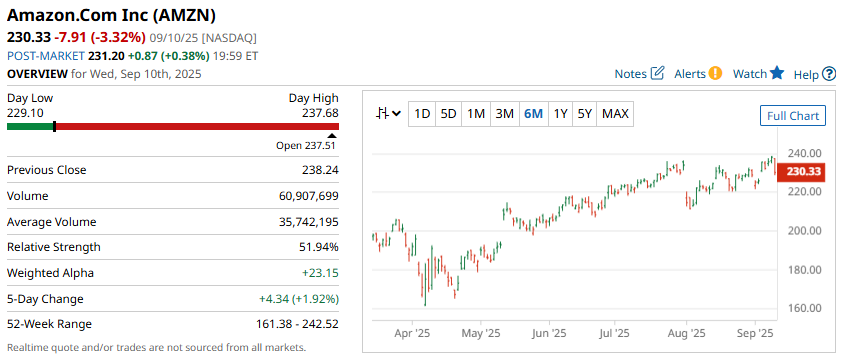

Amazon (AMZN), experienced a big drop yesterday, falling 3.32% on the day and the options market is hinting that further downside might be in store.

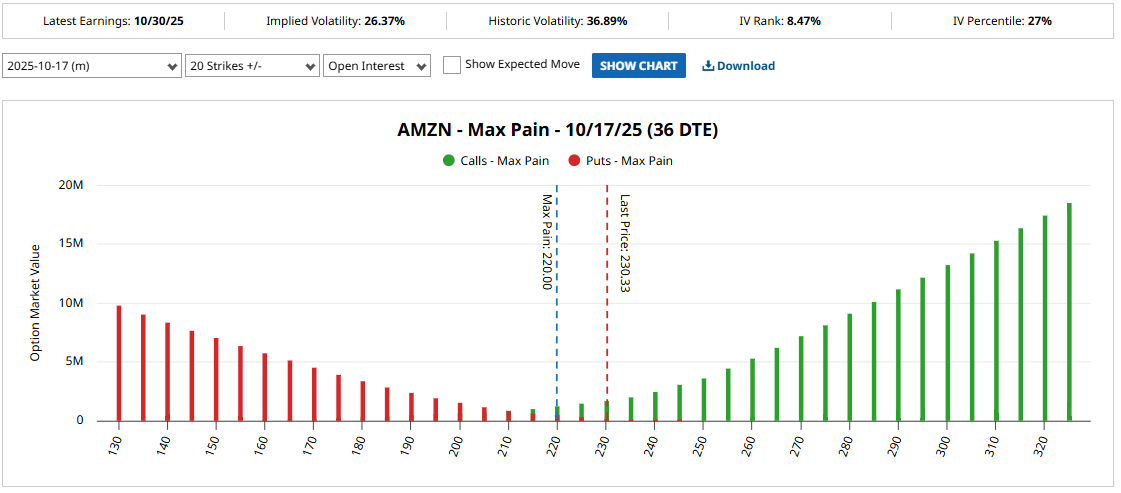

The options market could be indicating that the stock might settle around the 220 mark by mid-October.

This is due to a theory called Max Pain and is something I talked about in a video for Barchart.

The Max Pain Theory claims that as option expiration approaches, stock prices will get pushed toward the price at which the greatest number of options in terms of dollar value will expire worthless.

Large institutions are generally net sellers of options, so they will benefit the most from options expiring worthless, or with the lowest net value.

We can use Barchart to find the Max Pain level quickly and easily for any stock and expiration.

Here we can see that the Max Pain level for AMZN on October 17th is right around 220.

What can we do with this information?

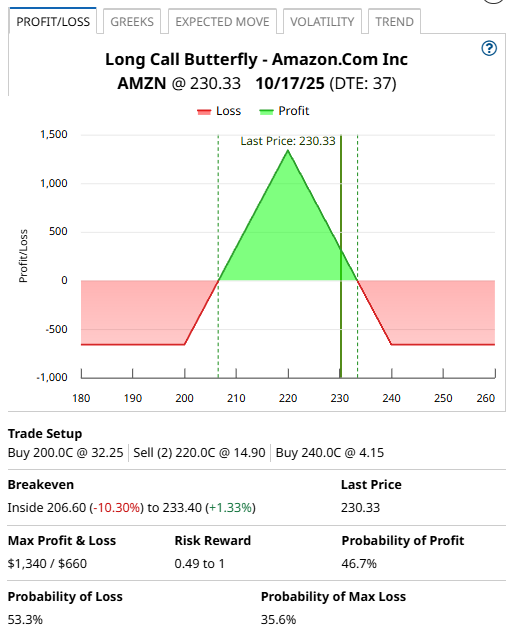

Well, if we think that the Max Pain theory might play out this month, we could look to trade a butterfly spread centred at the 220 strike.

Let’s take a look at how that trade idea might be structured.

AMZN MAX PAIN BUTTERFLY SPREAD

A butterfly spread is constructed by buying a lower strike put, selling two middle strike puts and buying one upper strike put. The trade is entered for a net debit meaning the trader pays to enter the trade. This debit is also the maximum possible loss.

The maximum profit is calculated as the difference between the short and long puts less the premium that you paid for the spread.

Using the October 17 expiry, the trade would involve buying the $200 strike put, selling two of the $220 strike puts and buying one $240 strike put.

The cost for the trade would be around $660 which is the most the trade could lose. The maximum potential gain is around $1,340.

AMZN COMPANY DETAILS

The Barchart Technical Opinion rating is a 100% Buy with a Strengthening short term outlook on maintaining the current direction.

Long term indicators fully support a continuation of the trend.

AMZN rates as a Strong Buy according to 47 analysts with 6 Moderate Buy and 2 Hold ratings.

Implied volatility is 26.37% which gives AMZN an IV Percentile of 27% and an IV Rank of 8.47%

Amazon.com is one of the largest e-commerce providers, with sprawling operations spreading across the globe.

Its online retail business revolves around the Prime program well-supported by the company's massive distribution network.

Further, the Whole Foods Market acquisition helped Amazon establish footprint in physical grocery supermarket space.

Amazon also enjoys dominant position in the cloud-computing market, particularly in the Infrastructure as a Service space, thanks to Amazon Web Services, which is one of its high-margin generating businesses.

Amazon has also become a household name with its Alexa powered Echo devices. Artificial Intelligence backed Alexa is helping the company sell products and services.

The company reports revenue under three broad heads'North America, International and AWS, respectively. Amazon targets three categories of customers - consumers, sellers and website developers.

Conclusion And Risk Management

The Max Pain theory suggests Amazon stock could gravitate toward $220 by October 17th expiration, creating a potential opportunity for butterfly spread traders.

The butterfly spread outlined offers a defined-risk approach to capitalize on this theory, with maximum loss limited to the $660 premium paid.

The strategy profits if Amazon trades near $220 at expiration but loses money if the stock moves significantly in either direction.

Key risk considerations include:

- The strategy requires precise timing and price prediction

- Max Pain levels can shift as new options positions are established

For traders considering this approach, position sizing is crucial. The butterfly spread should represent only a small portion of your overall portfolio given its speculative nature.

The Max Pain level offers one perspective but shouldn't be the sole basis for trading decisions.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.