/Amphenol%20Corp_%20logo%20on%20phone%20and%20stock%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

With a market capitalization of about $149.2 billion, Connecticut-based Amphenol Corporation (APH) is a global powerhouse in connectors, sensors, antennas, and high-speed specialty cables. With operations in around 40 countries and a mix of direct sales, reps, and distributors, the company serves high-growth markets including automotive, aerospace, communications, defense, industrial, IT, and mobile devices, driving innovation and connectivity across the globe.

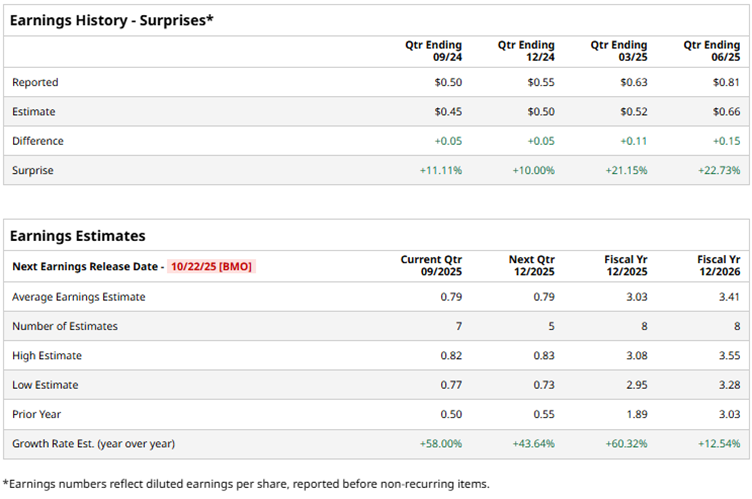

The company is all set to report its fiscal 2025 third-quarter earnings before the market opens on Oct. 22. And ahead of this upcoming earnings report, analysts expect Amphenol to post $0.79 per share, marking a striking 58% jump from $0.50 in the same quarter last year. The company has a strong track record of exceeding expectations, having topped Wall Street’s profit estimates in each of the past four quarters.

In its latest earnings report, the company delivered an adjusted EPS of $0.81, smashing Wall Street expectations by a striking 22.7% margin. Looking forward, Amphenol’s growth trajectory remains strong, with fiscal 2025 EPS projected to soar 60.3% to $3.03 from $1.89 registered in fiscal 2024, followed by another 12.5% rise in fiscal 2026 to $3.41, underscoring the company’s sustained momentum and long-term earnings potential.

Amphenol shares have soared a stunning 97% over the past year, handily outperforming the broader market and tech peers. For comparison, the broader S&P 500 Index ($SPX) has climbed roughly 17.8% over the same period, while the Technology Select Sector SPDR Fund (XLK) surged an impressive 27.8%.

Amphenol reported its second-quarter earnings results on July 23, handily surpassing Wall Street forecasts. Net sales soared to $5.7 billion, up 57% year-over-year (YOY), fueled by strong organic growth across all end markets, including exceptional performance in the IT datacom segment and contributions from its acquisition program. The topline comfortably beat analysts’ $5 billion estimate.

Earnings were equally impressive, with adjusted EPS climbing 84% YOY to $0.81, well ahead of the $0.66 forecast. Profitability also hit new heights, as adjusted operating margin reached a record 25.6%, underscoring Amphenol’s ability to combine robust growth with strong operational efficiency.

Wall Street remains overwhelmingly bullish on Amphenol, with the stock holding a consensus “Strong Buy” rating. Of the 17 analysts covering the company, 13 have issued a “Strong Buy,” while the remaining four maintain a “Hold,” reflecting broad confidence in the company’s growth prospects.

While the mean price target of $123 implies a marginal upside potential from the current market price, the Street high target of $145 suggests that the stock can rally as much as 18.6% from here.