Amazon (AMZN) stock continues to grind higher in the lead up to their Q2 earnings announcement on July 31.

Amazon currently has a historically low PE Ratio of 37.88.

By using a combination of option strategies, we could potentially buy the stock for a significant discount, or achieve a healthy profit if the stock trades sideways.

Here’s the trade:

- Sell to open the AMZN August 15 put with a strike price of $225, which was trading around $4.60 yesterday.

Then, add a bear call spread:

Sell to open the AMZN August 15 call with a strike price of $250, which was trading around $1.90 yesterday.

- Buy to open the AMZN August 15 call with a strike price of $255, which was trading around $1.00 yesterday.

The sold put brings in around $460 in option premium, and the bear call spread adds another $90 in premium. In total, the combination of the two trades generates $540 in premium.

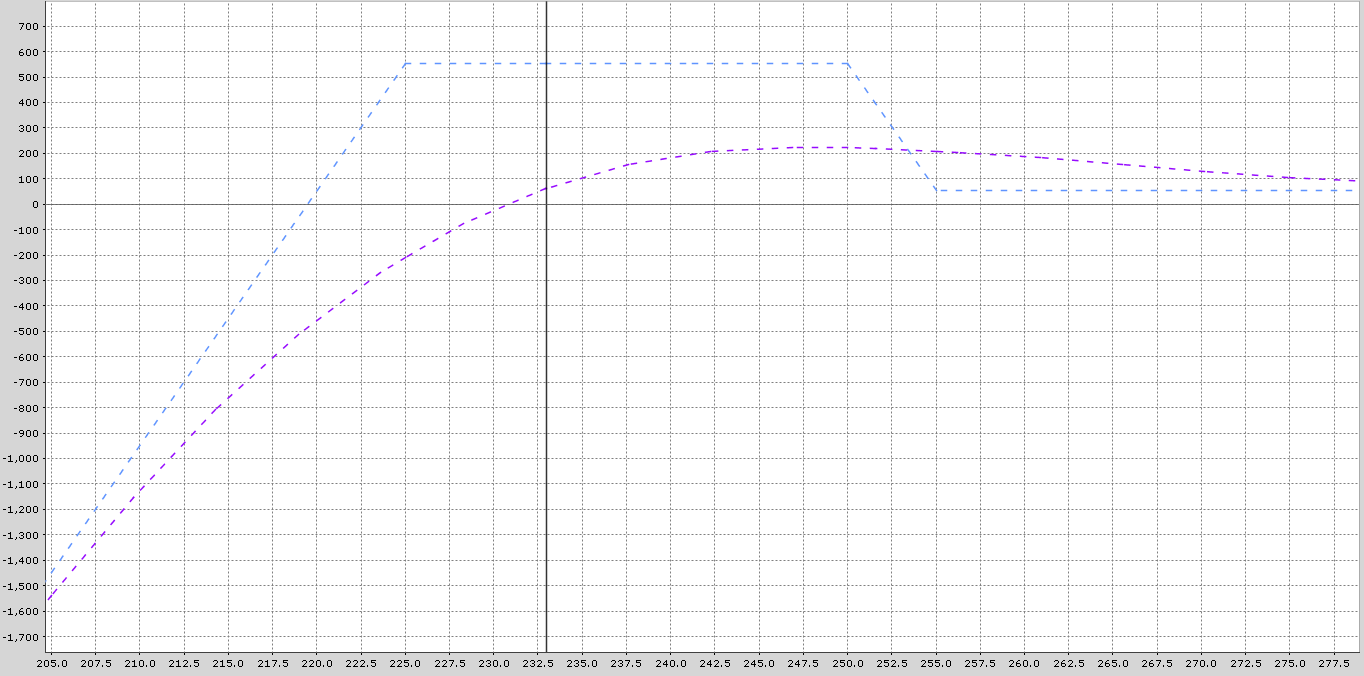

Here’s how the trade looks at trade initiation. The blue line represents the profit or loss at expiration and the purple line shows the trade as of today.

The position starts with a delta of 25, meaning it is roughly equivalent to owning 25 shares of AMZN stock. This figure will change as the trade progresses.

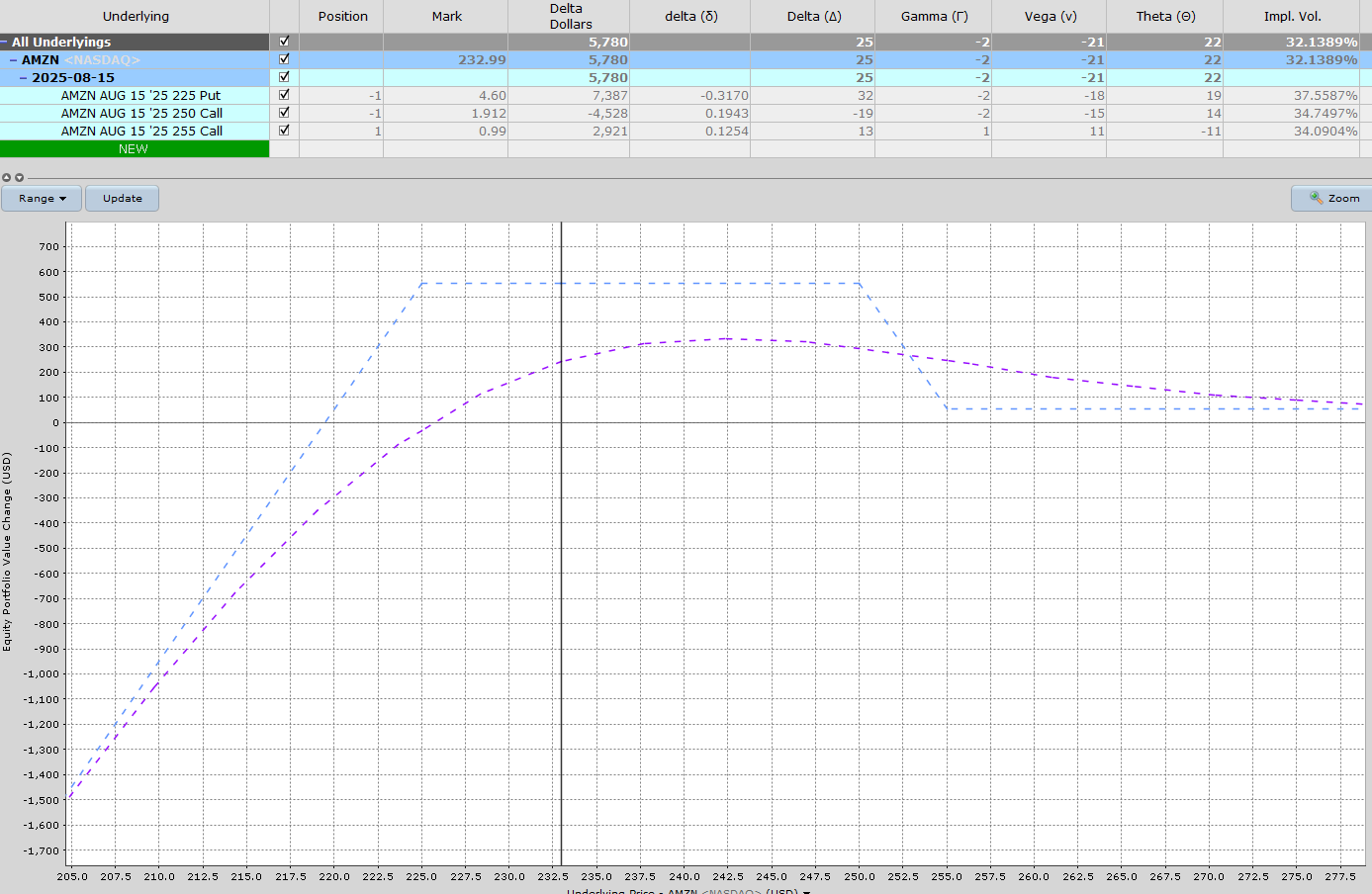

This is how the trade could look in around one week’s time.

Looking pretty good as long as the stock is above $225.

Possible Scenarios For This AMZN Stock Option Trade

Let’s work through a couple of scenarios of how this trade could look at expiration on August 15.

- If AMZN stock trades sideways and finishes between $225 and $250, the sold put and bear call spread will both expire worthless. The total profit will be equal to the premium received of $540.

- IF AMZN falls below $225 at expiration, we will be assigned on the sold put and will be forced to buy 100 shares at $225. However, our net cost basis will be $219.60, thanks to the $540 in option premium received. That is 5.66% below the closing price on Monday.

- If AMZN rallies above $255, the bear call spread will suffer a full loss of $500, but this will be fully offset by the $540 premium received, leaving the trade with a small profit of $40.

Not that this trade contains earnings risk with Amazon due to report on July 31st.

Company Details

The Barchart Technical Opinion rating is a 88% Buy with a Strongest short term outlook on maintaining the current direction.

Of 54 analysts covering AMZN stock, 47 have a Strong Buy rating, 6 have a Moderate Buy rating and 1 has a Hold rating.

Implied volatility is 32.70% compared to a twelve-month high of 63.91% and a low of 22.90%. That gives AMZN stock an IV Percentile of 56% and an IV Rank of 23.91%.

Amazon.com is one of the largest e-commerce providers, with sprawling operations spreading across the globe. Its online retail business revolves around the Prime program well-supported by the company's massive distribution network. Further, the Whole Foods Market acquisition helped Amazon establish footprint in physical grocery supermarket space. Amazon also enjoys dominant position in the cloud-computing market, particularly in the Infrastructure as a Service space, thanks to Amazon Web Services, which is one of its high-margin generating businesses. Amazon has also become a household name with its Alexa powered Echo devices. Artificial Intelligence backed Alexa is helping the company sell products and services. The company reports revenue under three broad heads'North America, International and AWS, respectively. Amazon targets three categories of customers - consumers, sellers and website developers.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own.

If you end up being assigned, you can start selling covered calls against the stock position.

You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Mitigating Risk

With any option trade, it’s important to have a plan in place on how you will manage the trade if it moves against you.

Some traders like to add a deep out-of-the-money long put to reduce risk. For example, an August 15 put option with a strike price of $205 could be purchased for around $70. Buying this put, would cap losses below $205 and reduce total capital at risk.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.