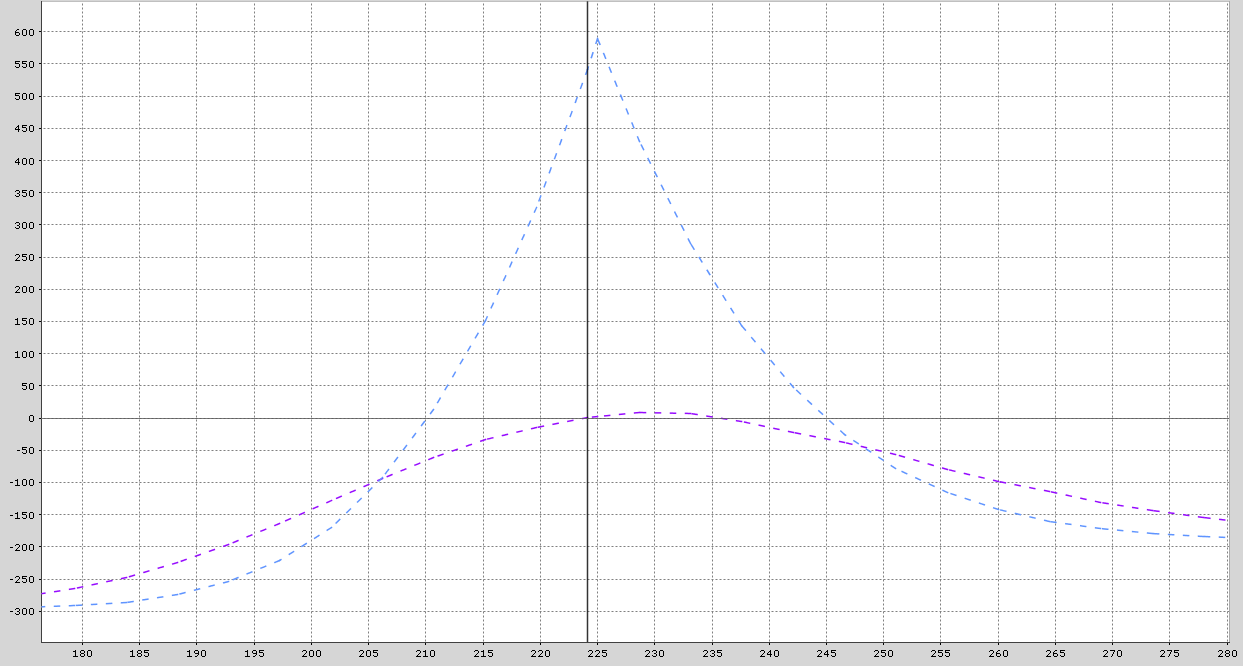

The breakeven prices for the trade are estimated at around $210 and $245, but these can also change slightly depending on changes in implied volatility.

In terms of trade management if AMZN broke through either $210 or $245, I would look to adjust or close the trade.

Below is the payoff graph with the blue line representing the profit or loss at expiration and the purple line being the trade as of today.

Amazon Company Details

Amazon.com is one of the largest e-commerce providers, with sprawling operations spreading across the globe.

Its online retail business revolves around the Prime program well-supported by the company's massive distribution network.

Further, the Whole Foods Market acquisition helped Amazon establish footprint in physical grocery supermarket space.

Amazon also enjoys dominant position in the cloud-computing market, particularly in the Infrastructure as a Service space, thanks to Amazon Web Services, which is one of its high-margin generating businesses.

Amazon has also become a household name with its Alexa powered Echo devices.

Artificial Intelligence backed Alexa is helping the company sell products and services.

The company reports revenue under three broad heads' North America, International and AWS, respectively.

Amazon targets three categories of customers - consumers, sellers and website developers.

Mitigating Risk

Thankfully, calendar spreads are risk defined trades, so they have some build in risk management. Position sizing is crucial to ensure that minimal damage is done if the trade suffers a full loss.

One way to set a stop loss for a calendar spread is close the trade if the loss is 20-30% of the premium paid.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.